Question: U.S. Dollar/British Pound. Assuming the same initial values for the dollar/pound cross- rate in the FX Option Pricing workbook, how much more would a call

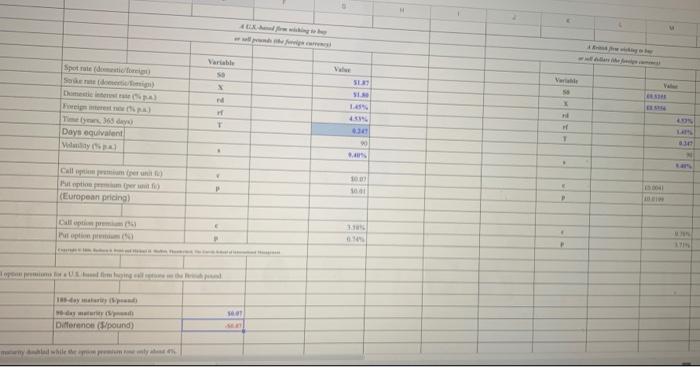

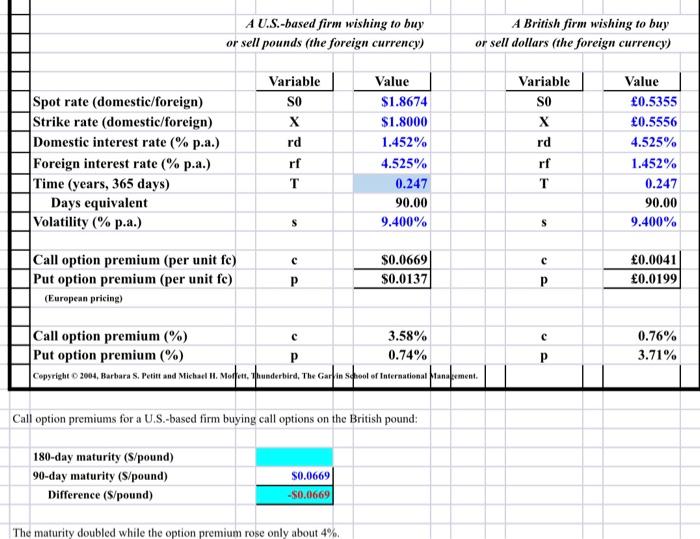

U.S. Dollar/British Pound. Assuming the same initial values for the dollar/pound cross- rate in the FX Option Pricing workbook, how much more would a call option on pounds be if the maturity was doubled from 90 to 180 days? What percentage increase is this for twice the length of maturity? Variable Spot rated SET Vre SI 1. 14 Ty365 day Days equivalent T -- . Put pomper) (European pricing) P P . Difference (pound) while theme A U.S.-based firm wishing to buy or sell pounds (the foreign currency) A British firm wishing to buy or sell dollars (the foreign currency) Value Spot rate (domestic/foreign) Strike rate (domestic/foreign) Domestic interest rate (% p.a.) Foreign interest rate (% p.a.) Time (years, 365 days) Days equivalent Volatility (% p.a.) Variable SO X rd rf T Value $1.8674 $1.8000 1.452% 4.525% 0.247 90.00 9.400% Variable SO X rd rf T 0.5355 0.5556 4.525% 1.452% 0.247 90.00 9.400% S S c c Call option premium (per unit fc) Put option premium (per unit fe) (European pricing) $0.0669 $0.0137 0.0041 0.0199 P c c Call option premium (%) 3.58% Put option premium (%) 0.74% Copyright 2004, Barbara S. Petit and Michael H. More hunderbird, The Garbin school of International tanpement. 0.76% 3.71% Call option premiums for a U.S.-based firm buying call options on the British pound: 180-day maturity (S/pound) 90-day maturity (S/pound) Difference (S/pound) $0.06691 -$0.0669 The maturity doubled while the option premium rose only about 4%. U.S. Dollar/British Pound. Assuming the same initial values for the dollar/pound cross- rate in the FX Option Pricing workbook, how much more would a call option on pounds be if the maturity was doubled from 90 to 180 days? What percentage increase is this for twice the length of maturity? Variable Spot rated SET Vre SI 1. 14 Ty365 day Days equivalent T -- . Put pomper) (European pricing) P P . Difference (pound) while theme A U.S.-based firm wishing to buy or sell pounds (the foreign currency) A British firm wishing to buy or sell dollars (the foreign currency) Value Spot rate (domestic/foreign) Strike rate (domestic/foreign) Domestic interest rate (% p.a.) Foreign interest rate (% p.a.) Time (years, 365 days) Days equivalent Volatility (% p.a.) Variable SO X rd rf T Value $1.8674 $1.8000 1.452% 4.525% 0.247 90.00 9.400% Variable SO X rd rf T 0.5355 0.5556 4.525% 1.452% 0.247 90.00 9.400% S S c c Call option premium (per unit fc) Put option premium (per unit fe) (European pricing) $0.0669 $0.0137 0.0041 0.0199 P c c Call option premium (%) 3.58% Put option premium (%) 0.74% Copyright 2004, Barbara S. Petit and Michael H. More hunderbird, The Garbin school of International tanpement. 0.76% 3.71% Call option premiums for a U.S.-based firm buying call options on the British pound: 180-day maturity (S/pound) 90-day maturity (S/pound) Difference (S/pound) $0.06691 -$0.0669 The maturity doubled while the option premium rose only about 4%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts