Question: Done with (a) and (b). Need help with (c). ---> Thank you a) A Big Jet flight from Philadelphia to Boston has 60 seats. A

Done with (a) and (b).

Need help with (c). ---> Thank you

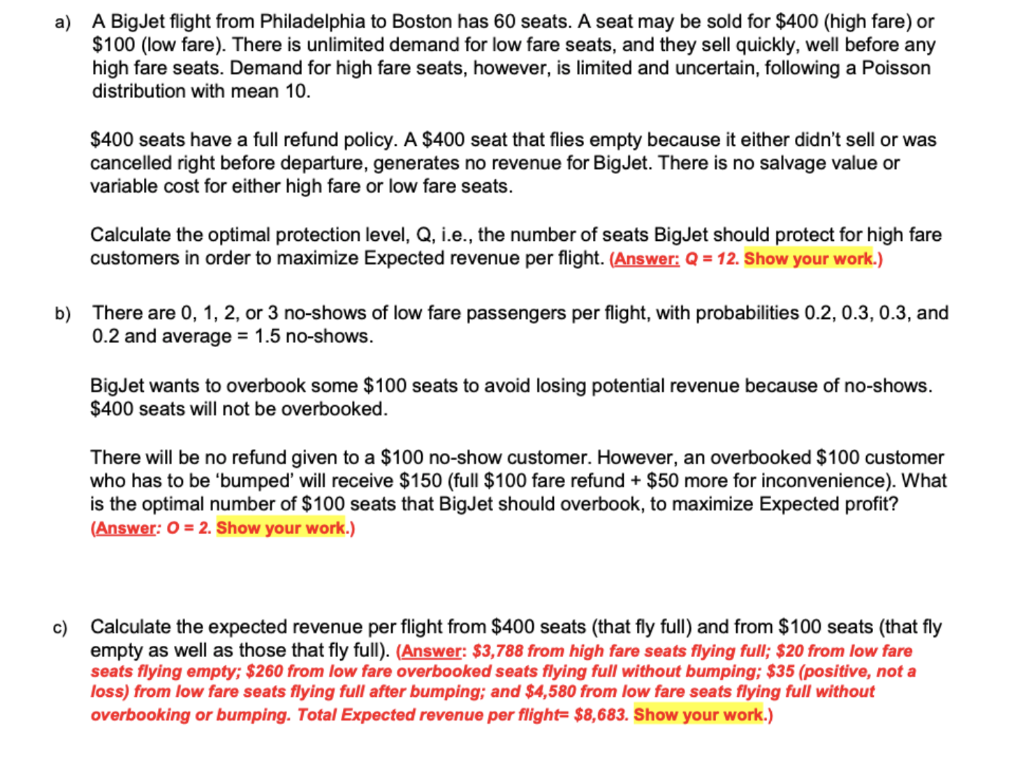

a) A Big Jet flight from Philadelphia to Boston has 60 seats. A seat may be sold for $400 (high fare) or $100 (low fare). There is unlimited demand for low fare seats, and they sell quickly, well before any high fare seats. Demand for high fare seats, however, is limited and uncertain, following a Poisson distribution with mean 10. $400 seats have a full refund policy. A $400 seat that flies empty because it either didn't sell or was cancelled right before departure, generates no revenue for Big Jet. There is no salvage value or variable cost for either high fare or low fare seats. Calculate the optimal protection level, Q, i.e., the number of seats Big Jet should protect for high fare customers in order to maximize Expected revenue per flight. (Answer: Q = 12. Show your work.) b) There are 0, 1, 2, or 3 no-shows of low fare passengers per flight, with probabilities 0.2, 0.3, 0.3, and 0.2 and average = 1.5 no-shows. Big Jet wants to overbook some $100 seats to avoid losing potential revenue because of no-shows. $400 seats will not be overbooked. There will be no refund given to a $100 no-show customer. However, an overbooked $100 customer who has to be 'bumped' will receive $150 (full $100 fare refund + $50 more for inconvenience). What is the optimal number of $100 seats that Big Jet should overbook, to maximize Expected profit? (Answer: 0 = 2. Show your work.) c) Calculate the expected revenue per flight from $400 seats (that fly full) and from $100 seats (that fly empty as well as those that fly full). (Answer: $3,788 from high fare seats flying full; $20 from low fare seats flying empty; $260 from low fare overbooked seats flying full without bumping; $35 (positive, not a loss) from low fare seats flying full after bumping; and $4,580 from low fare seats flying full without overbooking or bumping. Total Expected revenue per flight= $8,683. Show your work.) a) A Big Jet flight from Philadelphia to Boston has 60 seats. A seat may be sold for $400 (high fare) or $100 (low fare). There is unlimited demand for low fare seats, and they sell quickly, well before any high fare seats. Demand for high fare seats, however, is limited and uncertain, following a Poisson distribution with mean 10. $400 seats have a full refund policy. A $400 seat that flies empty because it either didn't sell or was cancelled right before departure, generates no revenue for Big Jet. There is no salvage value or variable cost for either high fare or low fare seats. Calculate the optimal protection level, Q, i.e., the number of seats Big Jet should protect for high fare customers in order to maximize Expected revenue per flight. (Answer: Q = 12. Show your work.) b) There are 0, 1, 2, or 3 no-shows of low fare passengers per flight, with probabilities 0.2, 0.3, 0.3, and 0.2 and average = 1.5 no-shows. Big Jet wants to overbook some $100 seats to avoid losing potential revenue because of no-shows. $400 seats will not be overbooked. There will be no refund given to a $100 no-show customer. However, an overbooked $100 customer who has to be 'bumped' will receive $150 (full $100 fare refund + $50 more for inconvenience). What is the optimal number of $100 seats that Big Jet should overbook, to maximize Expected profit? (Answer: 0 = 2. Show your work.) c) Calculate the expected revenue per flight from $400 seats (that fly full) and from $100 seats (that fly empty as well as those that fly full). (Answer: $3,788 from high fare seats flying full; $20 from low fare seats flying empty; $260 from low fare overbooked seats flying full without bumping; $35 (positive, not a loss) from low fare seats flying full after bumping; and $4,580 from low fare seats flying full without overbooking or bumping. Total Expected revenue per flight= $8,683. Show your work.)Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock