Question: Does anyone know this? Please show working out Part 2 (10 marks) - Fixed Income Analysis 1. (6 marks) The term structure for zero-coupon bonds

Does anyone know this? Please show working out

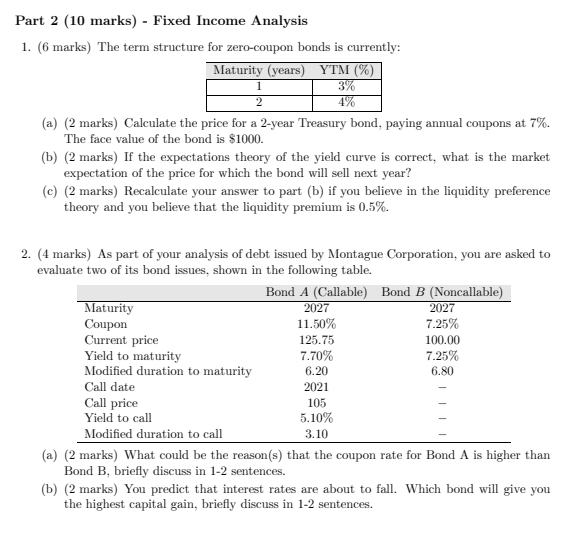

Part 2 (10 marks) - Fixed Income Analysis 1. (6 marks) The term structure for zero-coupon bonds is currently: (a) (2 marks) Calculate the price for a 2-year Treasury bond, paying annual coupons at 7%. The face value of the bond is $1000. (b) (2 marks) If the expectations theory of the yield curve is correct, what is the market expectation of the price for which the bond will sell next year? (c) (2 marks) Recalculate your answer to part (b) if you believe in the liquidity preference theory and you believe that the liquidity premium is 0.5%. 2. (4 marks) As part of your analysis of debt issued by Montague Corporation, you are asked to evaluate two of its bond issues, shown in the following table. (a) (2 marks) What could be the reason(s) that the coupon rate for Bond A is higher than Bond B, briefly discuss in 1-2 sentences. (b) (2 marks) You predict that interest rates are about to fall. Which bond will give you the highest capital gain, briefly discuss in 1-2 sentences

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts