Question: dove US Dollar British Pound. Assuming the same initial values for the dollar pound cross rate in this table how much more would a call

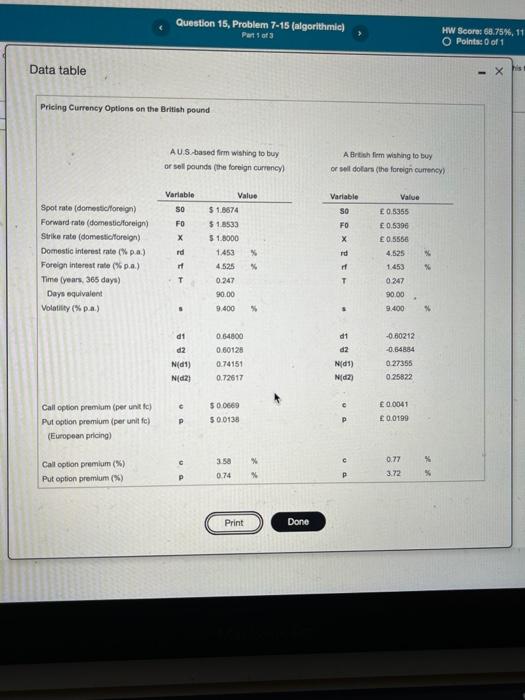

dove US Dollar British Pound. Assuming the same initial values for the dollar pound cross rate in this table how much more would a call option on pounds be if the maturity come from 90 180 days? What percentage increase is this for the length of maturity? the maturity increases from 90 to 180 days, a call option on pounds would be $. (Round to six decimal places) Clear all Check answer Help me solve this View an example Get more help 5 R G S D Question 15, Problem 7-15 (algorithmic) Part 1 of 3 HW Score: 68.75%, 11 O Points of 1 Data table Pricing Currency Options on the British pound AUS-based firm wishing to buy or sell pounds (the foreign currency) A British firm wishing to buy or soll dofars (the foreign currency Variable Value SO E 0.5355 Variable SO FO X rd FO X Value $ 1.6674 $ 1.8533 5 1.8000 1453 % 4.525 0.247 90.00 9.400 0.5390 E 0.5556 4.525 Spot rate (domestic foreign) Forward rate (domestic foreign Strike rate (domestic foreign) Domestic interest rate (pa) Foreign interest rate (p.a.) Time (years, 365 days) Days equivalent Volatility (%p.a.) % f 1.453 T 0.247 90.00 9.400 5 5 d1 d1 -0.60212 -0.54884 d2 d2 N(1) Nd2) 0.64800 060120 0.74151 0.72617 Nid1) Nida 027355 0.25822 c Call option premium (per unit) Put option premium (per unit fc) (European pricing) $ 0.0669 500138 0.0041 0.0199 P P C 3.58 0.77 Call option premium (%) Put option premium (%) % % 0.74 P 3.72 P % Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts