Question: Drop Down 1: Both investments, A, B, Neither Drop Down 2: Both investments, A, B, Neither Drop Down 3: Is, Is Not Drop Down 4:

Drop Down 1: Both investments, A, B, Neither

Drop Down 1: Both investments, A, B, Neither

Drop Down 2: Both investments, A, B, Neither

Drop Down 3: Is, Is Not

Drop Down 4: Both investments, A, B, Neither

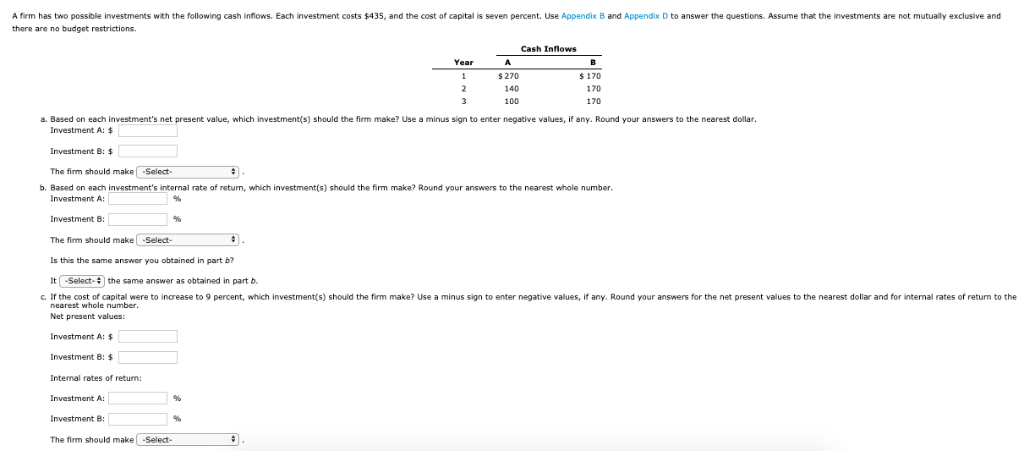

A firm has two possible investments with the following cash inflows. Each investment costs $435, and the cost of capital is seven percent. Use Appendix B and Appendix D to answer the questions. Assume that the investments are not mutually exclusive and there are no budget restrictions Cash Inflows Year $ 270 140 100 $ 170 170 170 a. Based on each investment's net present value, which investment(s) should the firm make? Use a minus sign to enter negative values, if any. Round your answers to the nearest dollar Investment A: The firm should make Select b. Based on each investment's internal rate of return, which investment(s) should the firm make? Round your answers to the nearest whole number Investment A Investment B: The firm should makeSelect- Is this the same answer you obtained in part b? It l-select- the same answer as obtained in part b. c. If the cost of capital were to increase to 9 percent, which investment(s) should the firm make? Use a minus sign to enter negative values, if any, Round your answers for the net present values to the nearest dollar and for internal rates of return to the nearest whole number Net present values: Investment A: $ Investment B: Internal rates of retum: Investment B: The firm should make -Select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts