Question: Don't copy others answer please, or I'll report it. Thank you. KQ Development Company has an Accessories division that produces various computer accessories and is

Don't copy others answer please, or I'll report it.

Thank you.

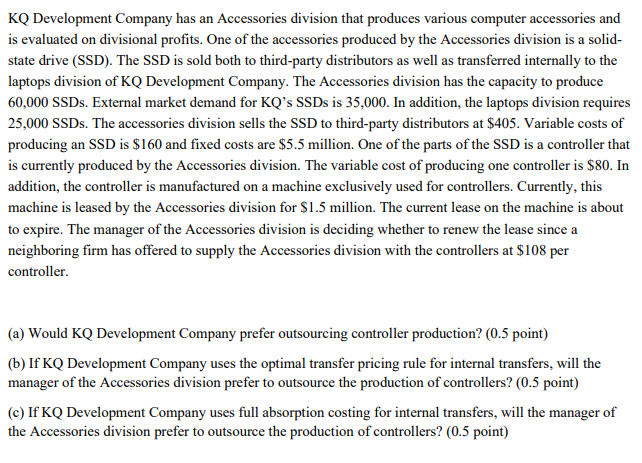

KQ Development Company has an Accessories division that produces various computer accessories and is evaluated on divisional profits. One of the accessories produced by the Accessories division is a solid- state drive (SSD). The SSD is sold both to third-party distributors as well as transferred internally to the laptops division of KQ Development Company. The Accessories division has the capacity to produce 60,000 SSDs. External market demand for KQ's SSDs is 35,000. In addition, the laptops division requires 25,000 SSDs. The accessories division sells the SSD to third-party distributors at $405. Variable costs of producing an SSD is $160 and fixed costs are $5.5 million. One of the parts of the SSD is a controller that is currently produced by the Accessories division. The variable cost of producing one controller is $80. In addition, the controller is manufactured on a machine exclusively used for controllers. Currently, this machine is leased by the Accessories division for $1.5 million. The current lease on the machine is about to expire. The manager of the Accessories division is deciding whether to renew the lease since a neighboring firm has offered to supply the Accessories division with the controllers at $108 per controller. (a) Would KQ Development Company prefer outsourcing controller production? (0.5 point) (b) If KQ Development Company uses the optimal transfer pricing rule for internal transfers, will the manager of the Accessories division prefer to outsource the production of controllers? (0.5 point) (c) If KQ Development Company uses full absorption costing for internal transfers, will the manager of the Accessories division prefer to outsource the production of controllers? (0.5 point) KQ Development Company has an Accessories division that produces various computer accessories and is evaluated on divisional profits. One of the accessories produced by the Accessories division is a solid- state drive (SSD). The SSD is sold both to third-party distributors as well as transferred internally to the laptops division of KQ Development Company. The Accessories division has the capacity to produce 60,000 SSDs. External market demand for KQ's SSDs is 35,000. In addition, the laptops division requires 25,000 SSDs. The accessories division sells the SSD to third-party distributors at $405. Variable costs of producing an SSD is $160 and fixed costs are $5.5 million. One of the parts of the SSD is a controller that is currently produced by the Accessories division. The variable cost of producing one controller is $80. In addition, the controller is manufactured on a machine exclusively used for controllers. Currently, this machine is leased by the Accessories division for $1.5 million. The current lease on the machine is about to expire. The manager of the Accessories division is deciding whether to renew the lease since a neighboring firm has offered to supply the Accessories division with the controllers at $108 per controller. (a) Would KQ Development Company prefer outsourcing controller production? (0.5 point) (b) If KQ Development Company uses the optimal transfer pricing rule for internal transfers, will the manager of the Accessories division prefer to outsource the production of controllers? (0.5 point) (c) If KQ Development Company uses full absorption costing for internal transfers, will the manager of the Accessories division prefer to outsource the production of controllers? (0.5 point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts