Question: Does Aqua Fun really need a quality improvement program? How would you justify the cost of implementing such an exorbitant program? CASE Aqua-Fun Roberta Brown

Does Aqua Fun really need a quality improvement program? How would you justify the cost of implementing such an exorbitant program?

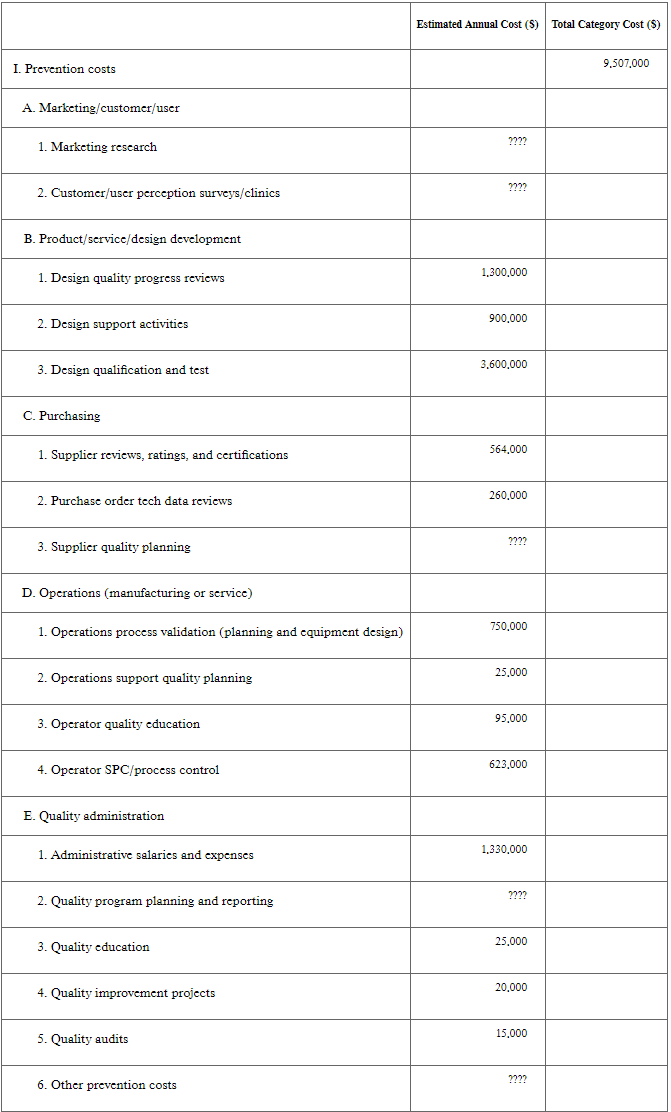

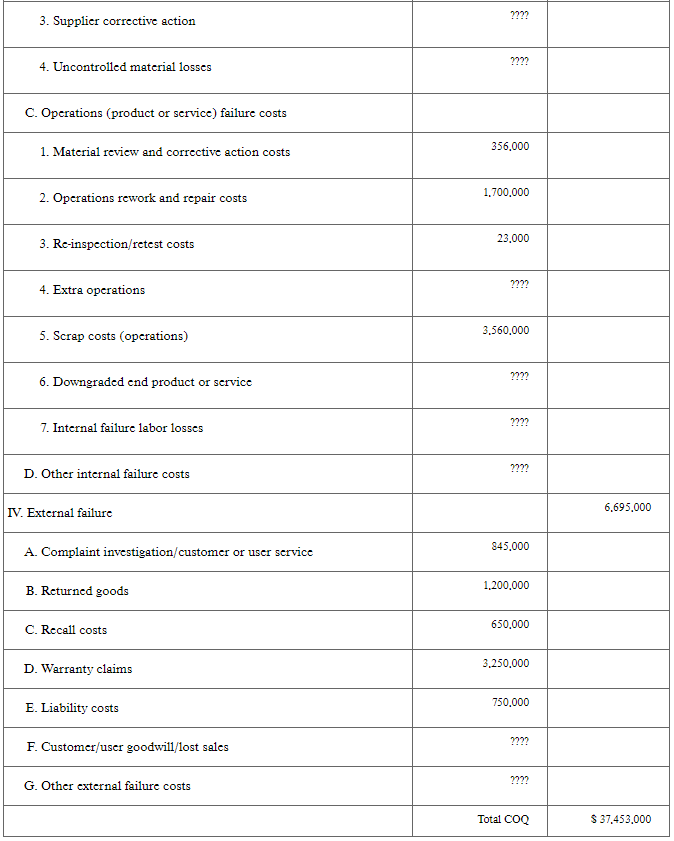

CASE Aqua-Fun Roberta Brown sat at her desk and looked through the preliminary slide deck she had prepared. This presentation had to be good. In two Page 194 weeks she would be giving the presentation to the top management team of Aqua-Fun. The goal: to secure their commitment to a new program aimed at improving quality. Improvements were to come through a new (to Aqua-Fun) corporatewide program to implement Six Sigma. Involvement in this program was the principal reason that Roberta had been hired by Eric Tremble, the vice president of operations/supply chain management at Aqua- Fun, some six months earlier. Demand for Aqua-Fun's products had grown from an emerging interest in home swimming pools over the past few decades. During that time, the founders of Aqua-Fun recognized that there was a need for good quality, fun water toys and swimming pool accessories. Since then, Aqua-Fun had grown to its current state of $195 million in annual sales, employing some 650 employees. The secret to its growth: a fair price, reliable products, and the ability to design and introduce interesting and fun new toys and accessories quickly. However, in the last two years, there was evidence that Aqua-Fun's reputation was suffering. Sales growth had slowed, and, as some of the accessories (such as pool automatic cleaners) became more sophisticated, warranty claims had grown dramatically. Top management's best estimate of the costs of dealing with poor quality in the field was about $6.7 million. However, Eric Tremble was convinced that Aqua-Fun's managers did not fully comprehend the total costs associated with managing quality and quality failures. Before joining Aqua-Fun, Roberta Brown had worked for two years in a firm that had successfully improved quality, reduced costs, and increased revenues by implementing a companywide Six Sigma program. Roberta had been part of the Six Sigma planning and deployment team; she had gone through Green and Black Belt training, and she had successfully carried out three high visibility Six Sigma projects. Now, she was being asked to introduce a similar approach at Aqua-Fun. For both Aqua-Fun and Roberta, the time seemed right for Six Sigma. The Presentation Critical to this presentation was Roberta's COQ analysis (shown in the table following). She worried that the analysis was missing important cost categories. She was also unsure regarding which costs should be included. Items with question marks "????" in the COQ were items that she either did not have data for or was unsure about including. For example, she wasn't sure how the marketing managers would feel about including marketing research as a category in the COQ, though she knew that this was a large expense for the company, well above $ 10 million per year. Other missing categories could be quite substantial as well. Besides, Roberta still felt that there might be even more "hidden" costs of quality not captured in the analysis. As Roberta reviewed the presentation, she noted points that she wanted to make and questions she still needed to answer: Aqua-Fun had tended to underestimate the true costs of quality. For example, the external failure cost estimate of $6.7 million neglected lost sales and damaged customer goodwill that might occur from poor quality products. . The initial costs of training for a Six Sigma program (between $20,000 and $30,000 per Green Belt and $40,000-$50,000 per Black Belt) were high. In typical Six Sigma implementations, companies trained 2 to 5 percent of employees as Black Belts and they trained 50 to 100 percent of employees as Green Belts. . There were significant benefits to be gained by such investments. Other firms had achieved 10 to 20 percent reductions in the COQ each year for the first few years of the Six Sigma program. . To be successful, this program had to be corporatewide. It had to involve everyone from top managers to the people working on the floor. It had to involve not only operations, purchasing, logistics, and supply chain areas but also finance, personnel, training, marketing, engineering, and accounting Estimated Annual Cost ($) Total Category Cost (5) I. Prevention costs 9,507.000 A. Marketing/customer/user 1. Marketing rescarch 7727 2. Customer/user perception surveys/clinics B. Product/service/design development 1,300.000 1. Design quality progress reviews 2. Design support activities 900.000 3.600.000 3. Design qualification and test C. Purchasing 1. Supplier reviews, ratings, and certifications 564.000 2. Purchase order toch data reviews 260.000 3. Supplier quality planning D. Operations (manufacturing or service) 750,000 1. Operations process validation (planning and equipment design) 25.000 2. Operations support quality planning 95.000 3. Operator quality education 4. Operator SPC/process control 623.000 E. Quality administration 1. Administrative salaries and expenses 1,330.000 2. Quality program planning and reporting 25,000 3. Quality education 20.000 4. Quality improvement projects 15.000 5. Quality audits ???? 6. Other prevention costs 8,612,000 II. Appraisal costs A. Purchasing appraisal costs 2,260.000 1. Receiving or incoming inspections and tests 856,000 2. Measurement equipment (annualized cost) 3. Qualification of supplier product 2722 4. Source inspection and control programs B. Operations (manufacturing or service) appraisal costs 1. Planned operations inspections, tests, audits 3.950.000 225.000 2. Inspection and test materials 3. Process control measurements 325.000 145.000 4. Laboratory support 2727 5. Outside endorsements and certifications C. External appraisal costs 1. Field performance evaluation 75.000 2. Special product evaluations 3. Evaluation of field stock and spare parts 776,000 777? D. Review of tests and inspection data ???? E. Miscellancous quality evaluations III. Internal failure costs 12.639,000 Page 196 A. Product/Service design failure costs (internal) 1.230,000 1. Design corrective action 560.000 2. Rework due to design changes 3.650.000 3. Scrap due to design changes B. Purchasing failure costs 1. Purchased material reject disposition and rework costs 1,330.000 2. Purchased material replacement costs 230.000 ???? 3. Supplier corrective action ???? 4. Uncontrolled material losses C. Operations (product or service) failure costs 356,000 1. Material review and corrective action costs 2. Operations rework and repair costs 1.700.000 23.000 3. Re-inspection/retest costs ???? 4. Extra operations 3.560.000 5. Scrap costs (operations) ???? 6. Downgraded end product or service 7 7. Internal failure labor losses ???? D. Other internal failure costs 6.695.000 IV. External failure 845.000 A. Complaint investigation customer or user service B. Returned goods 1.200.000 650.000 C. Recall costs 3,250,000 D. Warranty claims 750.000 E. Liability costs ???? F. Customer/user goodwill/lost sales ???? G. Other external failure costs Total COQ $ 37,453,000Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts