Question: Dr. J. Hall and Dr. S. Young have been operating a dental practice as a partnership for several years. The fixed profit and loss

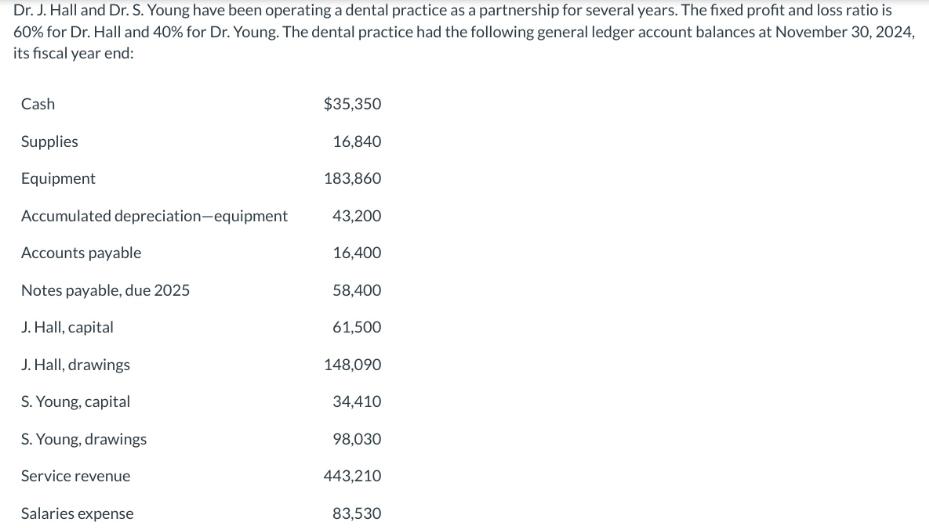

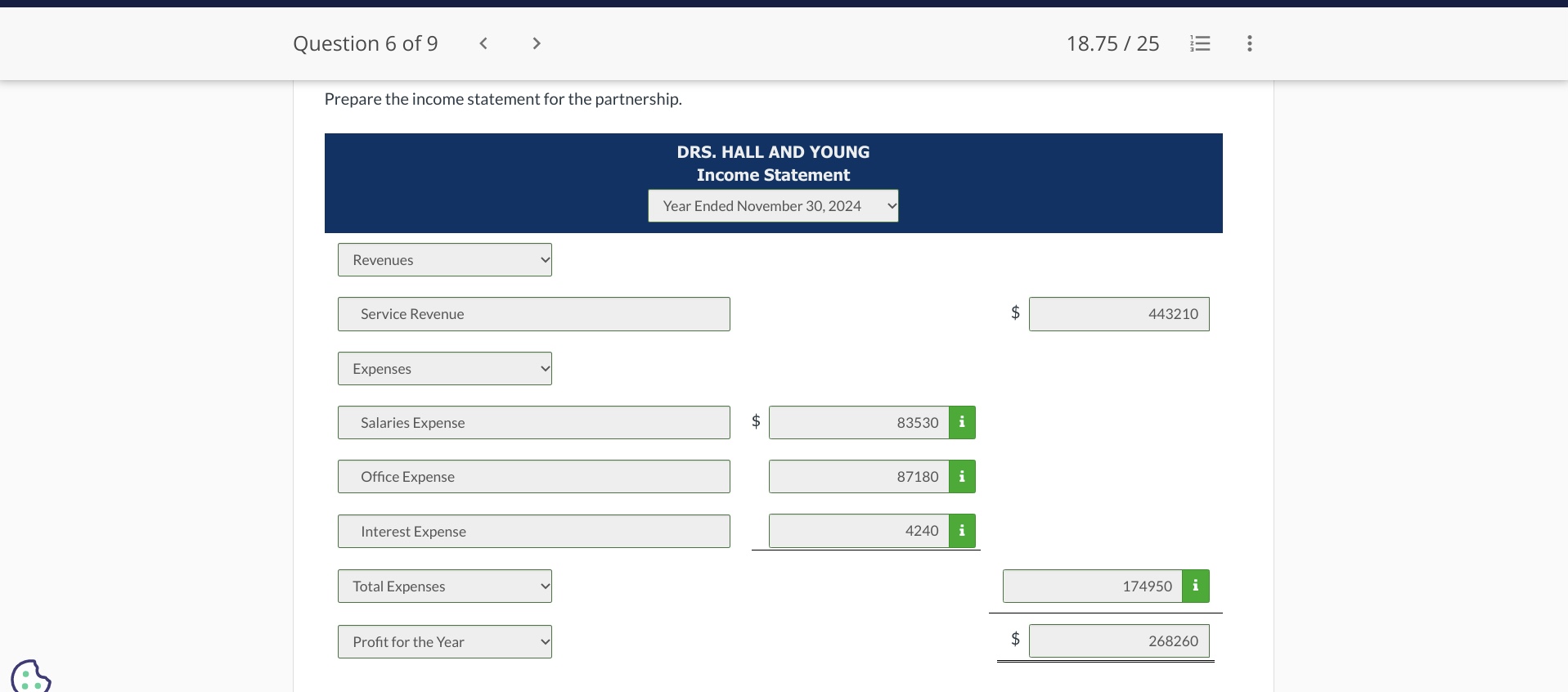

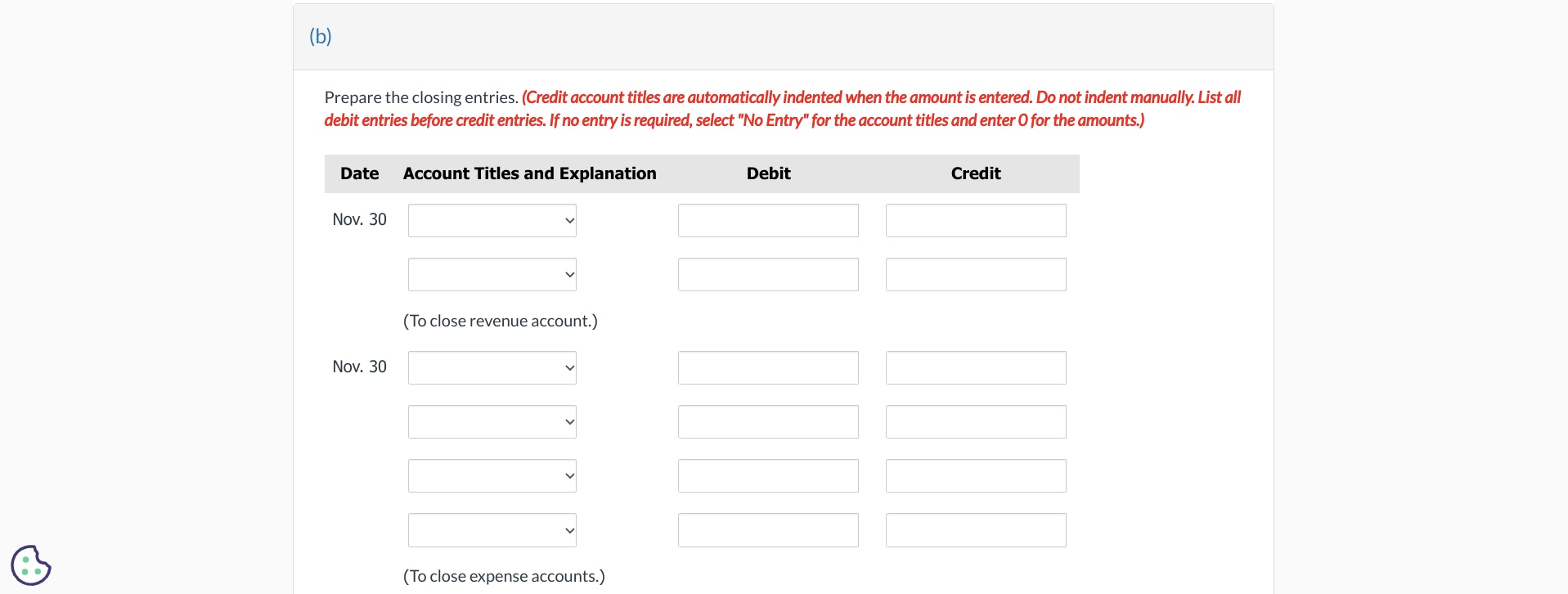

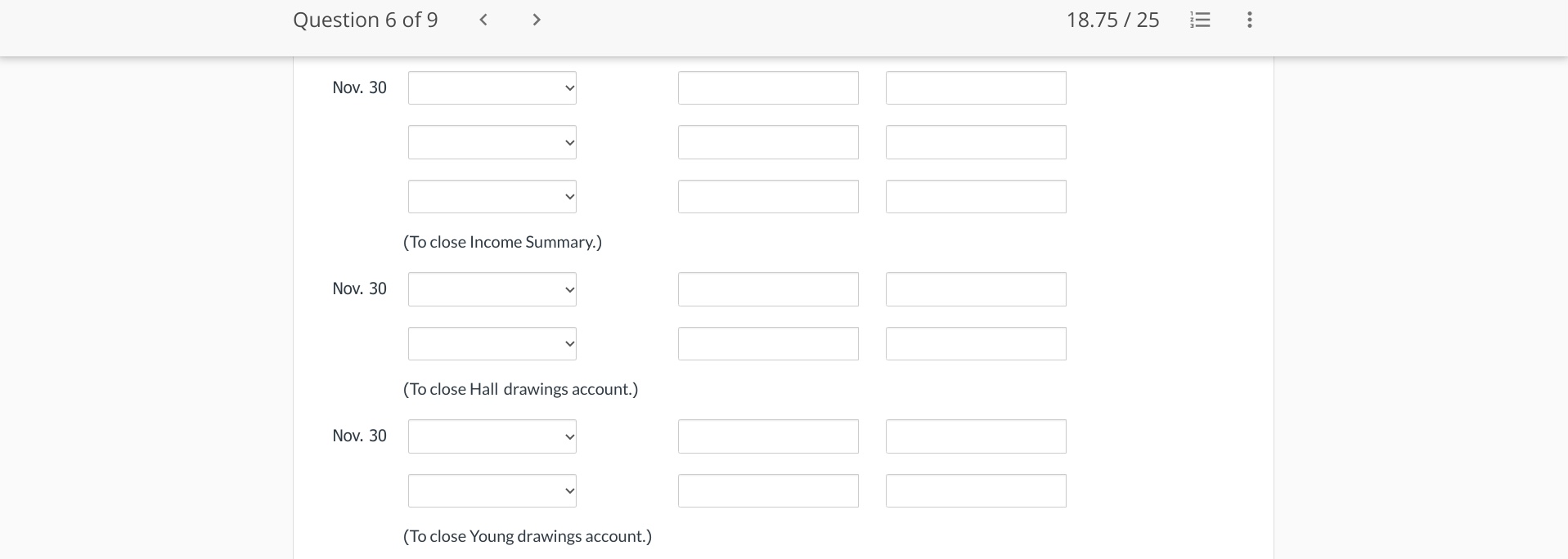

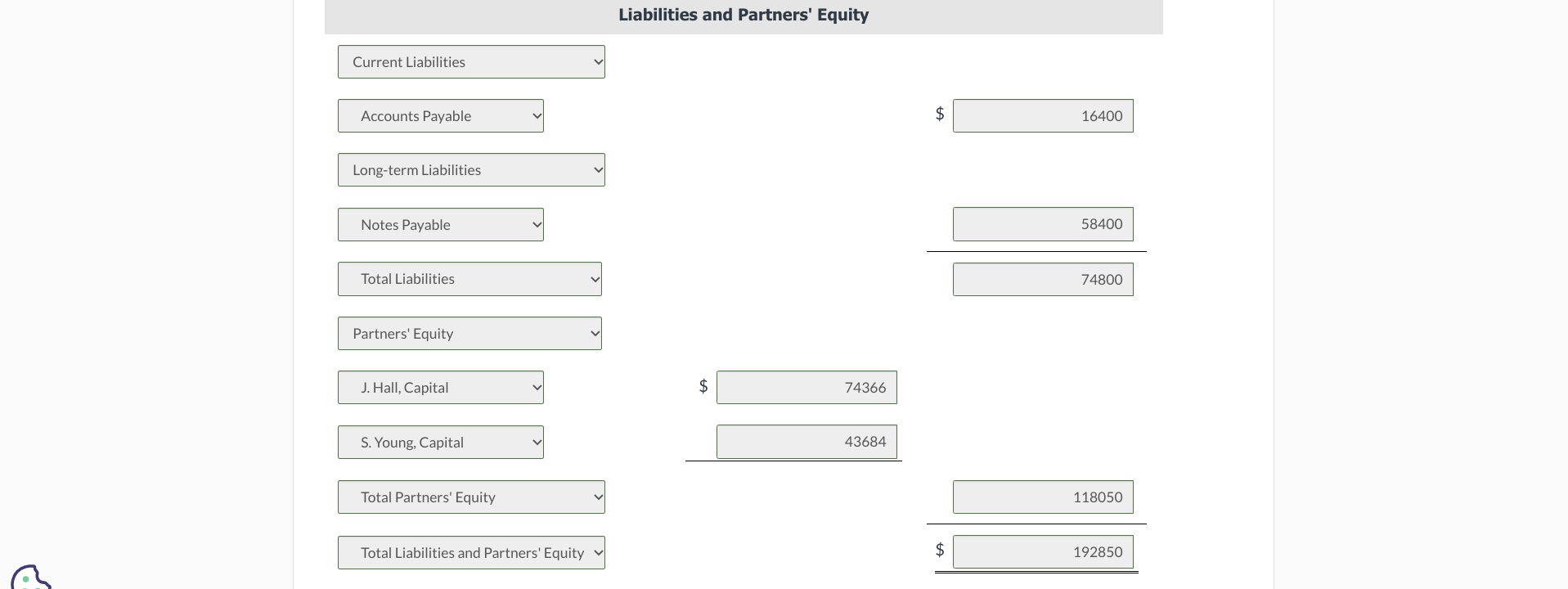

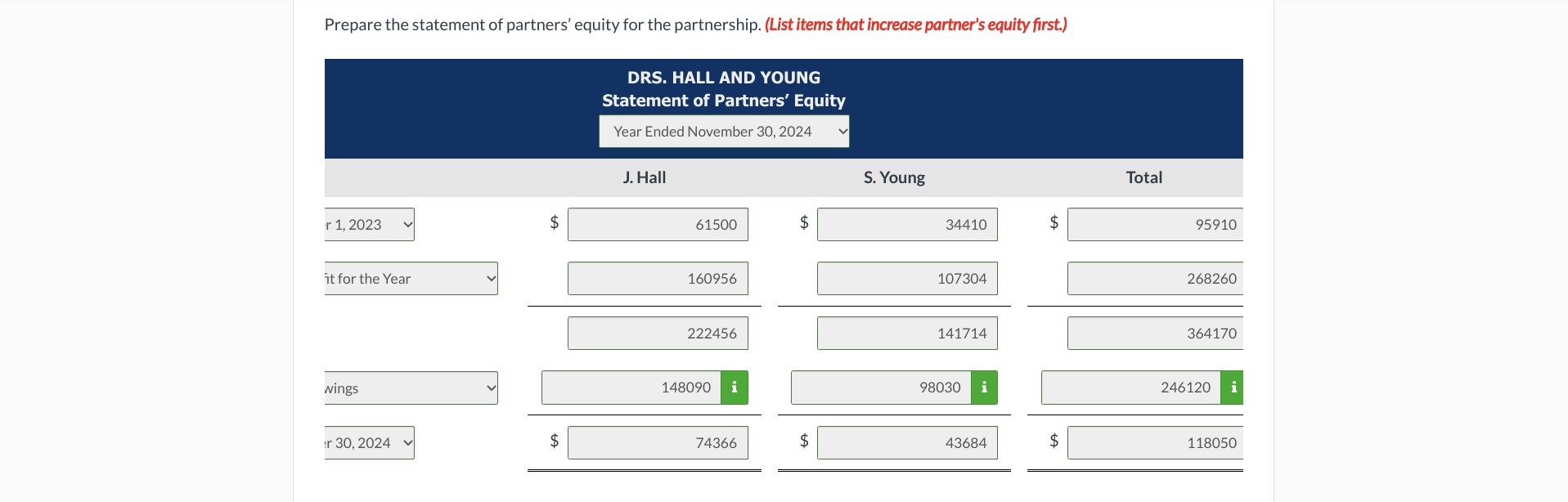

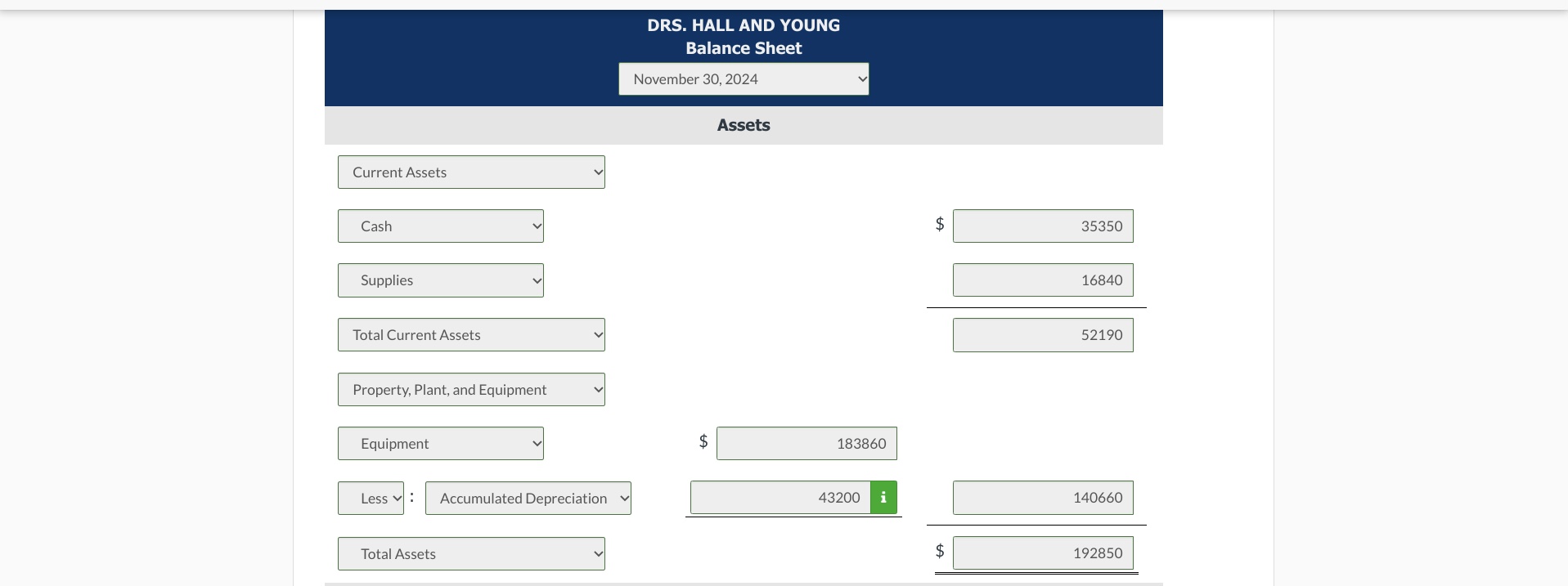

Dr. J. Hall and Dr. S. Young have been operating a dental practice as a partnership for several years. The fixed profit and loss ratio is 60% for Dr. Hall and 40% for Dr. Young. The dental practice had the following general ledger account balances at November 30, 2024, its fiscal year end: Cash $35,350 Supplies 16,840 Equipment 183,860 Accumulated depreciation-equipment 43,200 Accounts payable 16,400 Notes payable, due 2025 58,400 J. Hall, capital 61,500 J. Hall, drawings 148,090 S. Young, capital 34,410 S. Young, drawings 98,030 Service revenue 443,210 Salaries expense 83,530 Question 6 of 9 < Prepare the income statement for the partnership. DRS. HALL AND YOUNG Income Statement Year Ended November 30, 2024 Revenues Service Revenue Expenses Salaries Expense $ 83530 Office Expense Interest Expense Total Expenses Profit for the Year 87180 i 4240 18.75/25 $ 443210 $ 174950 i 268260 (b) Prepare the closing entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Nov. 30 (To close revenue account.) Nov. 30 (To close expense accounts.) Debit Credit Question 6 of 9 Nov. 30 > Nov. 30 (To close Income Summary.) Nov. 30 (To close Hall drawings account.) (To close Young drawings account.) 18.75/25 III Current Liabilities Liabilities and Partners' Equity Accounts Payable Long-term Liabilities Notes Payable Total Liabilities Partners' Equity J. Hall, Capital S. Young, Capital Total Partners' Equity Total Liabilities and Partners' Equity $ 74366 43684 +A $ 16400 58400 74800 118050 $ 192850 Prepare the statement of partners' equity for the partnership. (List items that increase partner's equity first.) r 1, 2023 it for the Year wings r 30, 2024 $ DRS. HALL AND YOUNG Statement of Partners' Equity Year Ended November 30, 2024 J. Hall 61500 $ 160956 222456 148090 i 74366 $ S. Young 34410 107304 141714 98030 i 43684 $ Total 95910 268260 364170 246120 i 118050 Current Assets Cash Supplies Total Current Assets Property, Plant, and Equipment Equipment Less : Accumulated Depreciation Total Assets DRS. HALL AND YOUNG Balance Sheet November 30, 2024 S Assets 183860 43200 i $ 35350 16840 52190 140660 $ 192850

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts