Question: Does someone know how to do this problem? Will rate a thumb up if correct, thanks so much! 5. Consider the credit terms granted by

Does someone know how to do this problem?

Will rate a thumb up if correct, thanks so much!

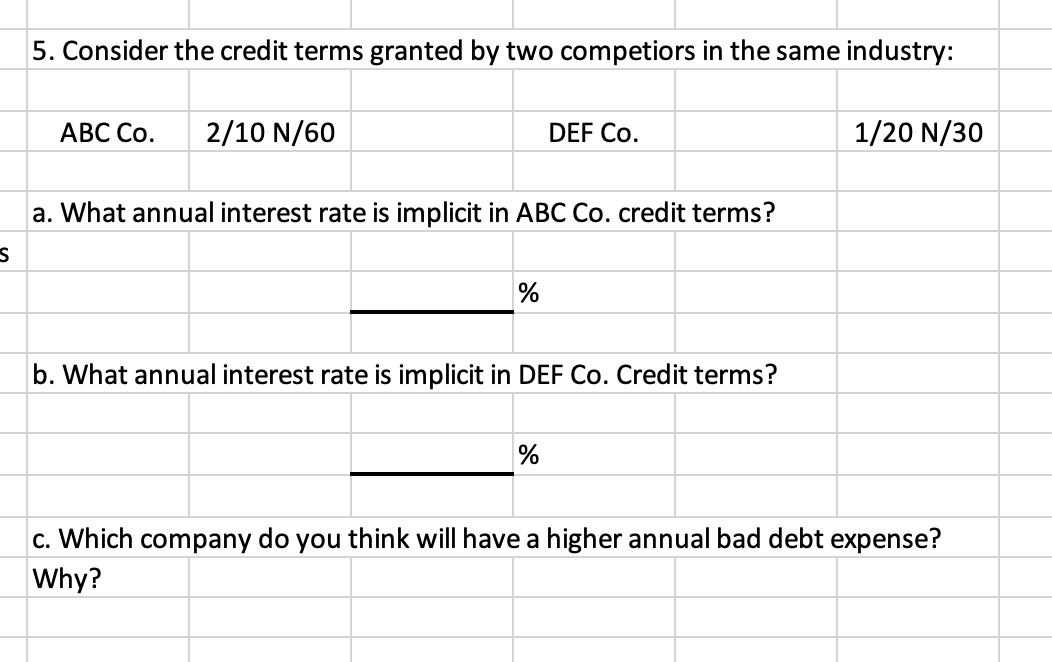

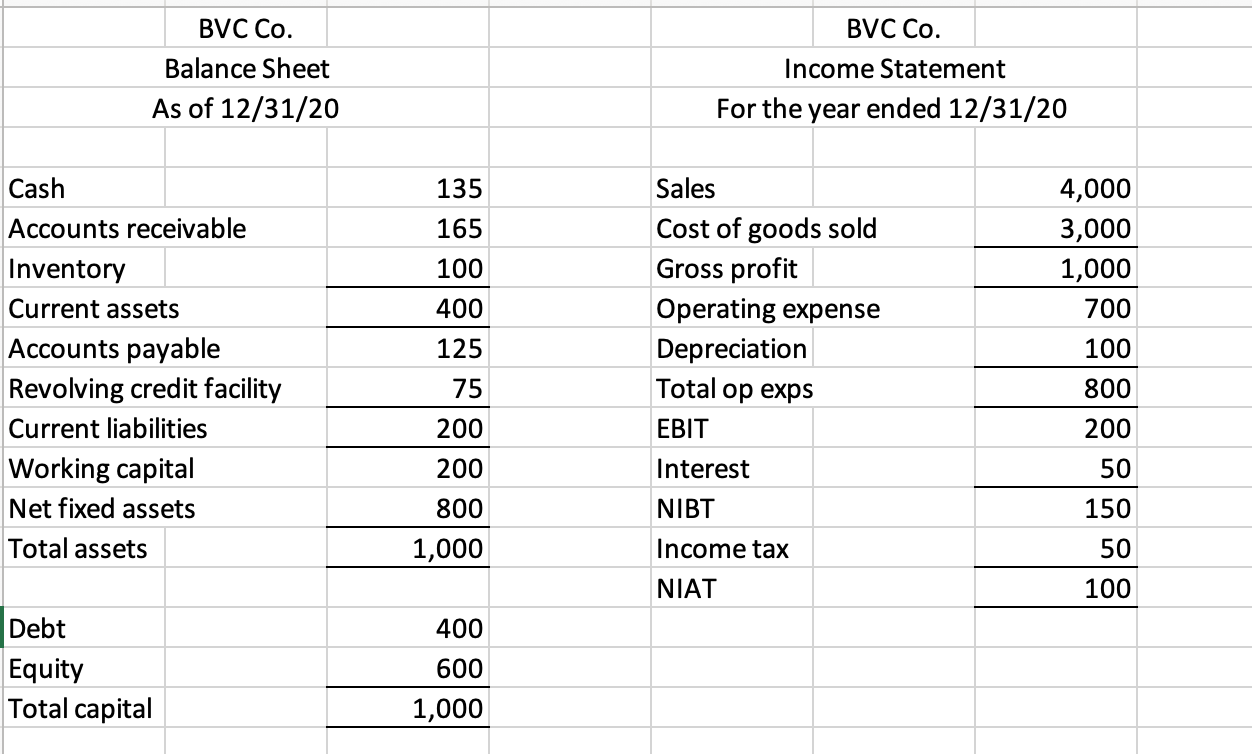

5. Consider the credit terms granted by two competiors in the same industry: ABC Co. 2/10 N/60 DEF Co. 1/20 N/30 a. What annual interest rate is implicit in ABC Co. credit terms? S % b. What annual interest rate is implicit in DEF Co. Credit terms? % c. Which company do you think will have a higher annual bad debt expense? Why? BVC Co. BVC Co. Balance Sheet As of 12/31/20 Income Statement For the year ended 12/31/20 135 165 4,000 3,000 1,000 700 100 400 Sales Cost of goods sold Gross profit Operating expense Depreciation Total op exps EBIT 125 Cash Accounts receivable Inventory Current assets Accounts payable Revolving credit facility Current liabilities Working capital Net fixed assets Total assets 100 75 800 200 200 50 200 800 1,000 Interest NIBT 150 50 Income tax NIAT 100 400 Debt Equity Total capital 600 1,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts