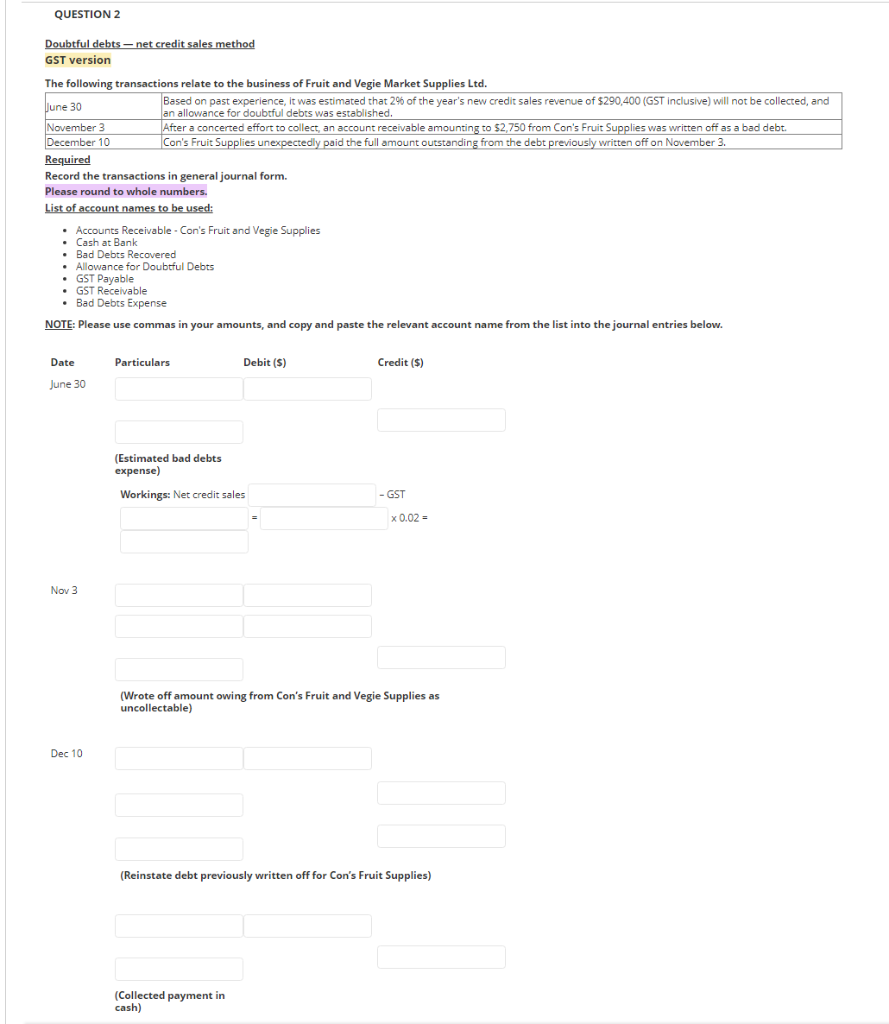

Question: Doubtful debts - net credit sales method GST version The following transactions relate to the business of Fruit and Vegie Market Supplies Ltd. begin{tabular}{|l|l|} hline

Doubtful debts - net credit sales method GST version The following transactions relate to the business of Fruit and Vegie Market Supplies Ltd. \begin{tabular}{|l|l|} \hline June 30 & Based on past experience, it was estimated that 2% of the year's new credit sales revenue of $290,400 (GST inclusive) will not be collected, and an allowance for doubtful debrs was established. \\ \hline November 3 & After a concerted effort to collect, an account receivable amounting to $2,750 from Con's Fruit Supplies was written off as a bad debt. \\ \hline December 10 & Con's Fruit Supplies unexpectedly paid the full amount outstanding from the debt previously written off on November 3. \\ \hline \end{tabular} Required Record the transactions in general journal form. Please round to whole numbers. List of account names to be used: - Accounts Receivable - Con's Fruit and Vegie Supplies - Cash at Bank - Bad Debts Recovered - Allowance for Doubtful Debts - GST Payable - GST Receivable - Bad Debts Expense NOTE: Please use commas in your amounts, and copy and paste the relevant account name from the list into the journal entries below. Date June 30 (Estimated bad debts expense) Workings: Net credit sales Debit (\$) Credit (\$) Nov 3 (Wrote off amount owing from Con's Fruit and Vegie Supplies as uncollectable) Dec 10 (Reinstate debt previously written off for Con's Fruit Supplies)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts