Question: Download the 'Applying Excel' worksheet below and save it to your computer, View the tutorial video, and then complete the worksheet. Enter formulas in cells

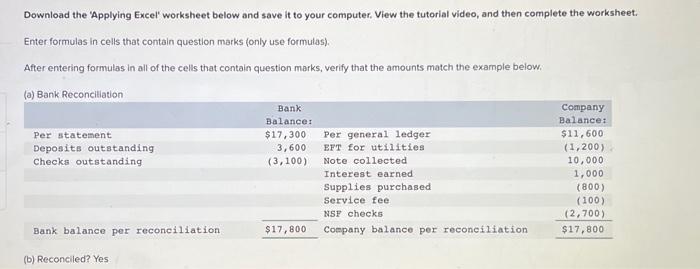

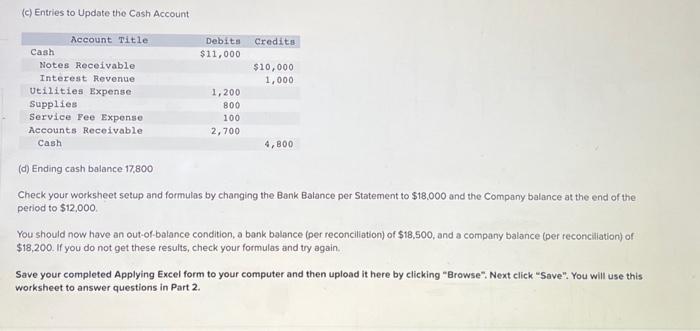

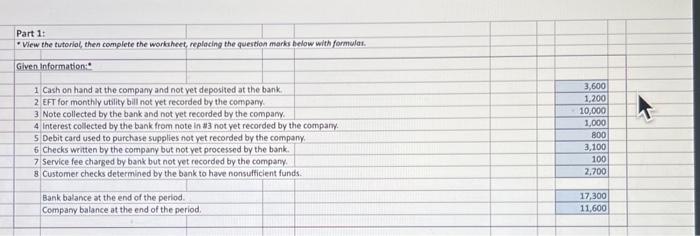

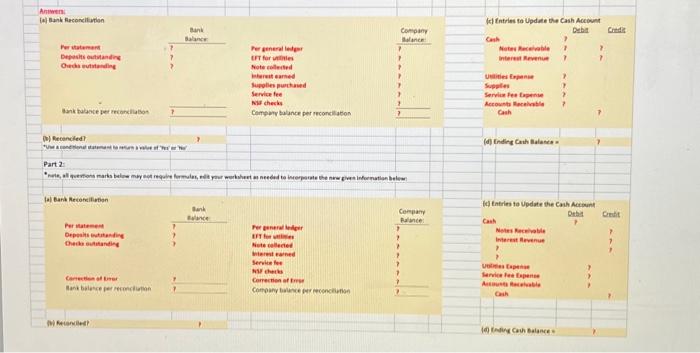

Download the 'Applying Excel' worksheet below and save it to your computer, View the tutorial video, and then complete the worksheet. Enter formulas in cells that contain question marks (only use formulas). After entering formulas in all of the cells that contain question marks, verify that the amounts match the example below. (c) Entries to Update the Cash Account (d) Ending cash balance 17,800 Check your worksheet setup and formulas by changing the Bank Balance per Statement to $18.000 and the Company balance at the end of the period to $12,000. You should now have an out-of-balance condition, a bank balance (per reconciliation) of $18,500, and a company balance (per reconciliation) of $18,200. If you do not get these results, check your formulas and try again. Save your completed Applying Excel form to your computer and then upload it here by clicking "Browse", Next click "Save". You will use this worksheet to answer questions in Part 2. Aniwen: [a] Bank Reconsitytion Part 1: - View the tutorial, then complete the workheet, replacing the question marks below with formular. Given information: 1 Cash on hand at the company and not vet deposited at the bank. 2 EFT for monthly utility bill not yet recorded by the company. 3 Note collected by the bank and not yet recorded by the company. 4 interest collected by the bank from note in $3 not yet recorded by the company. 5 Debit card used to purchase supplies not yet recorded by the company. 6 Checks written by the company but not yet processed by the bank. 7 Service fee charged by bank but not yet recorded by the company. 8 Customer checks determined by the bank to have nonsufficient funds. Bank balance at the end of the period. Company balance at the end of the period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts