Question: dogle.com E ools Help Last edit was 4 days ago *t Times New.. 12 + BIVA GA 15 TESORO The operating cycle covers the time

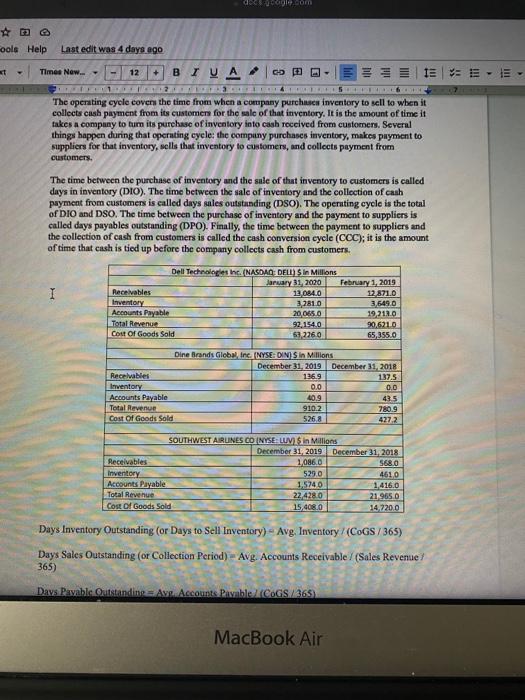

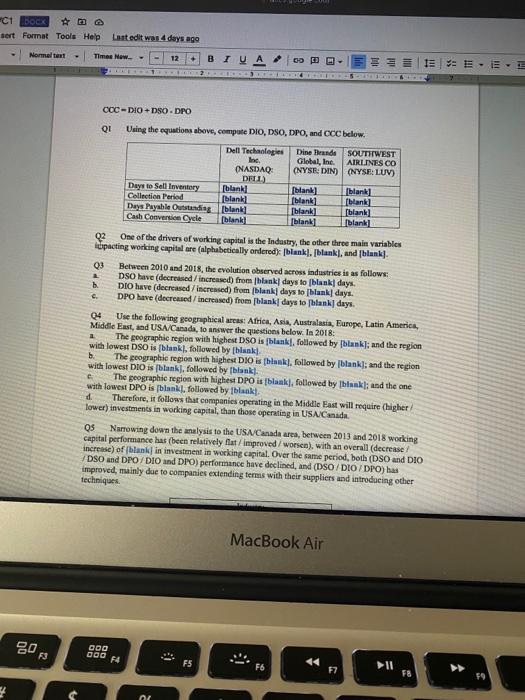

dogle.com E ools Help Last edit was 4 days ago *t Times New.. 12 + BIVA GA 15 TESORO The operating cycle covers the time from when a company purchase inventory to sell to when it collects cash payment from its customers for the sale of that inventory. It is the amount of time it takes a company to turn its purchase of inventory into cash received from customers. Several things happen during that operating cycle: the company purchases inventory, makes payment to suppliers for that inventory, sells that inventory to customers, and collects payment from customers. The time between the purchase of inventory and the sale of that inventory to customers is called days in inventory (DIO). The time between the sale of inventory and the collection of cash payment from customers is called days sales outstanding (DSO). The operating cycle is the total of DIO and DSO. The time between the purchase of inventory and the payment to suppliers is called days payables outstanding (DPO). Finally, the time between the payment to suppliers and the collection of cash from customers is called the cash conversion cycle (CCC); it is the amount of time that cash is tied up before the company collects cash from customers. Dell Technologies Inc. (NASDAQ: DELL) Sin Millions January 31, 2020 February 1, 2019 Receivables 13.084.0 12.871.0 Inventory 3,7810 3.549.0 Accounts Payable 20.065.0 19 2120 Total Revenue 92.154.0 90,6210 Cost Of Goods Sold 632260 65,355.0 Dine Brands Global Inc. (NYSE: DIN Sin Millions December 31, 2019 December 31, 2018 Receivables 1369 137,5 Inventory 0.0 0.0 Accounts Payable 40.9 Total Revenue 910.2 780.9 Cost Of Goods Sold 526,8 4272 45 SOUTHWEST AIRUNESCO INYSELUMS In Millions December 31, 2019 December 31, 2018 Receivables 1.086 0 568.0 Inventory 5290 4610 Accounts Payable 1,5740 1.416.0 Total Revenue 22 428 0 21.965.0 Cost of Goods Sold 15,408 0 14.220.0 Days Inventory Outstanding (or Days to Sell Inventory) - Avg. Inventory (COGS/365) Days Sales Outstanding (or Collection Period) - Avg. Accounts Receivable /(Sales Revenue 365) Days Pavable.Outstanding.As.Account Pablo COGS/365 MacBook Air C1 BOCK #m sert Format Tools Help Last edit was 4 days ago Nomment Times Now 12 BIUA = == : E-=-= COC-DIO+DSODPO QI Using the equations above, compute DIO, DSO, DPO, and CCC below. Dell Technologies Dine Brande SOUTIWEST Inc Global, Inc. AIRLINES CO (NASDAQ: (NYSE: DIN) (NYSE: LUV) DELL) Days to Sell Inventory [blank! [blank] blank Collection Period [blank blank] [blank] Days Payable Outstanding blank] blank] blank] Cash Converse Cycle [blank] blank] blank c. 02 One of the drivers of working capital is the Industry, the other three main variables upacting working capital are (alphabetically ordered) (blank], [blank], and blank] 03 Between 2010 and 2018, the evolution observed across industries is as follows: DSO have (decreased increased) from blank days to blankdays. b. DIO have (decreased increased) from (blank days to blank days. DPO have (decreased increased from blank days to blank] days. 04 Use the following geographical areas: Africa, Asia, Australasia, Europe, Latin America Middle East, and USA/Canada, to answer the questions below. In 2018: The geographic region with highest DSO is blank], followed by blank]; and the region with lowest DSO is blankl. followed by blank The geographic region with highest DIO is blank, followed by blanks and the region with lowest DIO is blank], followed by blank The geographic region with highest DPO is (blank], followed by blankt: and the one with lowest DPO is blank], followed by blankt. d. Therefore, it follows that companies operating in the Middle East will require (higher lower) investments in working capital, than those operating in USA/Canada QS Narrowing down the analysis to the USA/Canada ares, between 2013 and 2018 wocking capital performance has been relatively fat improved / wonen), with an overall (decrease increase) of blank in investment in werking capital. Over the same period, both (DSO and DIO DSO and DPO DIO and DPO) performance have declined, and (DSODIO/DPO) has improved, mainly due to companies extending terms with their suppliers and introducing other techniques b. MacBook Air 20 000 13 000 F4 F5 F6 57 II F8 59 07 dogle.com E ools Help Last edit was 4 days ago *t Times New.. 12 + BIVA GA 15 TESORO The operating cycle covers the time from when a company purchase inventory to sell to when it collects cash payment from its customers for the sale of that inventory. It is the amount of time it takes a company to turn its purchase of inventory into cash received from customers. Several things happen during that operating cycle: the company purchases inventory, makes payment to suppliers for that inventory, sells that inventory to customers, and collects payment from customers. The time between the purchase of inventory and the sale of that inventory to customers is called days in inventory (DIO). The time between the sale of inventory and the collection of cash payment from customers is called days sales outstanding (DSO). The operating cycle is the total of DIO and DSO. The time between the purchase of inventory and the payment to suppliers is called days payables outstanding (DPO). Finally, the time between the payment to suppliers and the collection of cash from customers is called the cash conversion cycle (CCC); it is the amount of time that cash is tied up before the company collects cash from customers. Dell Technologies Inc. (NASDAQ: DELL) Sin Millions January 31, 2020 February 1, 2019 Receivables 13.084.0 12.871.0 Inventory 3,7810 3.549.0 Accounts Payable 20.065.0 19 2120 Total Revenue 92.154.0 90,6210 Cost Of Goods Sold 632260 65,355.0 Dine Brands Global Inc. (NYSE: DIN Sin Millions December 31, 2019 December 31, 2018 Receivables 1369 137,5 Inventory 0.0 0.0 Accounts Payable 40.9 Total Revenue 910.2 780.9 Cost Of Goods Sold 526,8 4272 45 SOUTHWEST AIRUNESCO INYSELUMS In Millions December 31, 2019 December 31, 2018 Receivables 1.086 0 568.0 Inventory 5290 4610 Accounts Payable 1,5740 1.416.0 Total Revenue 22 428 0 21.965.0 Cost of Goods Sold 15,408 0 14.220.0 Days Inventory Outstanding (or Days to Sell Inventory) - Avg. Inventory (COGS/365) Days Sales Outstanding (or Collection Period) - Avg. Accounts Receivable /(Sales Revenue 365) Days Pavable.Outstanding.As.Account Pablo COGS/365 MacBook Air C1 BOCK #m sert Format Tools Help Last edit was 4 days ago Nomment Times Now 12 BIUA = == : E-=-= COC-DIO+DSODPO QI Using the equations above, compute DIO, DSO, DPO, and CCC below. Dell Technologies Dine Brande SOUTIWEST Inc Global, Inc. AIRLINES CO (NASDAQ: (NYSE: DIN) (NYSE: LUV) DELL) Days to Sell Inventory [blank! [blank] blank Collection Period [blank blank] [blank] Days Payable Outstanding blank] blank] blank] Cash Converse Cycle [blank] blank] blank c. 02 One of the drivers of working capital is the Industry, the other three main variables upacting working capital are (alphabetically ordered) (blank], [blank], and blank] 03 Between 2010 and 2018, the evolution observed across industries is as follows: DSO have (decreased increased) from blank days to blankdays. b. DIO have (decreased increased) from (blank days to blank days. DPO have (decreased increased from blank days to blank] days. 04 Use the following geographical areas: Africa, Asia, Australasia, Europe, Latin America Middle East, and USA/Canada, to answer the questions below. In 2018: The geographic region with highest DSO is blank], followed by blank]; and the region with lowest DSO is blankl. followed by blank The geographic region with highest DIO is blank, followed by blanks and the region with lowest DIO is blank], followed by blank The geographic region with highest DPO is (blank], followed by blankt: and the one with lowest DPO is blank], followed by blankt. d. Therefore, it follows that companies operating in the Middle East will require (higher lower) investments in working capital, than those operating in USA/Canada QS Narrowing down the analysis to the USA/Canada ares, between 2013 and 2018 wocking capital performance has been relatively fat improved / wonen), with an overall (decrease increase) of blank in investment in werking capital. Over the same period, both (DSO and DIO DSO and DPO DIO and DPO) performance have declined, and (DSODIO/DPO) has improved, mainly due to companies extending terms with their suppliers and introducing other techniques b. MacBook Air 20 000 13 000 F4 F5 F6 57 II F8 59 07

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts