Question: Don't answer unless you know how to do it. On April 5, 2018, Ryan received land and a building from Thom as a gift. Thom's

Don't answer unless you know how to do it.

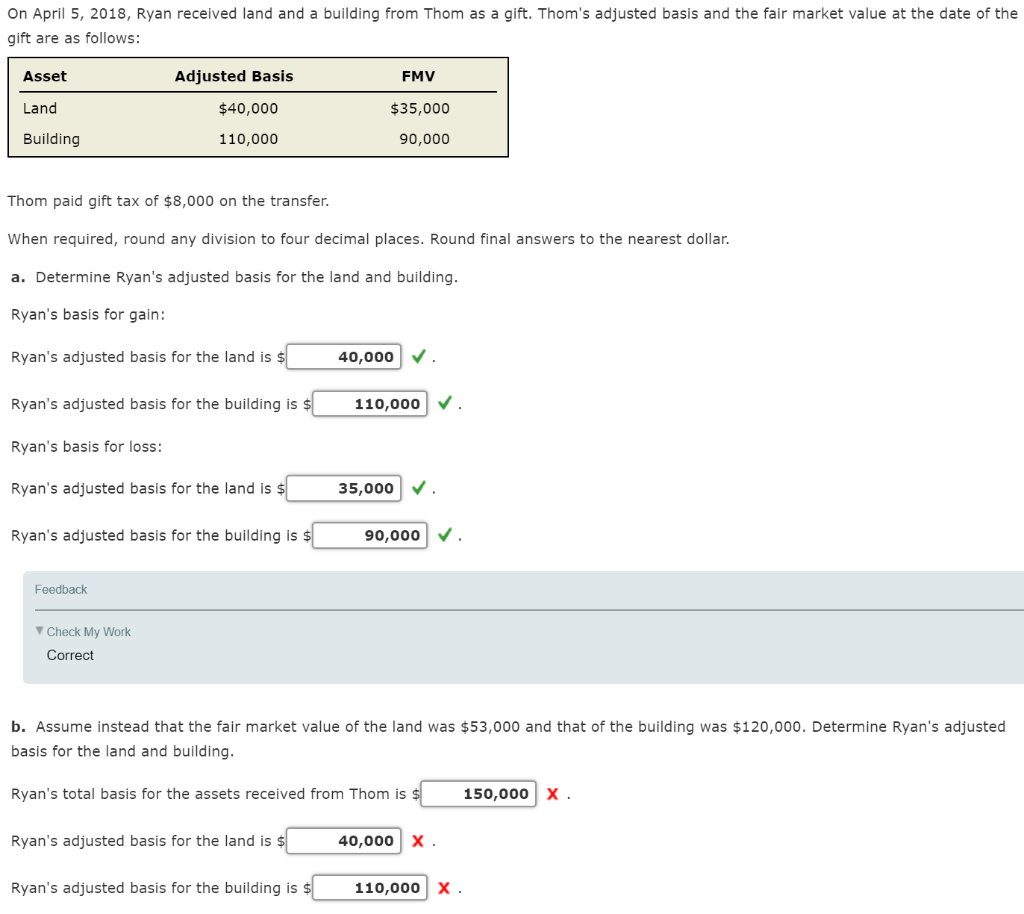

On April 5, 2018, Ryan received land and a building from Thom as a gift. Thom's adjusted basis and the fair market value at the date of the gift are as follows: Asset Adjusted Basis FMV Land $40,000 110,000 $35,000 90,000 Building Thom paid gift tax of $8,000 on the transfer. When required, round any division to four decimal places. Round final answers to the nearest dollar. a. Determine Ryan's adjusted basis for the land and building. Ryan's basis for gain: Ryan's adjusted basis for the land is $ 40,000 . Ryan's adjusted basis for the building is $ 110,000 . Ryan's basis for loss: Ryan's adjusted basis for the land is $ 35,000 V. Ryan's adjusted basis for the building is $ 90,000 . Feedback Check My Work Correct b. Assume instead that the fair market value of the land was $53,000 and that of the building was $120,000. Determine Ryan's adjusted basis for the land and building. Ryan's total basis for the assets received from Thom is $ 150,000 X. Ryan's adjusted basis for the land is $ 40,000 X. Ryan's adjusted basis for the building is $ 110,000 X. On April 5, 2018, Ryan received land and a building from Thom as a gift. Thom's adjusted basis and the fair market value at the date of the gift are as follows: Asset Adjusted Basis FMV Land $40,000 110,000 $35,000 90,000 Building Thom paid gift tax of $8,000 on the transfer. When required, round any division to four decimal places. Round final answers to the nearest dollar. a. Determine Ryan's adjusted basis for the land and building. Ryan's basis for gain: Ryan's adjusted basis for the land is $ 40,000 . Ryan's adjusted basis for the building is $ 110,000 . Ryan's basis for loss: Ryan's adjusted basis for the land is $ 35,000 V. Ryan's adjusted basis for the building is $ 90,000 . Feedback Check My Work Correct b. Assume instead that the fair market value of the land was $53,000 and that of the building was $120,000. Determine Ryan's adjusted basis for the land and building. Ryan's total basis for the assets received from Thom is $ 150,000 X. Ryan's adjusted basis for the land is $ 40,000 X. Ryan's adjusted basis for the building is $ 110,000 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts