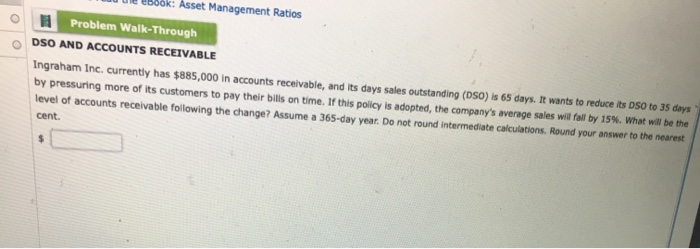

Question: - dok: Asset Management Ratios O H Problem Walk-Through DSO AND ACCOUNTS RECEIVABLE Ingraham Inc, currently has $885,000 in accounts receivable, and its days sales

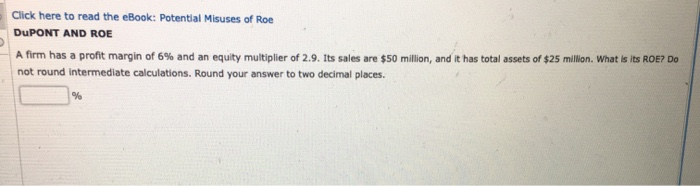

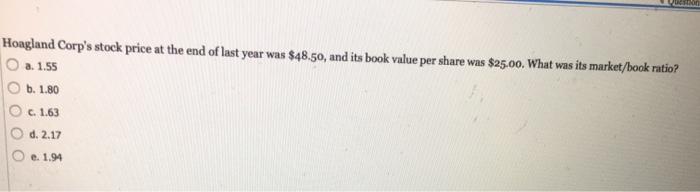

- dok: Asset Management Ratios O H Problem Walk-Through DSO AND ACCOUNTS RECEIVABLE Ingraham Inc, currently has $885,000 in accounts receivable, and its days sales outstanding (DSO) is 65 days. It wants to reduce its DSO to 35 days by pressuring more of its customers to pay their bills on time. If this policy is adopted, the company's average sales will fall by 15%. What will be the level of accounts receivable following the change? Assume a 365-day year. Do not round intermediate calculations. Round your answer to the nearest cent. Click here to read the eBook: Potential Misuses of Roe DUPONT AND ROE A firm has a profit margin of 6% and an equity multiplier of 2.9. Its sales are $50 million, and it has total assets of $25 million. What is its ROE? Do not round Intermediate calculations. Round your answer to two decimal places. Hongland Corp's stock price at the end of last year was $48.50, and its book value per share was $25.00. What was its market/book ratio? O a. 1.55 O b. 1.80 O c. 1.63 O d. 2.17 O e. 1.94

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts