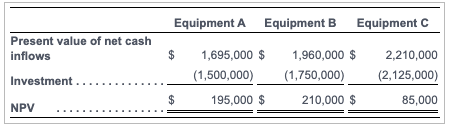

Question: Drop down: Equipment A Equipment B Equipment C Present value of net cash inflows $ 1,695,000 $ (1,500,000) 1,960,000 $ (1,750,000) 210,000 $ 2,210,000 (2,125,000)

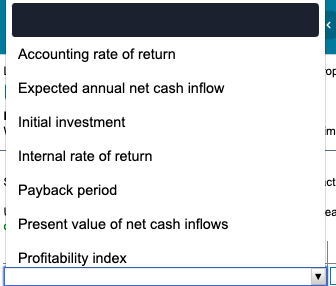

Drop down:

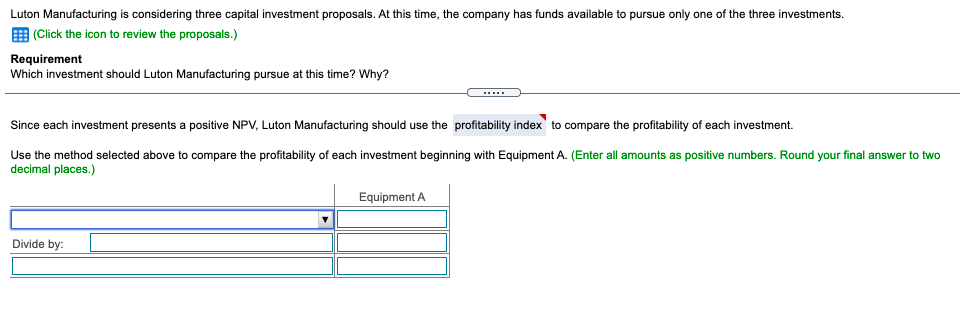

Equipment A Equipment B Equipment C Present value of net cash inflows $ 1,695,000 $ (1,500,000) 1,960,000 $ (1,750,000) 210,000 $ 2,210,000 (2,125,000) Investment.... NPV $ 195,000 $ 85,000 Luton Manufacturing is considering three capital investment proposals. At this time, the company has funds available to pursue only one of the three investments. (Click the icon to review the proposals.) Requirement Which investment should Luton Manufacturing pursue at this time? Why? Since each investment presents a positive NPV, Luton Manufacturing should use the profitability index to compare the profitability of each investment. Use the method selected above to compare the profitability of each investment beginning with Equipment A. (Enter all amounts as positive numbers. Round your final answer to two decimal places.) Equipment A Divide by:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts