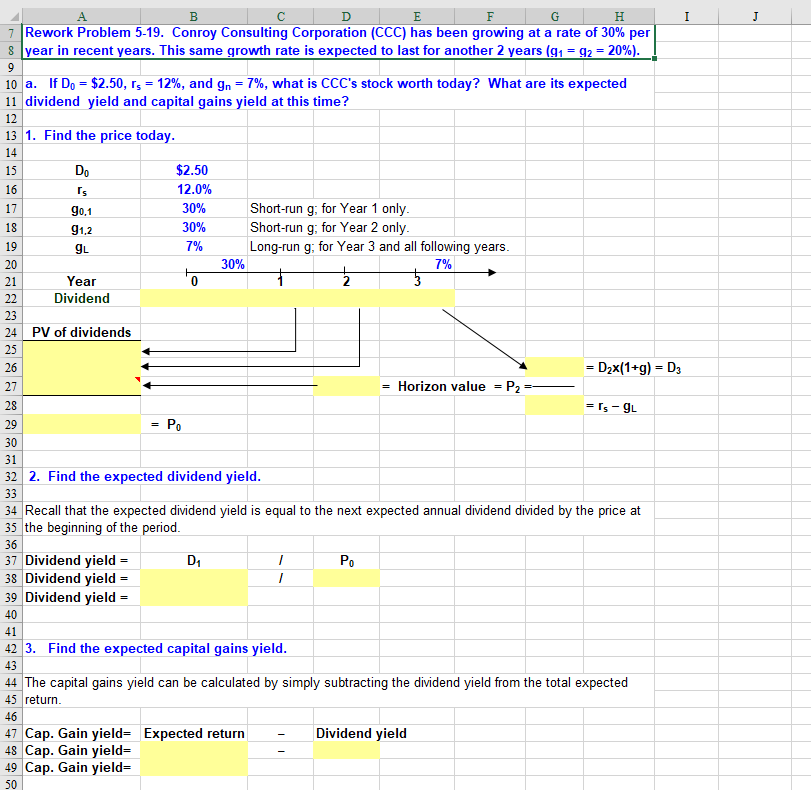

Question: Don't hard-code I J B C D E F G H Rework Problem 5-19. Conroy Consulting Corporation (CCC) has been growing at a rate of

Don't hard-code

I J B C D E F G H Rework Problem 5-19. Conroy Consulting Corporation (CCC) has been growing at a rate of 30% per Iyear in recent years. This same growth rate is expected to last for another 2 years (91 = 92 = 20%). 10 a. If Do = $2.50, rs = 12%, and gn = 7%, what is CCC's stock worth today? What are its expected 11 dividend yield and capital gains yield at this time? 13 1. Find the price today. Is 90,1 91,2 9L $2.50 12.0% 30% 30% 7% Short-run g; for Year 1 only. Short-run g; for Year 2 only. Long-run g; for Year 3 and all following years. 30% to Year Dividend PV of dividends = D2x(1+3) = D3 = Horizon value = P2=4 = 's - 9 = Po 32 2. Find the expected dividend yield. 34 Recall that the expected dividend yield is equal to the next expected annual dividend divided by the price at 35 the beginning of the period. 36 37 Dividend yield = D Po 38 Dividend yield = 39 Dividend yield = 40 41 42 3. Find the expected capital gains yield. 44 The capital gains yield can be calculated by simply subtracting the dividend yield from the total expected 45 return. - Dividend yield 47 Cap. Gain yield= Expected return 48 Cap. Gain yield= 49 Cap. Gain yield= 50 I J B C D E F G H Rework Problem 5-19. Conroy Consulting Corporation (CCC) has been growing at a rate of 30% per Iyear in recent years. This same growth rate is expected to last for another 2 years (91 = 92 = 20%). 10 a. If Do = $2.50, rs = 12%, and gn = 7%, what is CCC's stock worth today? What are its expected 11 dividend yield and capital gains yield at this time? 13 1. Find the price today. Is 90,1 91,2 9L $2.50 12.0% 30% 30% 7% Short-run g; for Year 1 only. Short-run g; for Year 2 only. Long-run g; for Year 3 and all following years. 30% to Year Dividend PV of dividends = D2x(1+3) = D3 = Horizon value = P2=4 = 's - 9 = Po 32 2. Find the expected dividend yield. 34 Recall that the expected dividend yield is equal to the next expected annual dividend divided by the price at 35 the beginning of the period. 36 37 Dividend yield = D Po 38 Dividend yield = 39 Dividend yield = 40 41 42 3. Find the expected capital gains yield. 44 The capital gains yield can be calculated by simply subtracting the dividend yield from the total expected 45 return. - Dividend yield 47 Cap. Gain yield= Expected return 48 Cap. Gain yield= 49 Cap. Gain yield= 50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts