Question: Does someone know how to do this problem? Will rate a thumb up if correct, thanks so much! 3. Refer again to the financial statements

Does someone know how to do this problem?

Will rate a thumb up if correct, thanks so much!

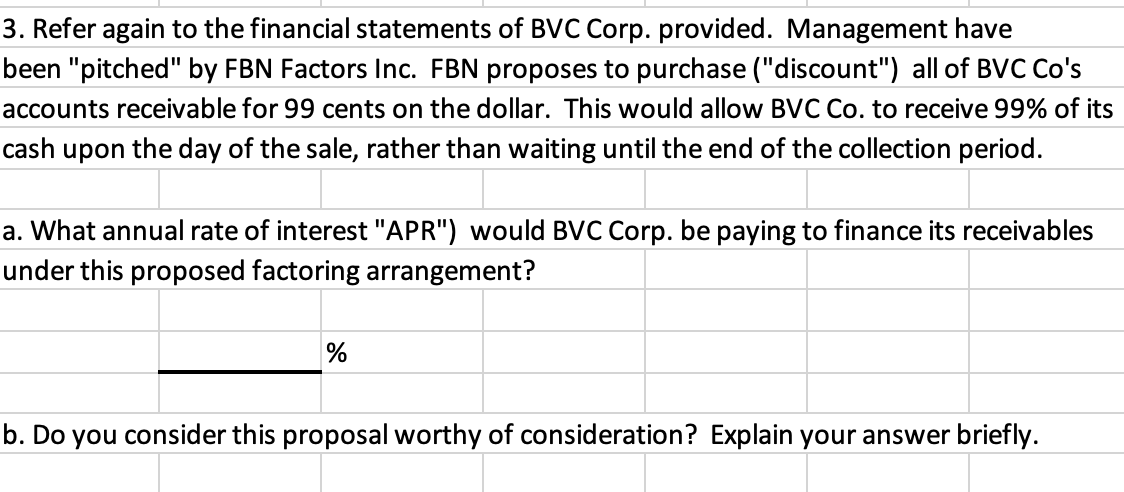

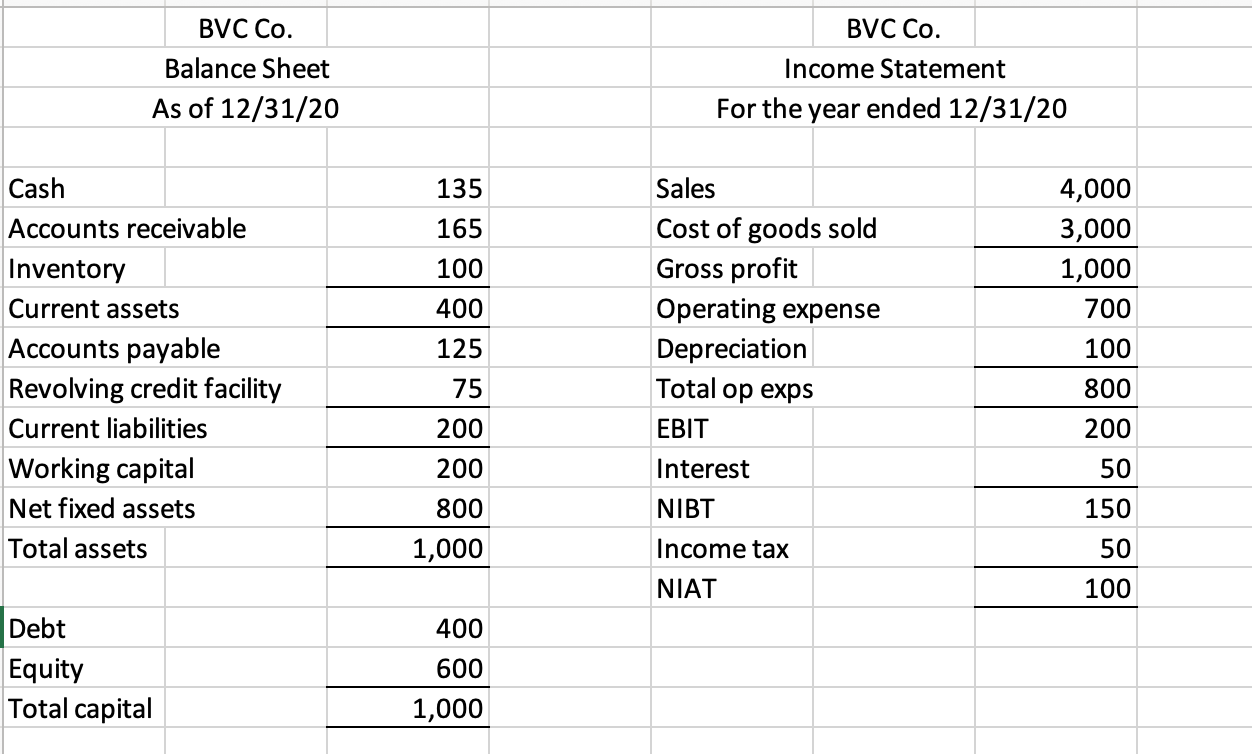

3. Refer again to the financial statements of BVC Corp. provided. Management have been "pitched" by FBN Factors Inc. FBN proposes to purchase ("discount") all of BVC Co's accounts receivable for 99 cents on the dollar. This would allow BVC Co. to receive 99% of its cash upon the day of the sale, rather than waiting until the end of the collection period. a. What annual rate of interest "APR") would BVC Corp. be paying to finance its receivables under this proposed factoring arrangement? % b. Do you consider this proposal worthy of consideration? Explain your answer briefly. BVC Co. BVC Co. Balance Sheet As of 12/31/20 Income Statement For the year ended 12/31/20 135 165 4,000 3,000 1,000 700 100 400 Sales Cost of goods sold Gross profit Operating expense Depreciation Total op exps EBIT 125 Cash Accounts receivable Inventory Current assets Accounts payable Revolving credit facility Current liabilities Working capital Net fixed assets Total assets 100 75 800 200 200 50 200 800 1,000 Interest NIBT 150 50 Income tax NIAT 100 400 Debt Equity Total capital 600 1,000 3. Refer again to the financial statements of BVC Corp. provided. Management have been "pitched" by FBN Factors Inc. FBN proposes to purchase ("discount") all of BVC Co's accounts receivable for 99 cents on the dollar. This would allow BVC Co. to receive 99% of its cash upon the day of the sale, rather than waiting until the end of the collection period. a. What annual rate of interest "APR") would BVC Corp. be paying to finance its receivables under this proposed factoring arrangement? % b. Do you consider this proposal worthy of consideration? Explain your answer briefly. BVC Co. BVC Co. Balance Sheet As of 12/31/20 Income Statement For the year ended 12/31/20 135 165 4,000 3,000 1,000 700 100 400 Sales Cost of goods sold Gross profit Operating expense Depreciation Total op exps EBIT 125 Cash Accounts receivable Inventory Current assets Accounts payable Revolving credit facility Current liabilities Working capital Net fixed assets Total assets 100 75 800 200 200 50 200 800 1,000 Interest NIBT 150 50 Income tax NIAT 100 400 Debt Equity Total capital 600 1,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts