Question: DONT NEED TO ANSWER PART (e) Please answer question(f),(g) and(h): (e) Consider the following GARCH(1,1) model Yt = u + ut, ut ~ N(0,0) of

DONT NEED TO ANSWER PART (e)

Please answer question(f),(g) and(h):

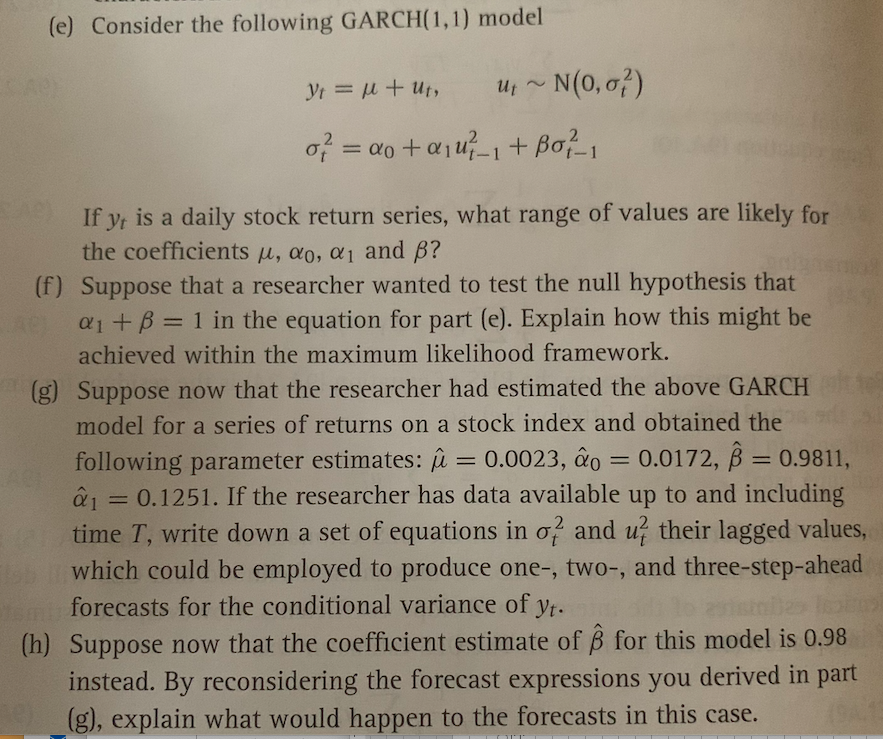

(e) Consider the following GARCH(1,1) model Yt = u + ut, ut ~ N(0,0) of = ao + a, uz-1 + Bol-1 If y, is a daily stock return series, what range of values are likely for the coefficients u, Qo, di and B? (f) Suppose that a researcher wanted to test the null hypothesis that Q1 + B = 1 in the equation for part (e). Explain how this might be achieved within the maximum likelihood framework. (g) Suppose now that the researcher had estimated the above GARCH model for a series of returns on a stock index and obtained the following parameter estimates: = 0.0023, o = 0.0172, = 0.9811, i = 0.1251. If the researcher has data available up to and including time T, write down a set of equations in of and u; their lagged values, which could be employed to produce one-, two-, and three-step-ahead forecasts for the conditional variance of Yt. (h) Suppose now that the coefficient estimate of for this model is 0.98 instead. By reconsidering the forecast expressions you derived in part (g), explain what would happen to the forecasts in this case. (e) Consider the following GARCH(1,1) model Yt = u + ut, ut ~ N(0,0) of = ao + a, uz-1 + Bol-1 If y, is a daily stock return series, what range of values are likely for the coefficients u, Qo, di and B? (f) Suppose that a researcher wanted to test the null hypothesis that Q1 + B = 1 in the equation for part (e). Explain how this might be achieved within the maximum likelihood framework. (g) Suppose now that the researcher had estimated the above GARCH model for a series of returns on a stock index and obtained the following parameter estimates: = 0.0023, o = 0.0172, = 0.9811, i = 0.1251. If the researcher has data available up to and including time T, write down a set of equations in of and u; their lagged values, which could be employed to produce one-, two-, and three-step-ahead forecasts for the conditional variance of Yt. (h) Suppose now that the coefficient estimate of for this model is 0.98 instead. By reconsidering the forecast expressions you derived in part (g), explain what would happen to the forecasts in this case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts