Question: dont copy from others Question 22 15 pts Consider the following information concerning Tristars Inc's capital structure The company has 1 million shares of common

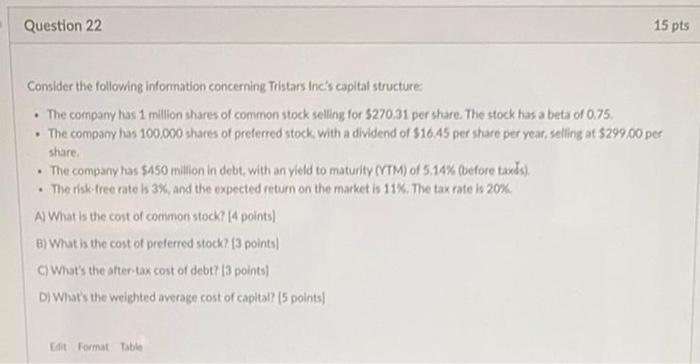

Question 22 15 pts Consider the following information concerning Tristars Inc's capital structure The company has 1 million shares of common stock selling for $270.31 per share. The stock has a beta of 0.75 The company has 100.000 shares of preferred stock with a dividend of $16.45 per share per year, selling at $299.00 per share The company has $450 million in debt, with an yield to maturity (VIM) of 5,14% (before tands) The risk free rate is 3%, and the expected return on the market is 11% The tax rate is 20% Al What is the cost of common stock? (4 points) B) What is the cost of preferred stock? (3 points) What's the after tax cost of debt? (3 points) D) What's the welehted average cost of capital? (5 points) it Format Table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts