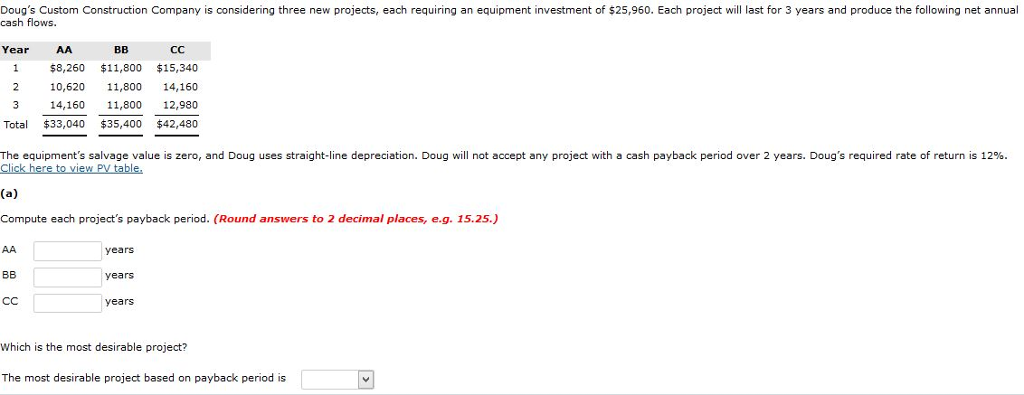

Question: Doug's Custom Construction Company is considering three new projects, each requiring an equipment investment of $25,960. Each project will last for 3 years and produce

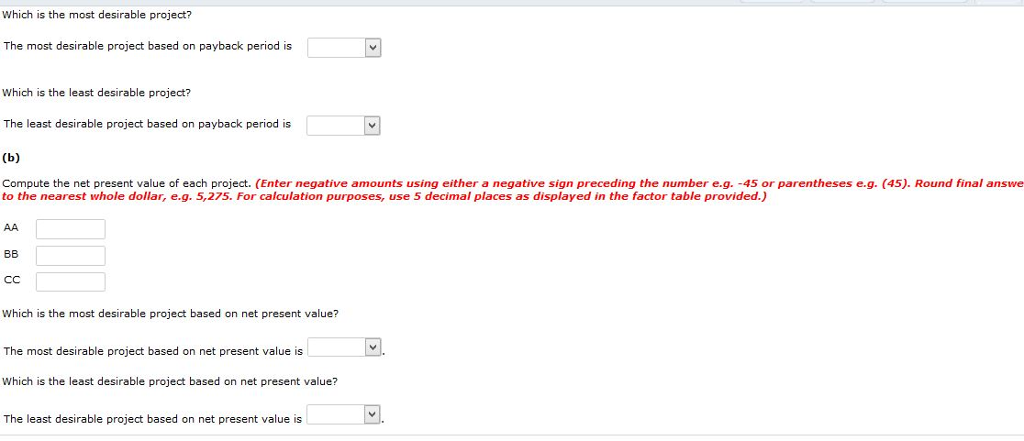

Doug's Custom Construction Company is considering three new projects, each requiring an equipment investment of $25,960. Each project will last for 3 years and produce the following net annual cash flows. Year AA $8,260 11,800 $15,340 2 10,620 11,800 14,160 3 14,160 11,800 12,980 Total $33,040 $35,400 $42,480 The equipment's salvage value is zero, and Doug uses straight-line depreciation. Doug will not accept any project with a cash payback period over 2 years. Doug's required rate of return is 12%. Click here to view PV Compute each project's payback period. (Round answers to 2 decimal places, e.g. 15.25.) years years years Which is the most desirable project? The most desirable project based on payback period is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts