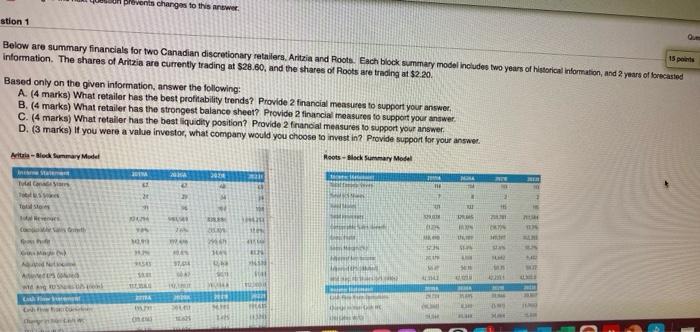

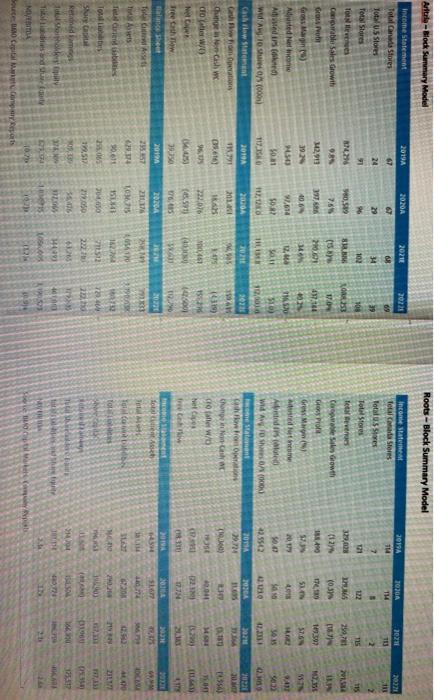

Question: Drevents changes to this answer stion 1 15 pts Below are summary financials for two Canadian discretionary retailers, Aritzia and Roots. Each block summary model

Drevents changes to this answer stion 1 15 pts Below are summary financials for two Canadian discretionary retailers, Aritzia and Roots. Each block summary model includes two years of historical information, and 2 years of forecasted Information. The shares of Aritzia are currently trading at $28.80, and the shares of Roots are trading at $2.20 Based only on the given information, answer the following: A. (4 marks) What retailer has the best profitability trends? Provide 2 financial measures to support your answer B. (4 marks) What retailer has the strongest balance sheet? Provide 2 financial measures to support your answer C. (4 marks) What retailer has the best liquidity position? Provide 2 financial measures to support your answer D. (3 marks) If you were a value investor, what company would you choose to invest in Provide support for your answer. Altri-Block Summary Model Roots - black Summary Model 2924 WE THE Total TS 20 3 1 UP w HAN . EN SH 370 A TU Art-Block Summary Model Roots -Block Summary Model 20.20 2019 67 2013 2021 08 2019 114 10300 114 2021 67 20221 69 24 29 GE . 34 102 91 801 121 115 812 AM OS 53 980.89 765 19 SR 221 WE ro) 2014 115 26,78 [ MA Income Statement focal Stores Totales Total Stores fotos Corbeiles Growth GoPro Grew Marg Ateneume Medis wid 000 MS) LOTOR Income statement Total Canada Stores Tots Stores Total Stores TON Cable Sales Growth Gros Pro Go Marin) Asted income Adi wedisid Widawy 100) Cash flow Sant Com Operation Chunonch w Cowo 329,028 (12) 1840 W. 2,911 392 47.44 MASE 40.6 SL WN SAN 7.614 50.22 11 S. 30.01 11.15 510 10,00 11, TH DO 2030 307 2020 2015 22.5562 2011 924 (30) 0321 20 906 17 09.6167 950 23 (6) 5 01.18 Com VP H | | | CHOWO hetes free SC 100 722.06 00 021 CO 15 so T. 2020 S90 BA 39.750 2014 since the To Asset folue LEX 25 0910 BE 2016 LOMS 15,48 C. 90.611 JOCA GRI 44 Telco fo 1622 no 2002 050 TIS 72240 Toutes Share Retained her pl 25.065 119.51 09.13 27.050 22 HE Do AL TOS 14794 TE DO MARI H49 100 TA MOVEDA Source: Como 1 CI Soleil Drevents changes to this answer stion 1 15 pts Below are summary financials for two Canadian discretionary retailers, Aritzia and Roots. Each block summary model includes two years of historical information, and 2 years of forecasted Information. The shares of Aritzia are currently trading at $28.80, and the shares of Roots are trading at $2.20 Based only on the given information, answer the following: A. (4 marks) What retailer has the best profitability trends? Provide 2 financial measures to support your answer B. (4 marks) What retailer has the strongest balance sheet? Provide 2 financial measures to support your answer C. (4 marks) What retailer has the best liquidity position? Provide 2 financial measures to support your answer D. (3 marks) If you were a value investor, what company would you choose to invest in Provide support for your answer. Altri-Block Summary Model Roots - black Summary Model 2924 WE THE Total TS 20 3 1 UP w HAN . EN SH 370 A TU Art-Block Summary Model Roots -Block Summary Model 20.20 2019 67 2013 2021 08 2019 114 10300 114 2021 67 20221 69 24 29 GE . 34 102 91 801 121 115 812 AM OS 53 980.89 765 19 SR 221 WE ro) 2014 115 26,78 [ MA Income Statement focal Stores Totales Total Stores fotos Corbeiles Growth GoPro Grew Marg Ateneume Medis wid 000 MS) LOTOR Income statement Total Canada Stores Tots Stores Total Stores TON Cable Sales Growth Gros Pro Go Marin) Asted income Adi wedisid Widawy 100) Cash flow Sant Com Operation Chunonch w Cowo 329,028 (12) 1840 W. 2,911 392 47.44 MASE 40.6 SL WN SAN 7.614 50.22 11 S. 30.01 11.15 510 10,00 11, TH DO 2030 307 2020 2015 22.5562 2011 924 (30) 0321 20 906 17 09.6167 950 23 (6) 5 01.18 Com VP H | | | CHOWO hetes free SC 100 722.06 00 021 CO 15 so T. 2020 S90 BA 39.750 2014 since the To Asset folue LEX 25 0910 BE 2016 LOMS 15,48 C. 90.611 JOCA GRI 44 Telco fo 1622 no 2002 050 TIS 72240 Toutes Share Retained her pl 25.065 119.51 09.13 27.050 22 HE Do AL TOS 14794 TE DO MARI H49 100 TA MOVEDA Source: Como 1 CI Soleil

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts