Question: does anyone know how to do this probelm question??? its mangerial accounting btw theres tbales that was given to us to answer the question. Theres

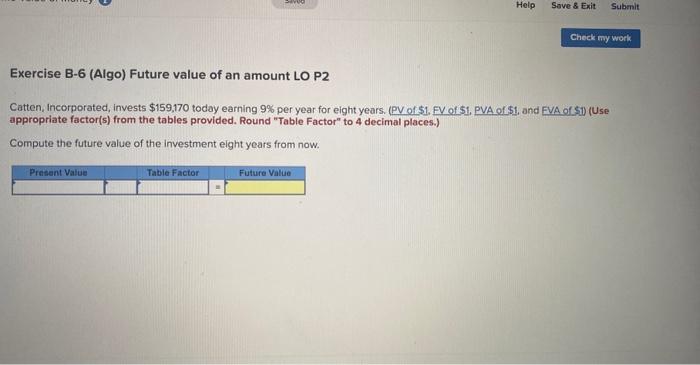

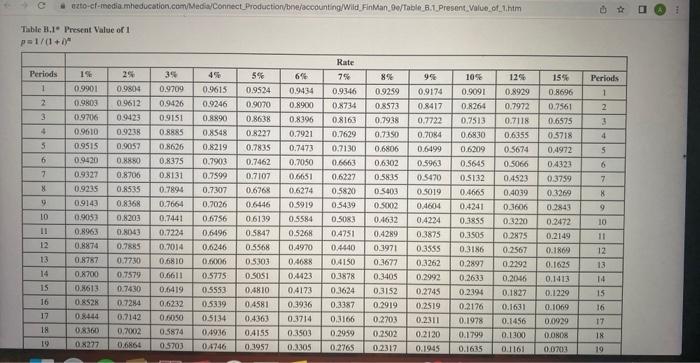

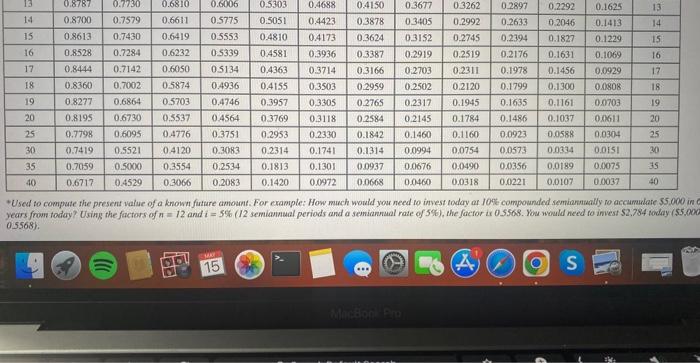

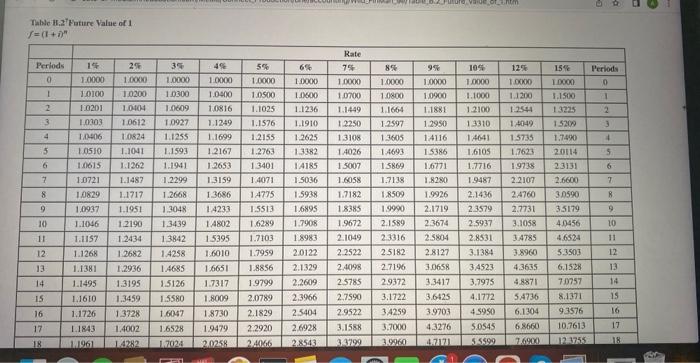

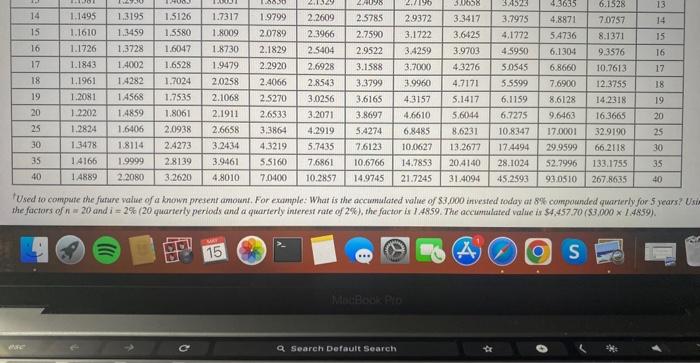

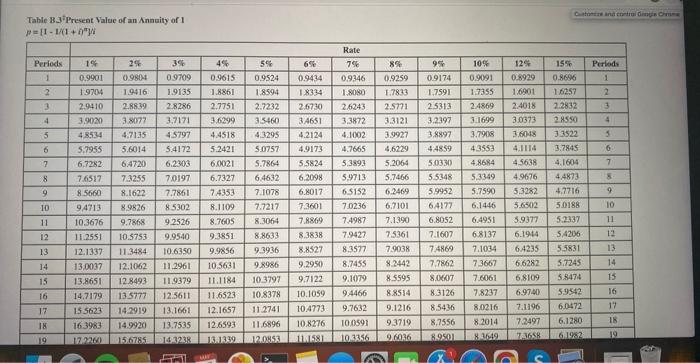

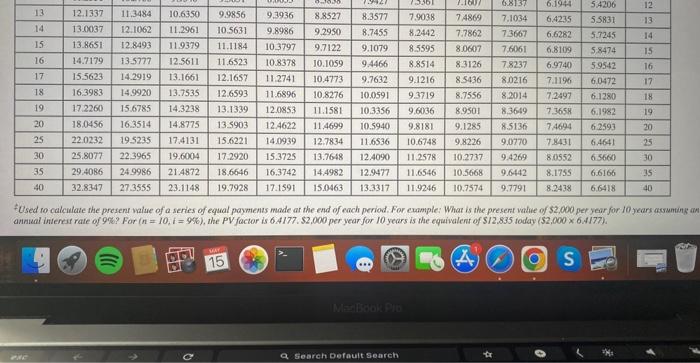

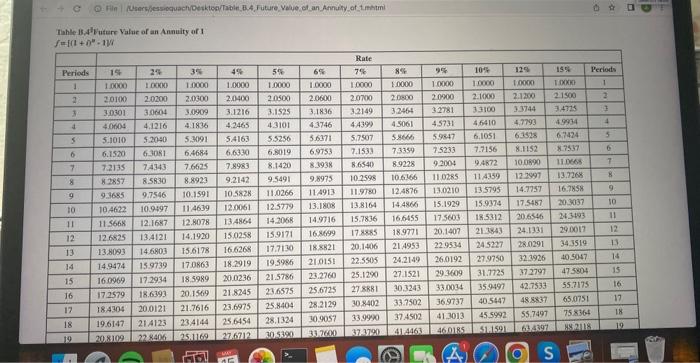

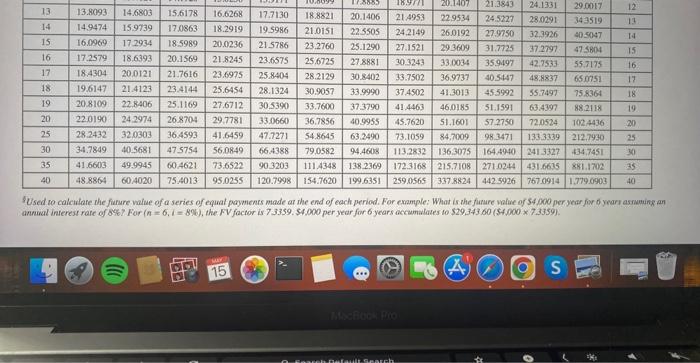

Exercise B-6 (Algo) Future value of an amount LO P2 Catten, incorporated, invests $159,170 today earning 9% per year for eight years. (PV of $1. FV of $1, PVA of $1, and EVA of $1 ) (Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.) Compute the future value of the investment eight years from now. Table H, 1* Present Value of 1 p=1/(1+m * Used to conpute the present value of a known firture amoant. For example: How much would you need to invest today at Jo compounded semiannually to accumblate 55 owo in years from today? Using the factors of n=12 and i=5%. ( 12 semiannual periods and a semiannaal rate of 5% ), the factor ar 0.5568 . You weald need fo invest $2,784 today ( 55 , Oo 0.5568) Tabde H.Z Fature Value of 1 f=(l+i)n TUsed to compute the future value of a known present amonint. For example: What is the accumalated value of $3,000 invested today at 8% conppounded quarierly for 5 years? the factors of n a 20 and i=2% (20 quarierly periods and a quarierly interest rate of 2%), the factar is 3.4859 . The accumalated value is $4,457.70 ( $3.0001.4559). p=[11/(1+n} FUsed ro calculate the present value of a series of equal payments made at the end of each period. For eumple: What is the presert value of $2,000 per yeir for 10 years assumtit annual intereir rate of 9% For (n=10,i=996), the PV factor is 6.4177,$2,000 per year for 10 years is the equivalent of $12.835 today ( $2,000 x 6.4177). Tiahle is. 4F Vutare Value of an Annuity of : f=[(1+n8+11) SUsed to caleulate the furure value of a series of equal paymenes made ar she end of each period. For enample: What is the firure value of 54000 per year for 6 yearr asmuning an annual interest rate of 8%7 For (n=6,i=8%5), the FV factor is 7.3359.$4.000 per year for 6 years accumalates to $29, 343 t.60 ( $4.0007.3359)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts