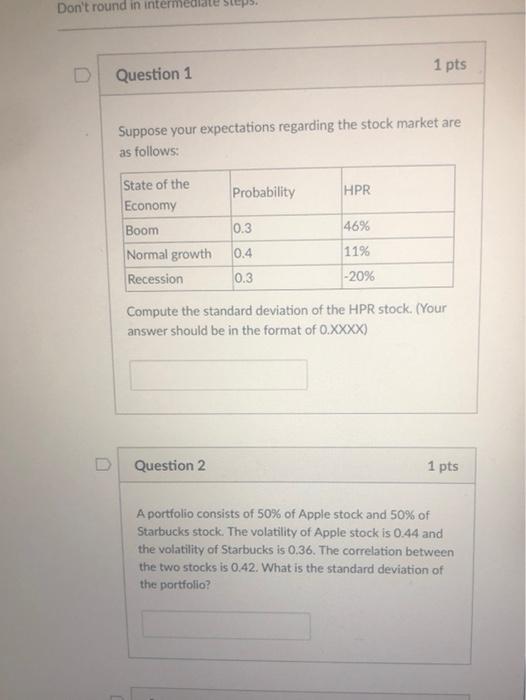

Question: Don't round in intermediate SEPS 1 pts D Question 1 Suppose your expectations regarding the stock market are as follows: Probability HPR State of the

Don't round in intermediate SEPS 1 pts D Question 1 Suppose your expectations regarding the stock market are as follows: Probability HPR State of the Economy Boom 0.3 46% 0.4 Normal growth Recession 11% -20% 0.3 Compute the standard deviation of the HPR stock. (Your answer should be in the format of O.XXXX) Question 2 1 pts A portfolio consists of 50% of Apple stock and 50% of Starbucks stock. The volatility of Apple stock is 0.44 and the volatility of Starbucks is 0.36. The correlation between the two stocks is 0.42. What is the standard deviation of the portfolio

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock