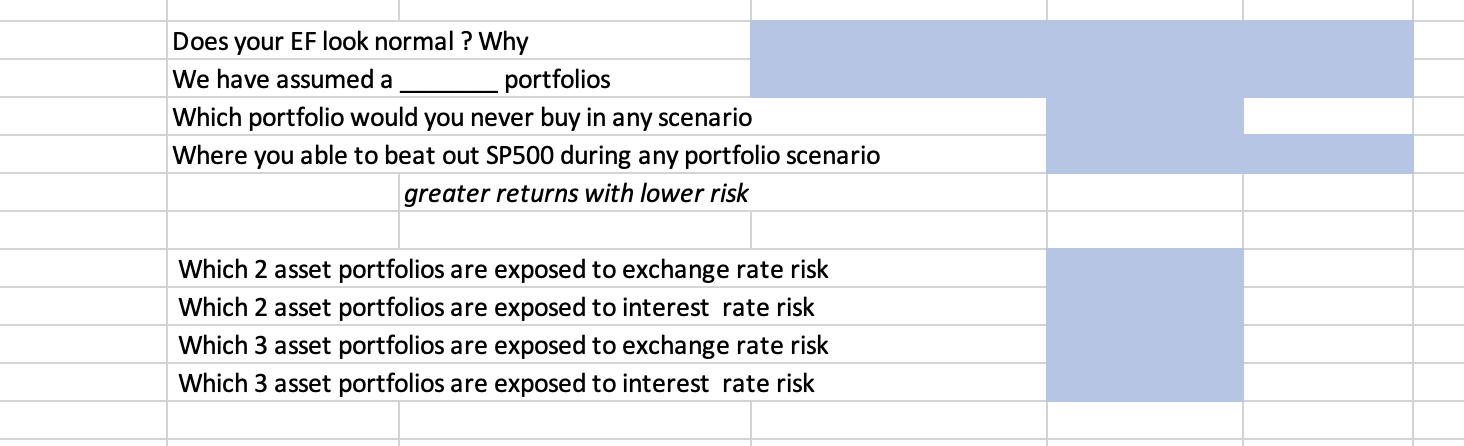

Question: Does your EF look normal ? Why We have assumed a portfolios Which portfolio would you never buy in any scenario Where you able to

Does your EF look normal ? Why We have assumed a portfolios Which portfolio would you never buy in any scenario Where you able to beat out SP500 during any portfolio scenario greater returns with lower risk Which 2 asset portfolios are exposed to exchange rate risk Which 2 asset portfolios are exposed to interest rate risk Which 3 asset portfolios are exposed to exchange rate risk Which 3 asset portfolios are exposed to interest rate risk Does your EF look normal ? Why We have assumed a portfolios Which portfolio would you never buy in any scenario Where you able to beat out SP500 during any portfolio scenario greater returns with lower risk Which 2 asset portfolios are exposed to exchange rate risk Which 2 asset portfolios are exposed to interest rate risk Which 3 asset portfolios are exposed to exchange rate risk Which 3 asset portfolios are exposed to interest rate risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts