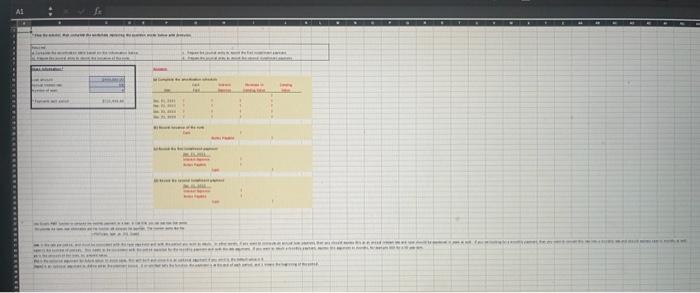

Question: pleade help and show formulas! View the store the complete the worksheet replacing the question marks below with formule Rret a Complete the amaton buted

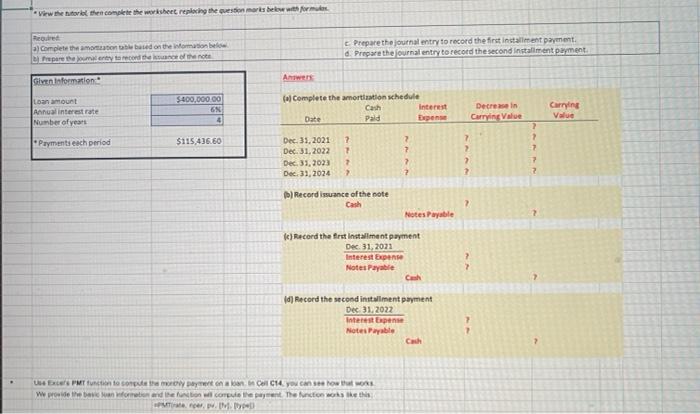

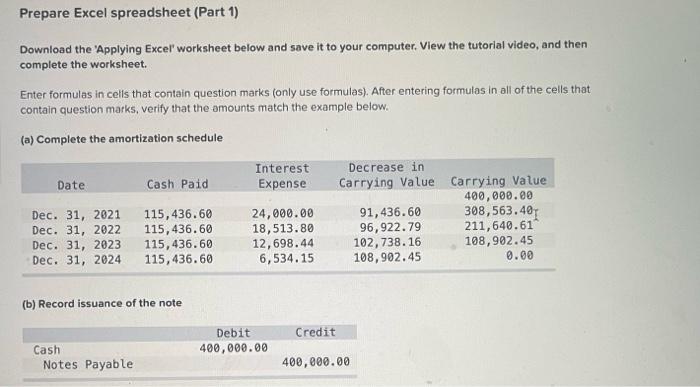

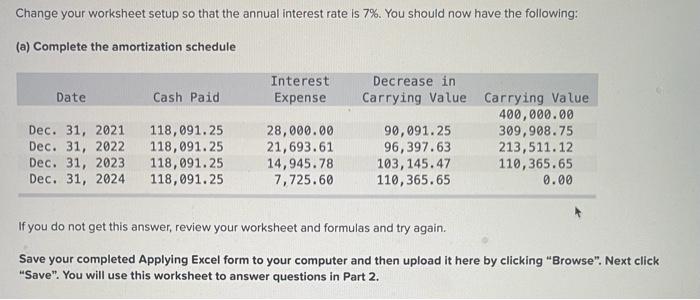

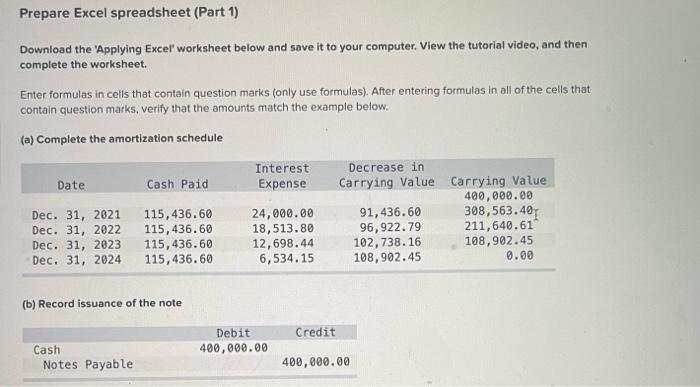

View the store the complete the worksheet replacing the question marks below with formule Rret a Complete the amaton buted on the Womation Prepare the journal entry to record the first installment payment d. Prepare the journal entry to record the second installment payment Glen Information Antwer Loan amount Annual interest rate Number of years $400,000.00 EN 3 (al Complete the amortization schedule interest Date Pald Espen Cash Decree in Carrying Value Carrying Value 2 Payments each period $115,436.60 ? 2 2 7 2 Dec 31, 2021 Dec 31,2022 Dec 31, 2023 Dec 31, 2024 7 7 2 2 2 f) Record issuance of the note Cash 2 Notes Payable (c) Record the first installment payment Dec 31, 2021 Interest Expense Notes Payable Call (d) Record the second installment payment Dec 31, 2022 Interest Expense Notes Payable Cash PMT function to computerowy on Call C14. you can see how the WORE we provide the bean formation and then we come prent. The action works the this P. M. Prepare Excel spreadsheet (Part 1) Download the "Applying Excel' worksheet below and save it to your computer. View the tutorial video, and then complete the worksheet. Enter formulas in cells that contain question marks (only use formulas). After entering formulas in all of the cells that contain question marks, verify that the amounts match the example below. (a) Complete the amortization schedule Interest Expense Date Cash Paid Dec. 31, 2021 Dec. 31, 2022 Dec. 31, 2023 Dec. 31, 2024 115, 436.60 115,436.60 115,436.60 115,436.60 24,000.00 18,513.80 12,698.44 6,534.15 Decrease in Carrying Value Carrying Value 400,000.00 91, 436.60 308,563.401 96,922.79 211,640.61 102,738.16 108,902.45 108,902.45 0.00 (b) Record issuance of the note Credit Debit 400,000.00 Cash Notes Payable 400,000.00 (b) Record issuance of the note Credit Debit 400,000.00 Cash Notes Payable 400,000.00 (c) Record the first installment payment Credit Dec. 31, 2021 Interest Expense Notes Payable Cash Debit 24,000.00 91,436.60 115,436.60 (d) Record the second installment payment Credit Dec. 31, 2022 Interest Expense Notes Payable Cash Debit 18,513.80 96,922.79 115,436.60 Change your worksheet setup so that the annual interest rate is 7%. You should now have the following: Change your worksheet setup so that the annual interest rate is 7%. You should now have the following: (a) Complete the amortization schedule Interest Expense Date Cash Paid Dec. 31, 2021 Dec. 31, 2022 Dec. 31, 2023 Dec. 31, 2024 118,091.25 118,091.25 118, 091.25 118,091.25 28,000.00 21,693.61 14,945.78 7,725.60 Decrease in Carrying Value Carrying Value 400,000.00 90,091.25 309,908.75 96,397.63 213,511.12 103,145.47 110,365.65 110,365.65 0.00 If you do not get this answer, review your worksheet and formulas and try again. Save your completed Applying Excel form to your computer and then upload it here by clicking "Browse". Next click "Save". You will use this worksheet to answer questions in Part 2. Prepare Excel spreadsheet (Part 1) Download the "Applying Excel' worksheet below and save it to your computer. View the tutorial video, and then complete the worksheet Enter formulas in cells that contain question marks (only use formulas). After entering formulas in all of the cells that contain question marks, verify that the amounts match the example below. (a) Complete the amortization schedule Interest Expense Date Cash Paid Dec. 31, 2021 Dec. 31, 2022 Dec. 31, 2023 Dec. 31, 2024 115, 436.60 115, 436.60 115,436.60 115,436.60 24,000.00 18,513.80 12,698.44 6,534.15 Decrease in Carrying Value Carrying Value 400,000.00 91, 436.60 308,563.401 96,922.79 211,640.61 102,738.16 108,902.45 108,902.45 0.00 (b) Record issuance of the note Credit Debit 400,000.00 Cash Notes Payable 400,000.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts