Question: doud 22. Excess return portfolio performance measures Adjust portfolio risk to match benchmark risk. Compare portfolio returns to expected returns under CAPM. Evaluate portfolio performance

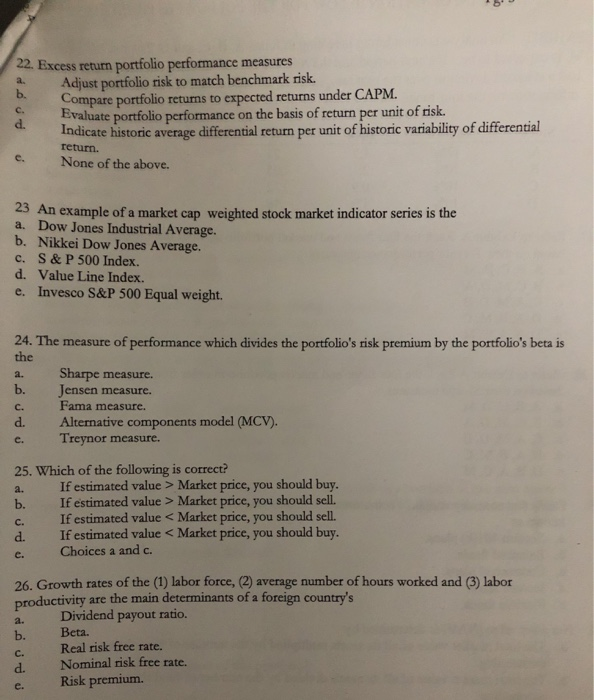

doud 22. Excess return portfolio performance measures Adjust portfolio risk to match benchmark risk. Compare portfolio returns to expected returns under CAPM. Evaluate portfolio performance on the basis of return per unit of risk. Indicate historic average differential return per unit of historic variability of differential return. None of the above. 23 An example of a market cap weighted stock market indicator series is the a. Dow Jones Industrial Average. b. Nikkei Dow Jones Average. c. S&P 500 Index. d. Value Line Index. e. Invesco S&P 500 Equal weight. 24. The measure of performance which divides the portfolio's risk premium by the portfolio's beta is the Sharpe measure. Jensen measure. Fama measure. Alternative components model (MCV). Treynor measure. 25. Which of the following is correct? If estimated value > Market price, you should buy. If estimated value > Market price, you should sell. If estimated value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts