Question: DogeMaster is a tech firm that has two divisions: One division - Dogela --- sells electric automobiles that will allegedly someday have th- capacity for

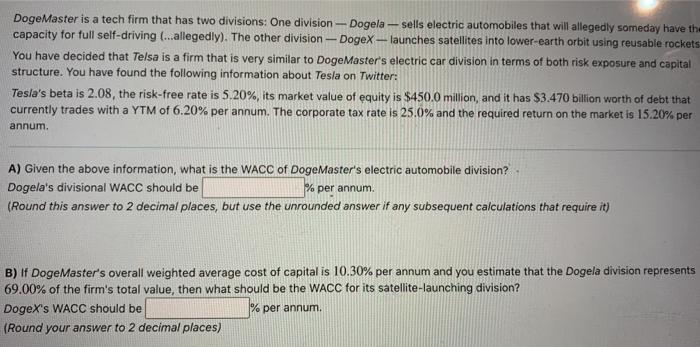

DogeMaster is a tech firm that has two divisions: One division - Dogela --- sells electric automobiles that will allegedly someday have th- capacity for full self-driving (...allegedly). The other division- Dogex - launches satellites into lower-earth orbit using reusable rockets You have decided that Telsa is a firm that is very similar to DogeMaster's electric car division in terms of both risk exposure and capital structure. You have found the following information about Tesla on Twitter: Tesla's beta is 2.08, the risk-free rate is 5.20%, its market value of equity is $450,0 million, and it has $3.470 billion worth of debt that currently trades with a YTM of 6.20% per annum. The corporate tax rate is 25.0% and the required return on the market is 15.20% per annum. A) Given the above information, what is the WACC of DogeMaster's electric automobile division? Dogela's divisional WACC should be % per annum (Round this answer to 2 decimal places, but use the unrounded answer if any subsequent calculations that require it) B) If DogeMaster's overall weighted average cost of capital is 10.30% per annum and you estimate that the Dogela division represents 69.00% of the firm's total value, then what should be the WACC for its satellite-launching division? DogeX's WACC should be % per annum. (Round your answer to 2 decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts