Question: Dont answer this question in handwriting please On 27 June 2017, a speculator sells five Aug 2017 crude oil futures contracts on NYMEX at a

Dont answer this question in handwriting please

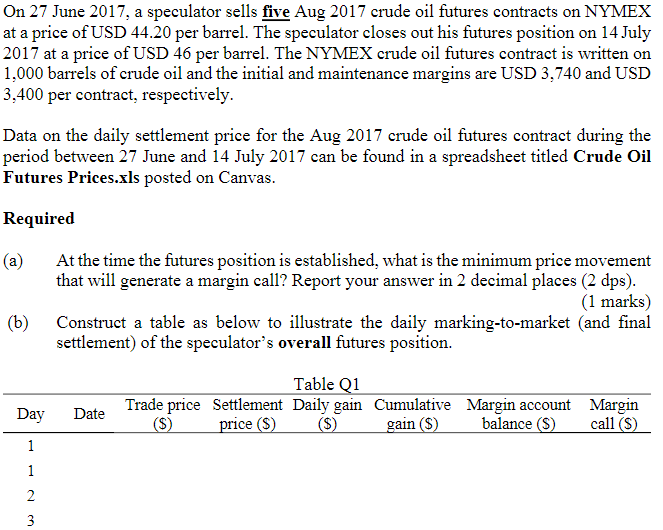

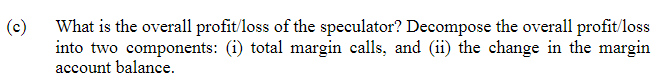

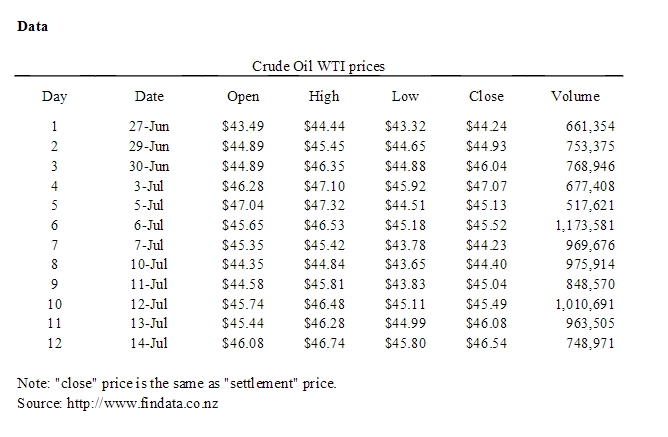

On 27 June 2017, a speculator sells five Aug 2017 crude oil futures contracts on NYMEX at a price of USD 44.20 per barrel. The speculator closes out his futures position on 14 July 2017 at a price of USD 46 per barrel. The NYMEX crude oil futures contract is written on 1,000 barrels of crude oil and the initial and maintenance margins are USD 3,740 and USD 3,400 per contract, respectively. Data on the daily settlement price for the Aug 2017 crude oil futures contract during the period between 27 June and 14 July 2017 can be found in a spreadsheet titled Crude Oil Futures Prices.xls posted on Canvas Required At the time the futures position is established, what is the minimum price movement that will generate a margin call? Report your answer in 2 decimal places (2 dps) (a) (1 marks) (b) Construct a table as below to illustrate the daily marking-to-market (and final settlement) of the speculator's overall futures positiorn. Table Q1 Trade price Settlement Daily gain Cumulative Margin account Margin call (S) Day Date ice ain balance (S)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts