Question: -ons Help Last edit was made seconds ago by Thi Dinh BIU A Arial 11 - IE E 11 2:13 4 15 2.5 points Taxpayer

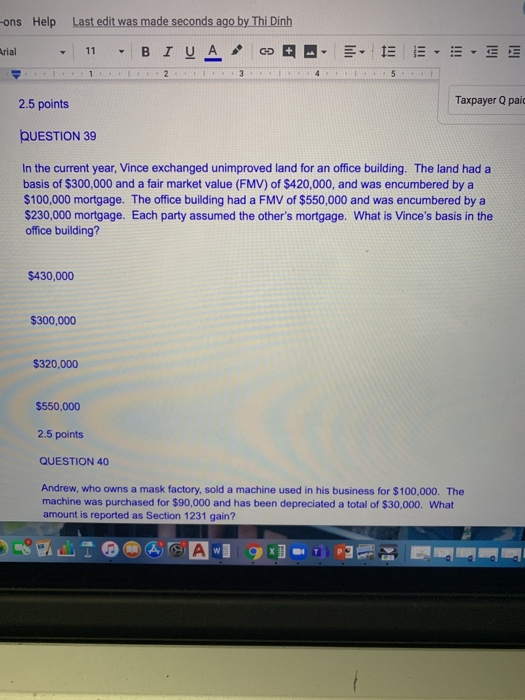

-ons Help Last edit was made seconds ago by Thi Dinh BIU A Arial 11 - IE E 11 2:13 4 15 2.5 points Taxpayer Q paid QUESTION 39 In the current year, Vince exchanged unimproved land for an office building. The land had a basis of $300,000 and a fair market value (FMV) of $420,000, and was encumbered by a $100,000 mortgage. The office building had a FMV of $550,000 and was encumbered by a $230,000 mortgage. Each party assumed the other's mortgage. What is Vince's basis in the office building? $430,000 $300,000 $320,000 $550,000 2.5 points QUESTION 40 Andrew, who owns a mask factory, sold a machine used in his business for $100,000. The machine was purchased for $90,000 and has been depreciated a total of $30,000. What amount is reported as Section 1231 gain? AW

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts