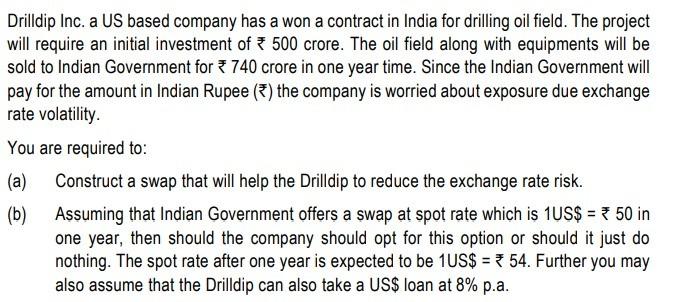

Question: Drilldip Inc. a US based company has a won a contract in India for drilling oil field. The project will require an initial investment of

Drilldip Inc. a US based company has a won a contract in India for drilling oil field. The project will require an initial investment of 500 crore. The oil field along with equipments will be sold to Indian Government for 740 crore in one year time. Since the Indian Government will pay for the amount in Indian Rupee () the company is worried about exposure due exchange rate volatility. You are required to: (a) Construct a swap that will help the Drilldip to reduce the exchange rate risk. (b) Assuming that Indian Government offers a swap at spot rate which is 1 US $=50 in one year, then should the company should opt for this option or should it just do nothing. The spot rate after one year is expected to be 1 US $=54. Further you may also assume that the Drilldip can also take a US $ loan at 8% p.a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts