Question: During June 2021, the following transactions occurred in Michael Ltd that sells office stationery to companies on credit. The entity's accounting period ends on

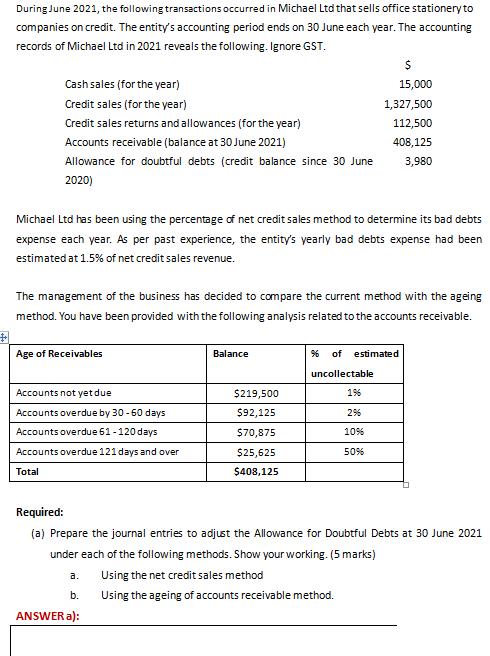

During June 2021, the following transactions occurred in Michael Ltd that sells office stationery to companies on credit. The entity's accounting period ends on 30 June each year. The accounting records of Michael Ltd in 2021 reveals the following. Ignore GST. Cash sales (for the year) 15,000 Credit sales (for the year) 1,327,500 Credit sales returns and allowances (for the year) 112,500 Accounts receivable (balance at 30 June 2021) 408,125 Allowance for doubtful debts (credit balance since 30 June 3,980 2020) Michael Ltd has been using the percentage of net credit sales method to determine its bad debts expense each year. As per past experience, the entity's yearly bad debts expense had been estimated at 1.5% of net credit sales revenue. The management of the business has decided to compare the current method with the ageing method. You have been provided with the following analysis related to the accounts receivable. Age of Receivables Balance % of estimated uncollectable Accounts not yetdue $219,500 1% Accounts overdue by 30 -60 days $92,125 2% Accounts overdue 61 -120 days $70,875 10% Accounts overdue 121 days and over $25,625 50% Total $408,125 Required: (a) Prepare the journal entries to adjust the Allowance for Doubtful Debts at 30 June 2021 under each of the following methods. Show your working. (5 marks) a. Using the net credit sales method b. Using the ageing of accounts receivable method. ANSWER a): (b) Determine the balance in the Allowance for Doubtful Debts account at 30 June 2021 under both methods. (2 marks) ANSWER b):

Step by Step Solution

3.49 Rating (162 Votes )

There are 3 Steps involved in it

All amounts in AJournal entries SNo Date Account titles Debit Credit Workings a 30 Jun... View full answer

Get step-by-step solutions from verified subject matter experts