Question: does anyone know how to do this probelm question??? its mangerial accounting btw theres tbales that was given to us to answer the question. Theres

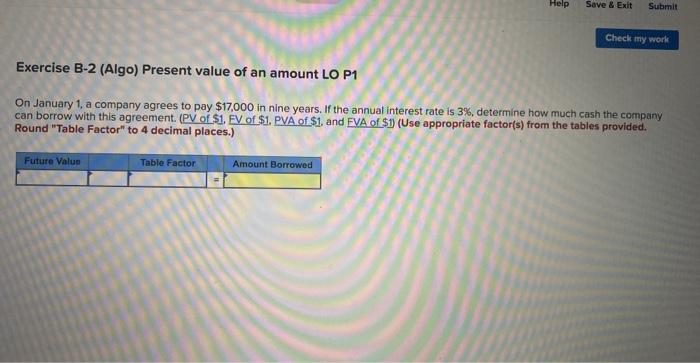

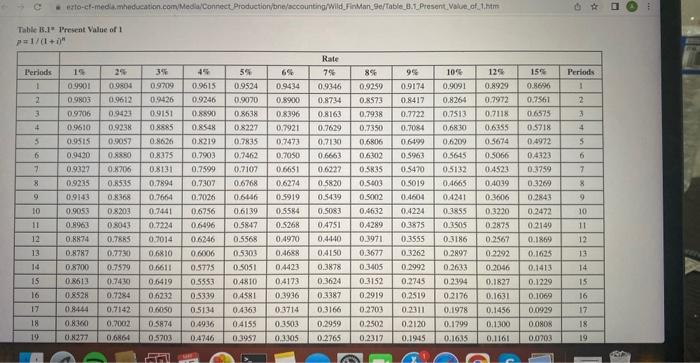

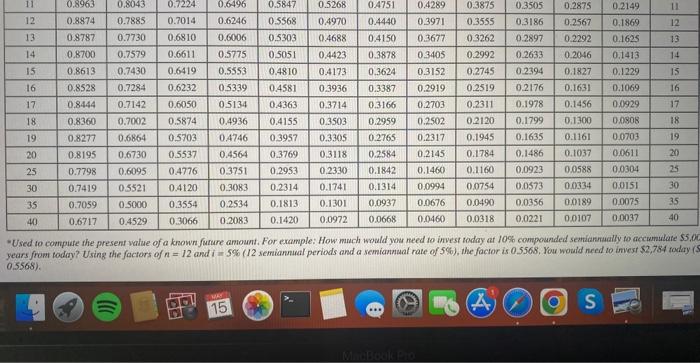

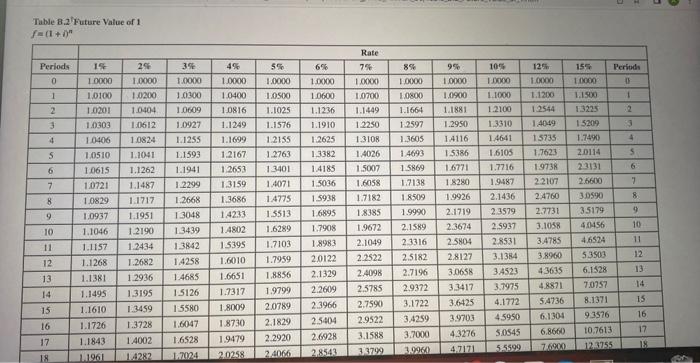

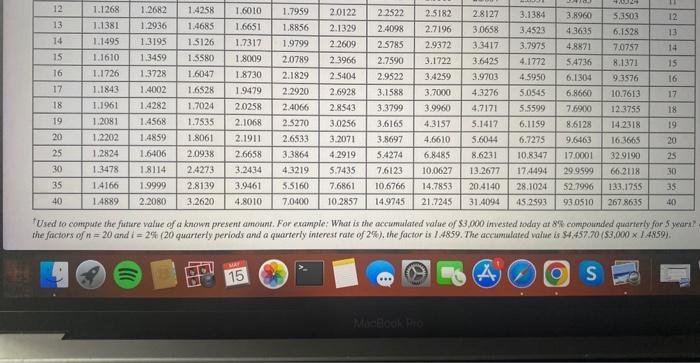

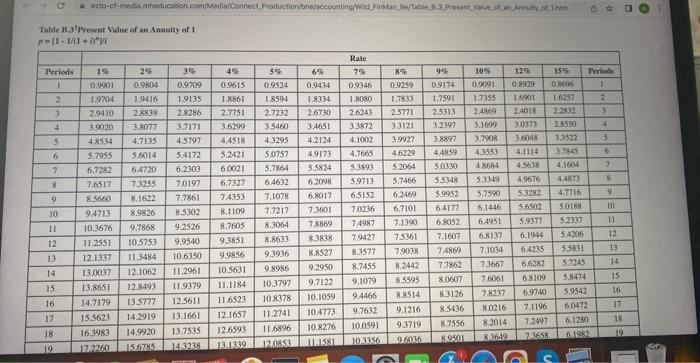

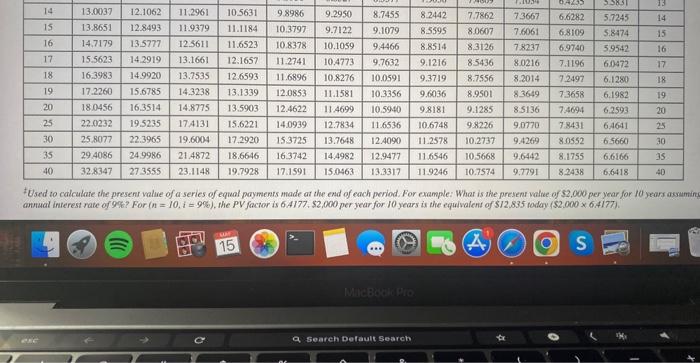

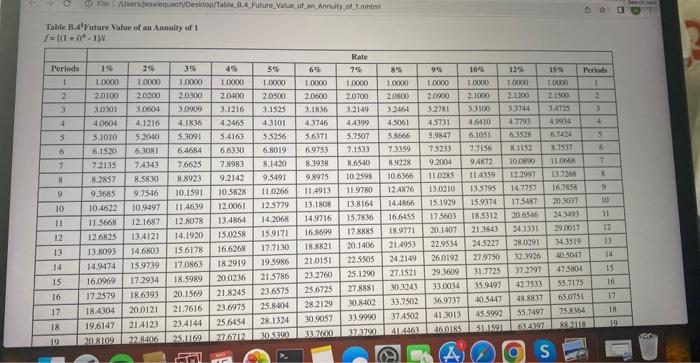

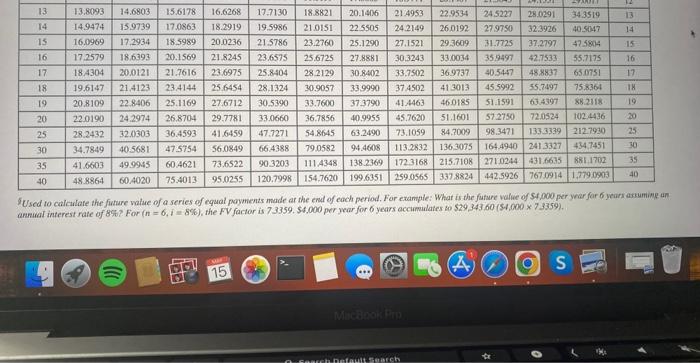

Exercise B-2 (Algo) Present value of an amount LO P1 On January 1, a company agrees to pay $17,000 in nine years. If the annual interest rate is 3%, determine how much cash the company can borrow with this agreement. (PV of \$1. EV of \$1. PVA of \$1, and EVA of $1 ) (Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.) Table B.I* Tresent Value of 1 p=1/(1+i)n -Used to compite the present vahue of a known funure amount. For example: How much would you need to invest today at los compounded sentarnally fo accumulare \$5, 0 . years from today? Using the foctors of n=12 and i i=5% ( 12 semiannual periods and a semiannual rate of 5%, the factor is 0.5568 , You would need to invest $2,784 todaty 0.5568). Table 8.2 Future Value of 1 f=(1+i)n Wsed to compute the finture value of a known present amouat. For example; What is the acenomalated value of $3,000 invested today at 85 compounded quarterly for 5 ynar: the factors of n=20 and i=25 (20 quarterly periods and a quarterly interest rate of 2% ). the factor is 1.4859 . The accumilared value is $4.457.70 ( 53,000 x. I.4859). Tahle BSFFresentValueofanAuablyof1 p=111/(1+e24 Used to calculate the presens value of a series of equal payments made at the end of each poriod. For example: What is the present value of $2,000 per year for lo years assumint annual interest rate of 99 ? For (n=10,i=90C), the PV fachor is 6.4177,$2,000 per year for 10 years ix the equivalent of $12.835 roday (\$2.000 6,4177. Table B.AlFuture Vatue of an Amaity of 1 f=(1+n2+1}) SUsed to catlialate the future value of a series of equal poyments made at the end of each period. Far example: What is the future vilue of S4 ,000 per yoar far 6 yeart attuming un anewat interest rate of 8%. For (n=6,i=8%6), the FV factor is 73359.54,000 per year for 6 years accumilates 60529343.60 ( $4,00073359 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts