Question: Does someone know how to do this problem? Will rate a thumb up for good response thanks so much! 3. IHM Inc. has no debt

Does someone know how to do this problem?

Will rate a thumb up for good response thanks so much!

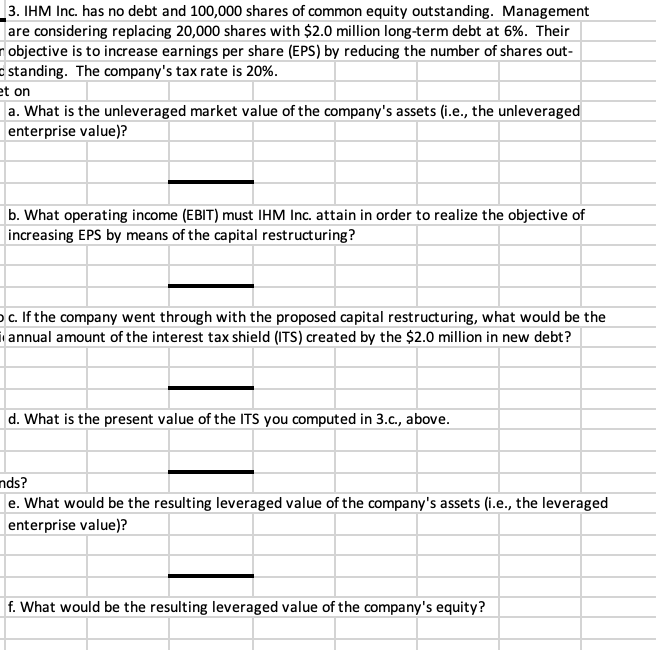

3. IHM Inc. has no debt and 100,000 shares of common equity outstanding. Management are considering replacing 20,000 shares with $2.0 million long-term debt at 6%. Their objective is to increase earnings per share (EPS) by reducing the number of shares out- standing. The company's tax rate is 20%. et on a. What is the unleveraged market value of the company's assets (i.e., the unleveraged enterprise value)? b. What operating income (EBIT) must IHM Inc. attain in order to realize the objective of increasing EPS by means of the capital restructuring? c. If the company went through with the proposed capital restructuring, what would be the annual amount of the interest tax shield (ITS) created by the $2.0 million in new debt? d. What is the present value of the ITS you computed in 3.c., above. nds? e. What would be the resulting leveraged value of the company's assets (i.e., the leveraged enterprise value)? f. What would be the resulting leveraged value of the company's equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts