Question: m- CBD GE RE DO EIN 5. The economic interpretation of duration is by the book value of the security A the percentage of the

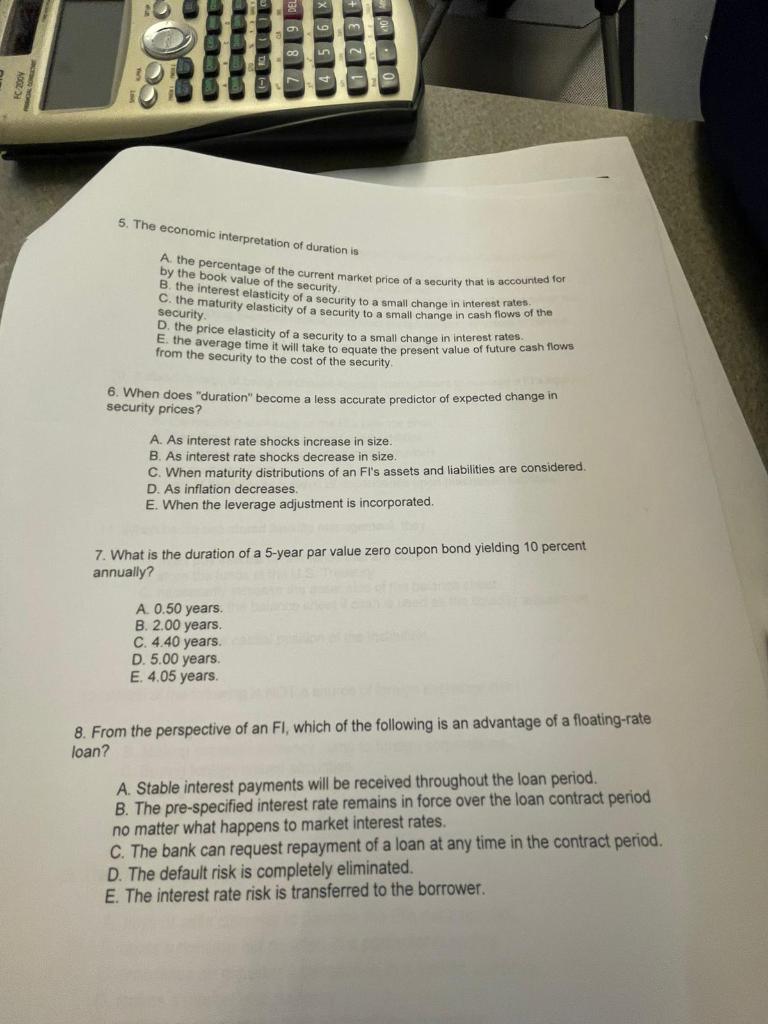

m- CBD GE RE DO EIN 5. The economic interpretation of duration is by the book value of the security A the percentage of the current market price of a security that is accounted for B the interest elasticity of a security to a small change in interest rates. security the the the price elasticity of a security to a small change in interest rates. E, the average time it will take to equate the present value of future cash flows from the security to the cost of the security 6. When does "duration" become a less accurate predictor of expected change in security prices? A. As interest rate shocks increase in size. B. As interest rate shocks decrease in size. C. When maturity distributions of an Fi's assets and liabilities are considered. D. As inflation decreases E. When the leverage adjustment is incorporated 7. What is the duration of a 5-year par value zero coupon bond yielding 10 percent annually? A. 0.50 years. B. 2.00 years. C. 4.40 years D. 5.00 years E. 4.05 years. 8. From the perspective of an FI, which of the following is an advantage of a floating-rate loan? A. Stable interest payments will be received throughout the loan period. B. The pre-specified interest rate remains in force over the loan contract period no matter what happens to market interest rates. C. The bank can request repayment of a loan at any time in the contract period. D. The default risk is completely eliminated. E. The interest rate risk is transferred to the borrower

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts