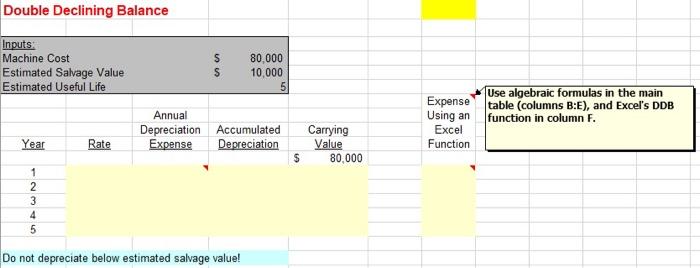

Question: Double Declining Balance Inputs: Machine Cost Estimated Salvage Value Estimated Useful Life S S 80,000 10,000 5 Annual Depreciation Accumulated Expense Depreciation Expense Use algebraic

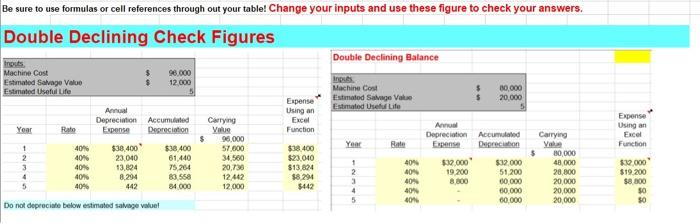

Double Declining Balance Inputs: Machine Cost Estimated Salvage Value Estimated Useful Life S S 80,000 10,000 5 Annual Depreciation Accumulated Expense Depreciation Expense Use algebraic formulas in the main table (columns B:E), and Excel's DDB Using an function in column F. Excel Function Year Rate Carrying Value 80,000 A Do not depreciate below estimated salvage value! Be sure to use formulas or cell references through out your table! Change your inputs and use these figure to check your answers. Double Declining Check Figures Double Declining Balance Frosts Machine Cost Estimated Salvage Value Estimated Useful Life 96.000 12.000 Inputs Machine Cost Estimated Salvage Value Estimated Useful Life 80,000 20.000 Expense Using an Excel Yoar Rate Function $ Annual Depreciation Accumulated Expense Depreciation $38.400 $38.400 23.040 61 440 13.824 75.254 8.294 83.558 442 84.000 40% Year $ Carrying Valur 96,000 57.000 34.500 20,736 12.442 12,000 2 3 4 5 - 40% 40% 40% 40% 404 $38.400 $23,040 $13 824 $8 2941 $442 Am Depreciation Accumulated Expense Depreciation $32000 $32.000 19.200 51,200 8.800 00.000 80.000 60.000 Expense Using an Excel Function $32.000 $19.200 $8.50 30 50 Carrying V 30,000 48 000 28,800 20,000 20.000 20,000 40 2 3 4 5 40% 40% 404 Do not depreciate below estimated salvage value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts