Question: Does IRR always choose the same project whether a firm has high cost of capital or a low cost of capital? How about NPV? Does

- Does IRR always choose the same project whether a firm has high cost of capital or a low cost of capital?

- How about NPV? Does NPV always choose the same project whether a firm has a high or low cost of capital?

- Sinning finds her results confusing so she decides to prepare the NPV profiles for the two projects. Faizan has just shown her how to prepare an NPV profile. How will the NVP profiles look like?

- According to the NPV profiles of the two projects, at what discount rate are these two projects equivalent?

- Over what range of discount rates should you choose Project A? Project B?

- If they were independent projects rather than mutually exclusive projects what would you do?

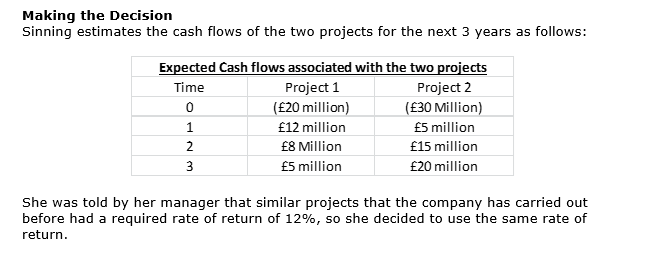

Making the Decision Sinning estimates the cash flows of the two projects for the next 3 years as follows: Expected Cash flows associated with the two projects Time Project 1 Project 2 0 (20 million) (30 Million) 1 12 million 5 million 2 8 Million 15 million 3 5 million 20 million She was told by her manager that similar projects that the company has carried out before had a required rate of return of 12%, so she decided to use the same rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts