Question: Dr Mo started his own medical practice at the end of 2020. At the end of his second year in business he thinks it prudent

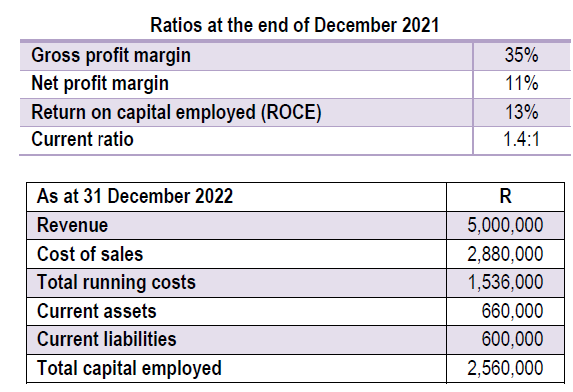

Dr Mo started his own medical practice at the end of 2020. At the end of his second year in business he thinks it prudent to compare his 2021 and 2022 financial results to reassess if its better for him to work in the private sector or return to public service. You are his financial manager, and he provides you with the following financial information:

Required: Showing the formulae, calculate the following ratios for the year 2022:

a) Gross profit margin; b) Net profit margin; c) Return on capital employed (ROCE); and d) Current ratio.

b. Tabulate the 2021 ratios and your calculated 2022 ratios. Comment on the changes in the ratios from one year to the next. In your assessment, provide two plausible reasons that could explain the financial trends observed.

c. Explain to Dr Mo, an exceptional medical doctor but sadly lacking in financial acumen, give him five advantages and five disadvantages of using ratios to analyse and interpret performance.

Ratios at the end of December 2021 \\begin{tabular}{l|c} \\hline Gross profit margin & \35 \\\\ \\hline Net profit margin & \11 \\\\ \\hline Return on capital employed (ROCE) & \13 \\\\ \\hline Current ratio & \\( 1.4: 1 \\) \\\\ \\hline \\end{tabular} \\begin{tabular}{|l|r|} \\hline As at 31 December 2022 & \\multicolumn{1}{|c|}{ R } \\\\ \\hline Revenue & \\( 5,000,000 \\) \\\\ \\hline Cost of sales & \\( 2,880,000 \\) \\\\ \\hline Total running costs & \\( 1,536,000 \\) \\\\ \\hline Current assets & 660,000 \\\\ \\hline Current liabilities & 600,000 \\\\ \\hline Total capital employed & \\( 2,560,000 \\) \\\\ \\hline \\end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts