Question: d-ons Help Last edit was made seconds ago by Thi Dinh Arial 11 BIU A co + im TIT ili 1 2 3 4 5A

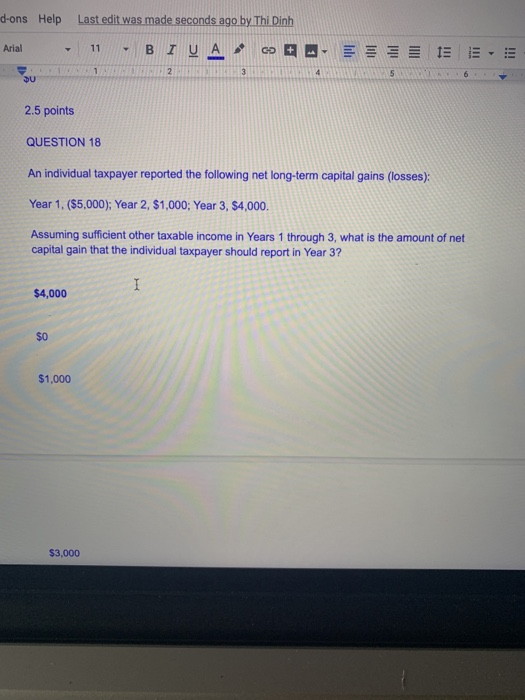

d-ons Help Last edit was made seconds ago by Thi Dinh Arial 11 BIU A co + im TIT ili 1 2 3 4 5A 6 DU 2.5 points QUESTION 18 An individual taxpayer reported the following net long-term capital gains (losses): Year 1. ($5,000); Year 2, $1,000; Year 3, $4,000. Assuming sufficient other taxable income in Years 1 through 3, what is the amount of net capital gain that the individual taxpayer should report in Year 3? I $4,000 $0 $1,000 $3,000

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock