Question: don't copy answer from Chegg...I will report against your answer npany should be willing to (after tax) were (1) 30%, (i) 40% and (ii) 60%.

don't copy answer from Chegg...I will report against your answer

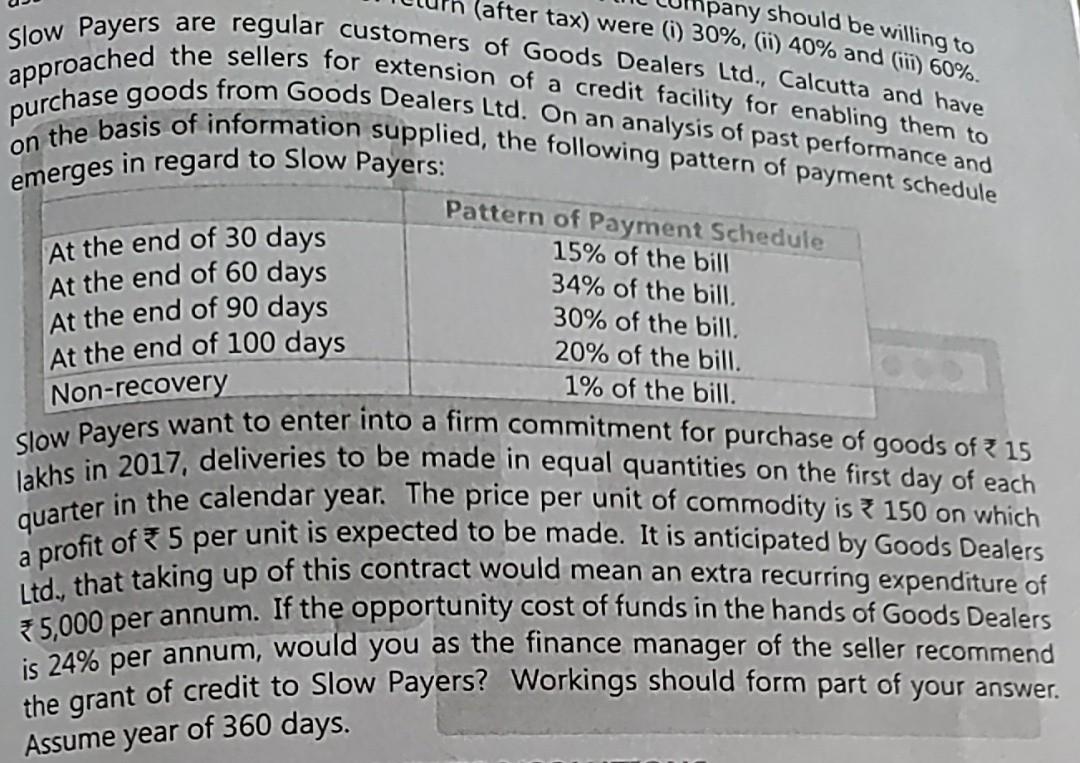

npany should be willing to (after tax) were (1) 30%, (i) 40% and (ii) 60%. Slow Payers are regular customers of Goods Dealers Ltd., Calcutta and have approached the sellers for extension of a credit facility for enabling them to purchase goods from Goods Dealers Ltd. On an analysis of past performance and on the basis of information supplied, the following pattern of payment schedule emerges in regard to Slow Payers: Pattern of Payment Schedule 15% of the bill 34% of the bill. 30% of the bill. 20% of the bill. 1% of the bill. At the end of 30 days At the end of 60 days At the end of 90 days At the end of 100 days Non-recovery Slow Payers want to enter into a firm commitment for purchase of goods of 15 lakhs in 2017, deliveries to be made in equal quantities on the first day of each quarter in the calendar year. The price per unit of commodity is 150 on which a profit of 5 per unit is expected to be made. It is anticipated by Goods Dealers Ltd., that taking up of this contract would mean an extra recurring expenditure of 5,000 per annum. If the opportunity cost of funds in the hands of Goods Dealers is 24% per annum, would you as the finance manager of the seller recommend the grant of credit to Slow Payers? Workings should form part of your answer. Assume year of 360 days. npany should be willing to (after tax) were (1) 30%, (i) 40% and (ii) 60%. Slow Payers are regular customers of Goods Dealers Ltd., Calcutta and have approached the sellers for extension of a credit facility for enabling them to purchase goods from Goods Dealers Ltd. On an analysis of past performance and on the basis of information supplied, the following pattern of payment schedule emerges in regard to Slow Payers: Pattern of Payment Schedule 15% of the bill 34% of the bill. 30% of the bill. 20% of the bill. 1% of the bill. At the end of 30 days At the end of 60 days At the end of 90 days At the end of 100 days Non-recovery Slow Payers want to enter into a firm commitment for purchase of goods of 15 lakhs in 2017, deliveries to be made in equal quantities on the first day of each quarter in the calendar year. The price per unit of commodity is 150 on which a profit of 5 per unit is expected to be made. It is anticipated by Goods Dealers Ltd., that taking up of this contract would mean an extra recurring expenditure of 5,000 per annum. If the opportunity cost of funds in the hands of Goods Dealers is 24% per annum, would you as the finance manager of the seller recommend the grant of credit to Slow Payers? Workings should form part of your answer. Assume year of 360 days

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts