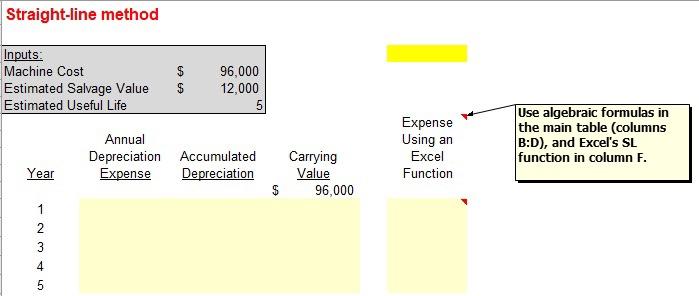

Question: Straight-line method Inputs: Machine Cost Estimated Salvage Value Estimated Useful Life $ $ 96,000 12,000 5 Annual Depreciation Accumulated Expense Depreciation Expense Using an Excel

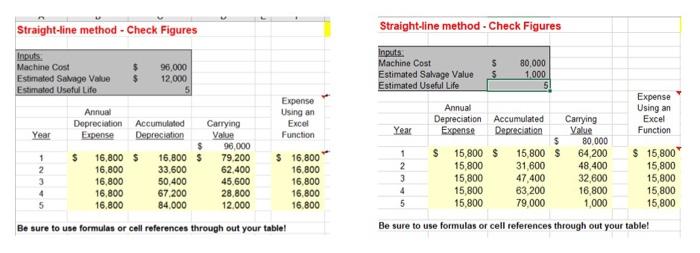

Straight-line method Inputs: Machine Cost Estimated Salvage Value Estimated Useful Life $ $ 96,000 12,000 5 Annual Depreciation Accumulated Expense Depreciation Expense Using an Excel Function Use algebraic formulas in the main table (columns B:D), and Excel's SL function in column F. Carrying Value 96,000 Year $ Straight-line method - Check Figures Straight-line method - Check Figures Inputs. Machine Cost $ 96,000 Estimated Savage Value 12 000 Estimated Useful Life inputs Machine Cost Estimated Salvage Value Estimated Useful Life 80,000 1.000 5 Expense Using an Expense Using an Excel Function Excel Year Function Year 1 2 3 4 5 Annual Depreciation Accumulated Carrying Expense Depreciation Value $ 96,000 $ 16,800 $ 16.800 $ 79.200 16.800 33.600 62.400 16,800 50.400 45,600 16,800 67,200 28,800 16.800 84.000 12.000 $ 16,800 16.800 16,800 16.800 16.800 1 2 3 4 5 Annual Depreciation Accumulated Carrying Expense Depreciation Value $ 80.000 $ 15,800 $ 15,800 $ 64,200 15,800 31,600 48,400 15,800 47,400 32,600 15,800 63,200 16 800 15,800 79.000 1.000 $ 15,800 15,800 15,800 15,800 15,800 Be sure to use formulas or cell references through out your table! Be sure to use formulas or cell references through out your table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts