Question: Does it require that I use the steps and the associated dollar amounts that appear on Method #1 or Method #2 and is in the

Does it require that I use the steps and the associated dollar amounts that appear on Method #1 or Method #2 and is in the middle of this listing to determine and calculate the $103,000 that I recorded a debit entry for Retained earnings account underneath the column called Consolidated adjustments journal entries?

Are the steps that make up Method #1 at the bottom of this listing to determine and calculate the credit entry of $217,000 for Common stock in the cell found underneath the column called Consolidated adjustments journal entries correct? Or, are the steps that make up Method #1 that appear at the very bottom of this listing the correct steps to get the credit entry of $2017,000 for Common stock in the cell found underneath the column called Consolidated adjustments journal entries?

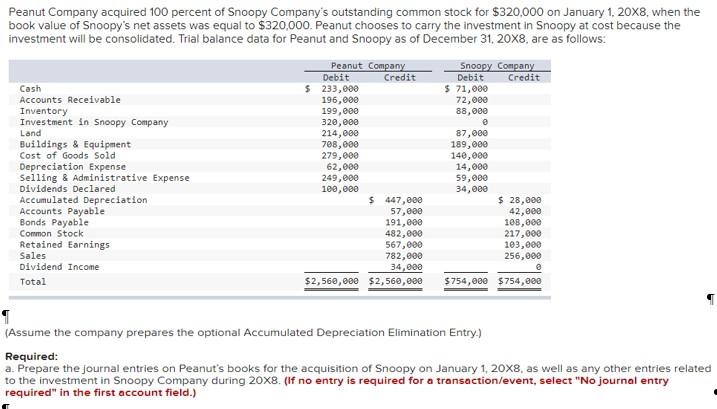

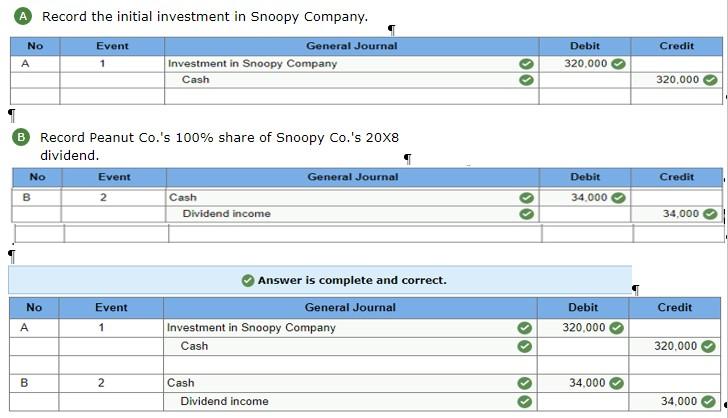

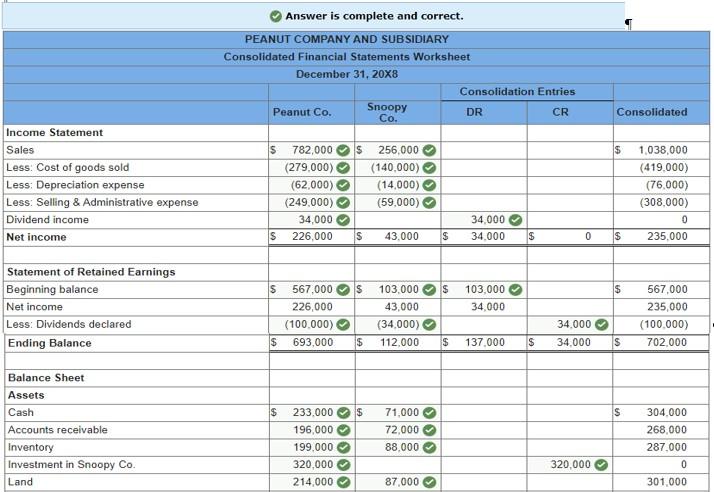

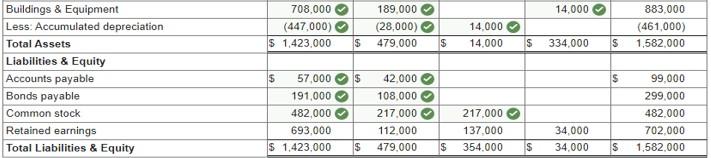

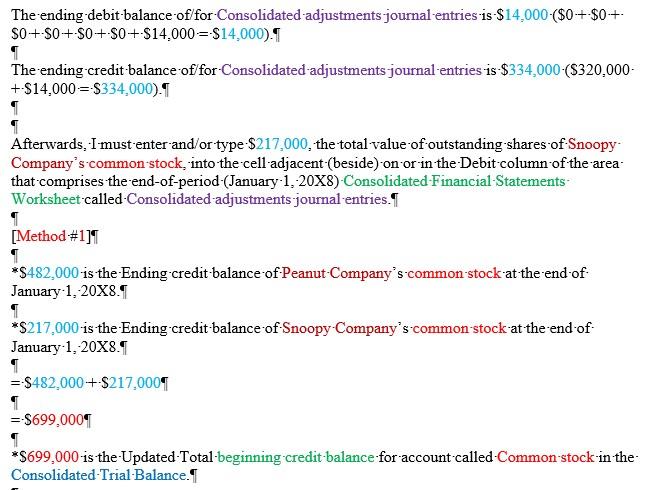

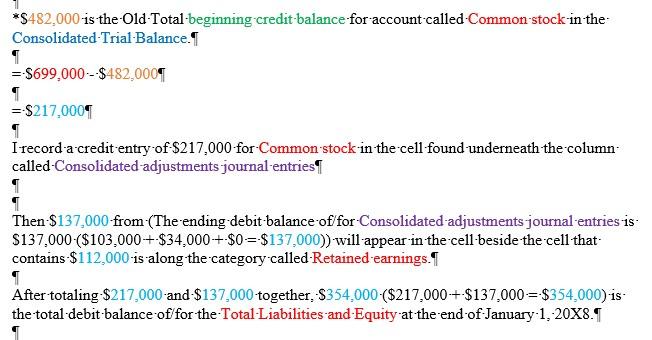

Peanut Company acquired 100 percent of Snoopy Company's outstanding common stock for $320,000 on January 1, 20x8, when the book value of Snoopy's net assets was equal to $320,000. Peanut chooses to carry the investment in Snoopy at cost because the investment will be consolidated. Trial balance data for Peanut and Snoopy as of December 31, 20x8, are as follows: Snoopy Company Debit Credit $ 71,000 72,000 88,000 Cash Accounts Receivable Inventory Investment in Snoopy Company Land Buildings & Equipment Cost of Goods Sold Depreciation Expense Selling & Administrative Expense Dividends Declared Accumulated Depreciation Accounts Payable Bonds Payable Common Stock Retained Earnings Sales Dividend Income Total Peanut Company Debit Credit 5 233,000 196,000 199,000 320,000 214,000 708,000 279,000 62,000 249,000 100,000 $ 447,000 57,000 191,000 482,000 567,000 782,000 34,000 $2,560,000 $2,560,000 87,000 189,000 140,000 14,000 59,000 34,000 $ 28,000 42,000 108,000 217,000 103,000 256,000 $754,000 $754,000 (Assume the company prepares the optional Accumulated Depreciation Elimination Entry) Required: a. Prepare the journal entries on Peanut's books for the acquisition of Snoopy on January 1, 20x8, as well as any other entries related to the investment in Snoopy Company during 20x8. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) A Record the initial investment in Snoopy Company. Event Credit No General Journal Investment in Snoopy Company Cash Debit 320,000 1 OO 320,000 B Record Peanut Co.'s 100% share of Snoopy Co.'s 20X8 dividend. No Event General Journal B 2 Cash Dividend income Debit Credit 34.000 34.000 No Event Credit Answer is complete and correct. General Journal Investment in Snoopy Company Cash Debit 320,000 A 1 320,000 B 2 34,000 Cash Dividend income Ol 34.000 Answer is complete and correct. PEANUT COMPANY AND SUBSIDIARY Consolidated Financial Statements Worksheet December 31, 20x8 Consolidation Entries Peanut Co. Snoopy DR CR Co. Consolidated $ $ Income Statement Sales Less: Cost of goods sold Less: Depreciation expense Less: Selling & Administrative expense Dividend income Net income 782,000 $ (279.000) (62,000) (249,000) 34,000 226,000 S 256,000 (140,000) (14,000) (59.000) 1,038,000 (419.000) (76.000) (308,000) 0 235.000 34.000 34.000 S 43.000 S S 0 S $ $ $ Statement of Retained Earnings Beginning balance Net income Less: Dividends declared Ending Balance 103,000 34.000 $ 567.000 226,000 (100.000) $ 693.000 103.000 43,000 (34.000) 112.000 567,000 235,000 (100.000) 702.000 34.000 34.000 $ $ 137.000 S S IS $ $ Balance Sheet Assets Cash Accounts receivable Inventory Investment in Snoopy Co. Land 233.000 196,000 199.000 320,000 214,000 71.000 72.000 88,000 304.000 268,000 287.000 0 301.000 320,000 87,000 14.000 708,000 (447,000) $ 1,423,000 189.000 (28,000) $ 479.000 14.000 14.000 883.000 (461,000) 1,582,000 $ $ 334,000 s Buildings & Equipment Less. Accumulated depreciation Total Assets Liabilities & Equity Accounts payable Bonds payable Common stock Retained earnings Total Liabilities & Equity is $ $ 57.000 191,000 482,000 693,000 $ 1.423.000 42.000 108,000 217.000 112.000 479.000 217,000 137.000 354.000 99.000 299,000 482.000 702.000 1.582.000 34.000 34,000 $ $ $ S [Method #1] Beginning credit balance of Retained earnings for/of Peanut-Company at the end of January 1, 20X8 was and is $567,000. Beginning credit balance of Retained earnings for/of Snoopy Company at the end of January 1,- 20X8 was and is $103,000.1 = $567,000+$103,000 =-S670.0001 *S670.000 is the-Updated Total beginning credit balance for Retained earnings in the Consolidated-Trial-Balance. I *$567.000 is the Old-Total-beginning credit balance for Retained earnings in the Consolidated- Trial-Balance. I =-S670,000-$567,000 = $103,0001 [Method #2]1 *Peanut Company-acquired -100%-of the outstanding shares of Snoopy Company's common stock for $320,000 on-January-1,-20X8, when the book value of Snoopy Company's net-assets was equal to $320.000.5 *The-Snoopy-Company's value (book value, total market value) and/or -balance-of-Total- Stockholders' Equity at the end of January 1, 20X8 was and is $217,000.1 =-$320,000-$217,0009 = $103,000 Next, I must record-a debit entry of $103,000 to the account called Retained-Earnings underneath- the Consolidated adjustments journal entries. Or. I must type and/or enter-S103.000-into the cell- to the right-of-Beginning credited balance associated with-Retained-Earnings for Snoopy Co. Eventually, the-Net-income of $34,000 will appear automatically into the cell-below the cell. where $103,000-is-located. $34,000 will appear in a cell representing the account-called-Retained-earnings in the Credit: column of the Consolidated adjustments journal entries that make up the end-of-period (January 1, 20X8) Consolidated Financial Statements-Worksheet. The ending-debit balance of for Consolidated adjustments journal entries is $137,000 ($103,000- + $34.000+.50=$137.000). 1 The ending credit balance of for Consolidated adjustments journal entries is $34.000-(S0+S0+ $34,000 = $34,000). Since-Peanut-Company acquired-(purchased)-100% of the Snoopy-Company's outstanding common-stock for $320,000 on January 1, 20X8 when the book value of Snoopy Company's net- assets was equal to-$320,000, I must type and/or enter-$320,000 underneath Peanut Company that make up the end-of-period (January 1, 20X8) Consolidated Financial Statements-Worksheet. I 1 Since it is the board of directors of Peanut Company who are buying 100%-all-of the outstanding shares of Snoopy Company's common-stock. I must record a debit-entry of $14.000-for- Accumulated depreciation in the cell-found underneath the-column-called-Consolidated adjustments journal-entries. I Eventually, I must type and/or enter-$14,000-into the cell that represent the Depreciated expense to the right of Buildings & Equipment, which is underneath the Consolidated adjustments journa entries that comprise the end-of-period (January 1, 20X8) Consolidated Financial Statements Worksheet --The estimated amount of depreciation on equipment at the end of January 1, 20X8- is $14,000.1 Itoo must type and/or-enter $14.000-into the cell that represent the Accumulated-Depreciation that is underneath the Consolidated adjustments journal entries that comprise the end-of-period (January 1, 20X8) Consolidated-Financial Statements-Worksheet. --The balance in the accumulated depreciationBuildings and Equipment account was and/or is $14,000 at the end of January 1, 20X8.5 After-Snoop Company's accountant(s) debited and recorded the total debit balance of $14,000- of for Depreciation expense, the total dollar amount that was depreciated from the fixed assets- like, in this example, the Buildings and Equipment, to the Income Statement by or at the end of January 1, 20X8-and-credited and recorded a total credit balance of $14.000 of for Accumulated depreciation, the accrued (cumulative) amount of depreciation that has been charged against the fixed assets, such as the Buildings and Equipment, to the Balance Sheet by or at the end of January 1, 20X8.--Next, these dollar amounts were recorded in the respective area(s) in the Debit/Credit column(s) that are underneath the Consolidated -adjustments journal entries that- comprise the-end-of-period (January 1, 20X8) Consolidated-Financial Statements-Worksheet. I The ending debit-balance of for Consolidated adjustments journal entries is $14,000-($0+$0+ $0+ $0+50+ 50+ $14.000=-$14,000). 1 The-ending-credit balance of for Consolidated-adjustments journal-entries is $334,000 ($320.000- +$14.000 = $334,000). Afterwards. I must enter and/or type-$217,000, the total value of outstanding shares of Snoopy- Company's common stock, into the cell adjacent (beside) on or in the Debit column of the area that comprises the end-of-period (January 1, 20X8) Consolidated Financial Statements Worksheet called-Consolidated-adjustments journal entries. I [Method #1]1 *$482,000 is the Ending credit balance of Peanut Company's common stock at the end of January 1, 20X8.4 *$217,000 is the Ending credit balance of Snoopy Company's common-stock at the end of January 1, 20X8.1 =-$482,000+$217,000 =-5699,0001 *$699,000 is the-Updated-Total-beginning credit balance for account called-Common-stock-in-the- Consolidated-Trial Balance. *$482,000 is the Old-Total-beginning credit-balance-for-account-called-Common-stock in the Consolidated-Trial-Balance. I =-5699,000-$482,000 = $217,0009 I record a credit entry of $217,000 for Common stock in the cell found underneath the column called-Consolidated adjustments journal entries Then-$137,000 from (The-ending-debit -balance-of for Consolidated-adjustments journal entries is. $137,000 ($103,000+$34,000+ $0=-$137,000)) will appear in the cell-beside the cell that contains $112,000 is along the category called-Retained earnings. 1 After totaling-$217,000-and-$137,000 together, $354,000 ($217,000+-$137,000-=-$354,000) is- the total debit balance of for the Total-Liabilities and Equity at the end of January 1, 20X8.5 Peanut Company acquired 100 percent of Snoopy Company's outstanding common stock for $320,000 on January 1, 20x8, when the book value of Snoopy's net assets was equal to $320,000. Peanut chooses to carry the investment in Snoopy at cost because the investment will be consolidated. Trial balance data for Peanut and Snoopy as of December 31, 20x8, are as follows: Snoopy Company Debit Credit $ 71,000 72,000 88,000 Cash Accounts Receivable Inventory Investment in Snoopy Company Land Buildings & Equipment Cost of Goods Sold Depreciation Expense Selling & Administrative Expense Dividends Declared Accumulated Depreciation Accounts Payable Bonds Payable Common Stock Retained Earnings Sales Dividend Income Total Peanut Company Debit Credit 5 233,000 196,000 199,000 320,000 214,000 708,000 279,000 62,000 249,000 100,000 $ 447,000 57,000 191,000 482,000 567,000 782,000 34,000 $2,560,000 $2,560,000 87,000 189,000 140,000 14,000 59,000 34,000 $ 28,000 42,000 108,000 217,000 103,000 256,000 $754,000 $754,000 (Assume the company prepares the optional Accumulated Depreciation Elimination Entry) Required: a. Prepare the journal entries on Peanut's books for the acquisition of Snoopy on January 1, 20x8, as well as any other entries related to the investment in Snoopy Company during 20x8. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) A Record the initial investment in Snoopy Company. Event Credit No General Journal Investment in Snoopy Company Cash Debit 320,000 1 OO 320,000 B Record Peanut Co.'s 100% share of Snoopy Co.'s 20X8 dividend. No Event General Journal B 2 Cash Dividend income Debit Credit 34.000 34.000 No Event Credit Answer is complete and correct. General Journal Investment in Snoopy Company Cash Debit 320,000 A 1 320,000 B 2 34,000 Cash Dividend income Ol 34.000 Answer is complete and correct. PEANUT COMPANY AND SUBSIDIARY Consolidated Financial Statements Worksheet December 31, 20x8 Consolidation Entries Peanut Co. Snoopy DR CR Co. Consolidated $ $ Income Statement Sales Less: Cost of goods sold Less: Depreciation expense Less: Selling & Administrative expense Dividend income Net income 782,000 $ (279.000) (62,000) (249,000) 34,000 226,000 S 256,000 (140,000) (14,000) (59.000) 1,038,000 (419.000) (76.000) (308,000) 0 235.000 34.000 34.000 S 43.000 S S 0 S $ $ $ Statement of Retained Earnings Beginning balance Net income Less: Dividends declared Ending Balance 103,000 34.000 $ 567.000 226,000 (100.000) $ 693.000 103.000 43,000 (34.000) 112.000 567,000 235,000 (100.000) 702.000 34.000 34.000 $ $ 137.000 S S IS $ $ Balance Sheet Assets Cash Accounts receivable Inventory Investment in Snoopy Co. Land 233.000 196,000 199.000 320,000 214,000 71.000 72.000 88,000 304.000 268,000 287.000 0 301.000 320,000 87,000 14.000 708,000 (447,000) $ 1,423,000 189.000 (28,000) $ 479.000 14.000 14.000 883.000 (461,000) 1,582,000 $ $ 334,000 s Buildings & Equipment Less. Accumulated depreciation Total Assets Liabilities & Equity Accounts payable Bonds payable Common stock Retained earnings Total Liabilities & Equity is $ $ 57.000 191,000 482,000 693,000 $ 1.423.000 42.000 108,000 217.000 112.000 479.000 217,000 137.000 354.000 99.000 299,000 482.000 702.000 1.582.000 34.000 34,000 $ $ $ S [Method #1] Beginning credit balance of Retained earnings for/of Peanut-Company at the end of January 1, 20X8 was and is $567,000. Beginning credit balance of Retained earnings for/of Snoopy Company at the end of January 1,- 20X8 was and is $103,000.1 = $567,000+$103,000 =-S670.0001 *S670.000 is the-Updated Total beginning credit balance for Retained earnings in the Consolidated-Trial-Balance. I *$567.000 is the Old-Total-beginning credit balance for Retained earnings in the Consolidated- Trial-Balance. I =-S670,000-$567,000 = $103,0001 [Method #2]1 *Peanut Company-acquired -100%-of the outstanding shares of Snoopy Company's common stock for $320,000 on-January-1,-20X8, when the book value of Snoopy Company's net-assets was equal to $320.000.5 *The-Snoopy-Company's value (book value, total market value) and/or -balance-of-Total- Stockholders' Equity at the end of January 1, 20X8 was and is $217,000.1 =-$320,000-$217,0009 = $103,000 Next, I must record-a debit entry of $103,000 to the account called Retained-Earnings underneath- the Consolidated adjustments journal entries. Or. I must type and/or enter-S103.000-into the cell- to the right-of-Beginning credited balance associated with-Retained-Earnings for Snoopy Co. Eventually, the-Net-income of $34,000 will appear automatically into the cell-below the cell. where $103,000-is-located. $34,000 will appear in a cell representing the account-called-Retained-earnings in the Credit: column of the Consolidated adjustments journal entries that make up the end-of-period (January 1, 20X8) Consolidated Financial Statements-Worksheet. The ending-debit balance of for Consolidated adjustments journal entries is $137,000 ($103,000- + $34.000+.50=$137.000). 1 The ending credit balance of for Consolidated adjustments journal entries is $34.000-(S0+S0+ $34,000 = $34,000). Since-Peanut-Company acquired-(purchased)-100% of the Snoopy-Company's outstanding common-stock for $320,000 on January 1, 20X8 when the book value of Snoopy Company's net- assets was equal to-$320,000, I must type and/or enter-$320,000 underneath Peanut Company that make up the end-of-period (January 1, 20X8) Consolidated Financial Statements-Worksheet. I 1 Since it is the board of directors of Peanut Company who are buying 100%-all-of the outstanding shares of Snoopy Company's common-stock. I must record a debit-entry of $14.000-for- Accumulated depreciation in the cell-found underneath the-column-called-Consolidated adjustments journal-entries. I Eventually, I must type and/or enter-$14,000-into the cell that represent the Depreciated expense to the right of Buildings & Equipment, which is underneath the Consolidated adjustments journa entries that comprise the end-of-period (January 1, 20X8) Consolidated Financial Statements Worksheet --The estimated amount of depreciation on equipment at the end of January 1, 20X8- is $14,000.1 Itoo must type and/or-enter $14.000-into the cell that represent the Accumulated-Depreciation that is underneath the Consolidated adjustments journal entries that comprise the end-of-period (January 1, 20X8) Consolidated-Financial Statements-Worksheet. --The balance in the accumulated depreciationBuildings and Equipment account was and/or is $14,000 at the end of January 1, 20X8.5 After-Snoop Company's accountant(s) debited and recorded the total debit balance of $14,000- of for Depreciation expense, the total dollar amount that was depreciated from the fixed assets- like, in this example, the Buildings and Equipment, to the Income Statement by or at the end of January 1, 20X8-and-credited and recorded a total credit balance of $14.000 of for Accumulated depreciation, the accrued (cumulative) amount of depreciation that has been charged against the fixed assets, such as the Buildings and Equipment, to the Balance Sheet by or at the end of January 1, 20X8.--Next, these dollar amounts were recorded in the respective area(s) in the Debit/Credit column(s) that are underneath the Consolidated -adjustments journal entries that- comprise the-end-of-period (January 1, 20X8) Consolidated-Financial Statements-Worksheet. I The ending debit-balance of for Consolidated adjustments journal entries is $14,000-($0+$0+ $0+ $0+50+ 50+ $14.000=-$14,000). 1 The-ending-credit balance of for Consolidated-adjustments journal-entries is $334,000 ($320.000- +$14.000 = $334,000). Afterwards. I must enter and/or type-$217,000, the total value of outstanding shares of Snoopy- Company's common stock, into the cell adjacent (beside) on or in the Debit column of the area that comprises the end-of-period (January 1, 20X8) Consolidated Financial Statements Worksheet called-Consolidated-adjustments journal entries. I [Method #1]1 *$482,000 is the Ending credit balance of Peanut Company's common stock at the end of January 1, 20X8.4 *$217,000 is the Ending credit balance of Snoopy Company's common-stock at the end of January 1, 20X8.1 =-$482,000+$217,000 =-5699,0001 *$699,000 is the-Updated-Total-beginning credit balance for account called-Common-stock-in-the- Consolidated-Trial Balance. *$482,000 is the Old-Total-beginning credit-balance-for-account-called-Common-stock in the Consolidated-Trial-Balance. I =-5699,000-$482,000 = $217,0009 I record a credit entry of $217,000 for Common stock in the cell found underneath the column called-Consolidated adjustments journal entries Then-$137,000 from (The-ending-debit -balance-of for Consolidated-adjustments journal entries is. $137,000 ($103,000+$34,000+ $0=-$137,000)) will appear in the cell-beside the cell that contains $112,000 is along the category called-Retained earnings. 1 After totaling-$217,000-and-$137,000 together, $354,000 ($217,000+-$137,000-=-$354,000) is- the total debit balance of for the Total-Liabilities and Equity at the end of January 1, 20X8.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts