Question: Here is full project, i cant show you full picture because my screen is small for that i divide on two screens. Please i need

Here is full project, i cant show you full picture because my screen is small for that i divide on two screens. Please i need your help . I'm pray!!

help me please with that work. I get problem to make it.

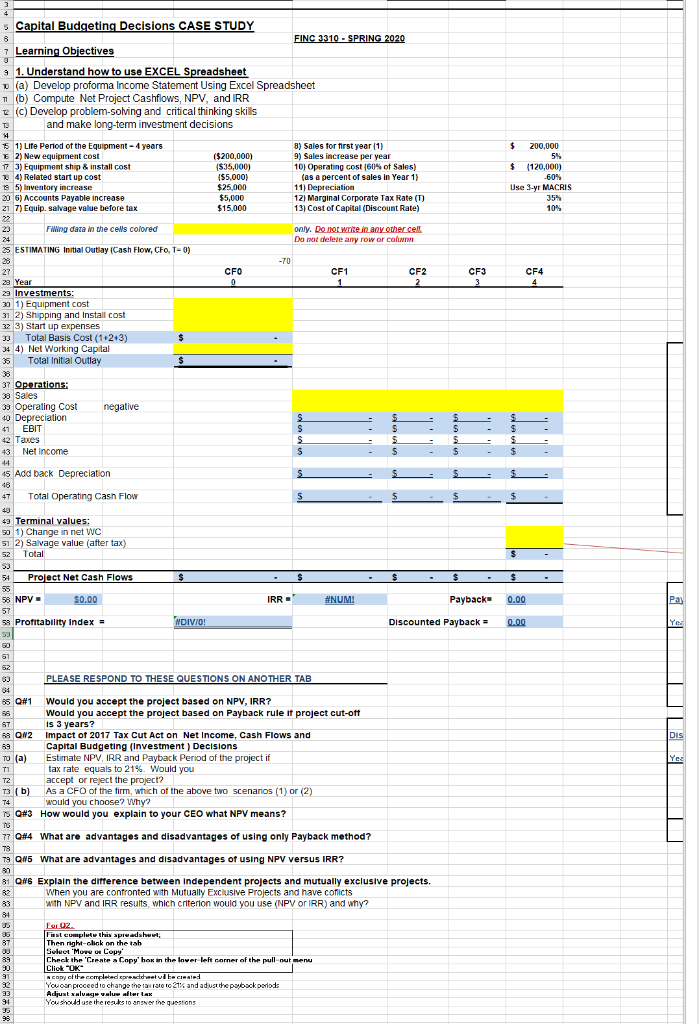

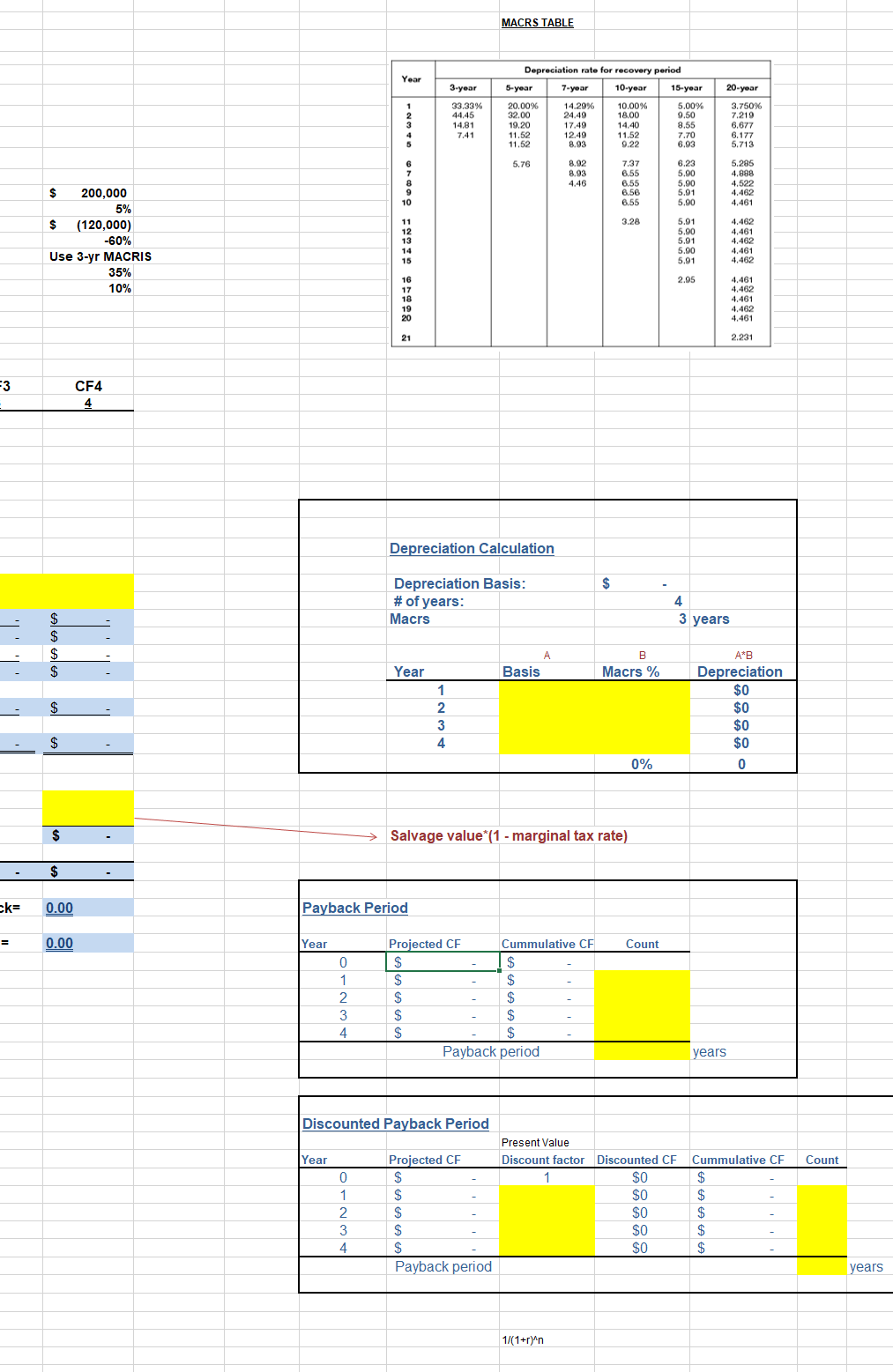

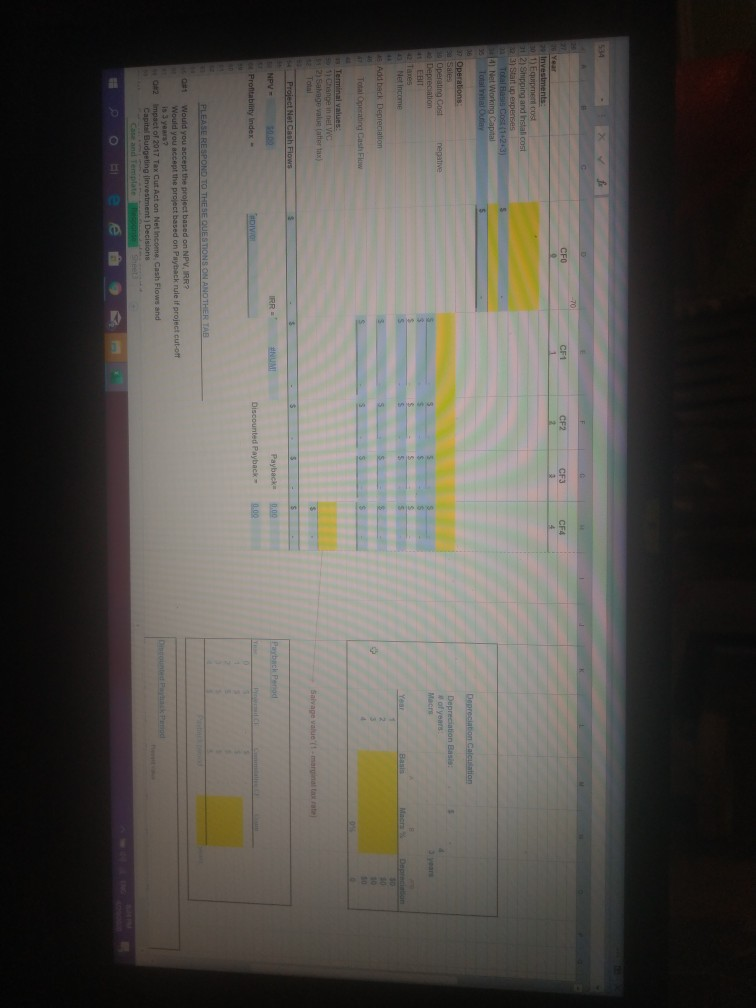

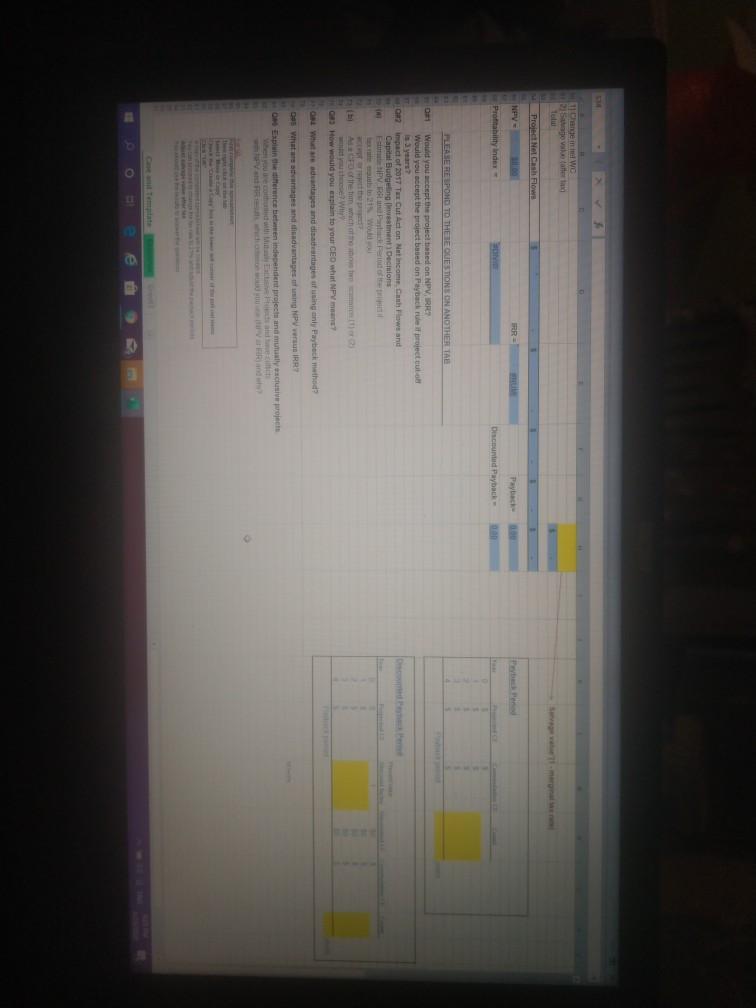

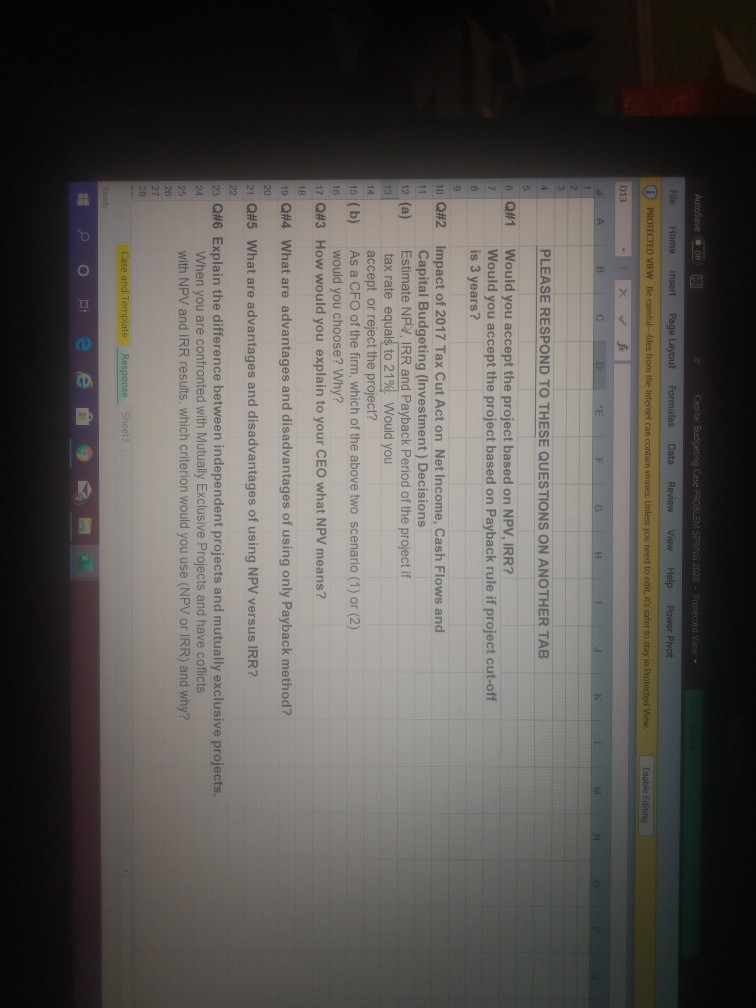

s Capital Budgeting Decisions CASE STUDY FINC 3310 - SPRING 2020 7 Learning Objectives 9 1. Understand how to use EXCEL Spreadsheet (a) Develop proforma Income Statement Using Excel Spreadsheet 1 (b) Compute Net Project Cashflows, NPV, and IRR (c) Develop problem-solving and critical thinking skills and make long-term investment decisions $ 200,000 6 1) Life Period of the Equipment - 4 years 52) New equipment cost 13) Equipment ship & install cost 4) Related start up cost 195) Inventory increase 20 6) Accounts Payable increase 217) Equip. salvage value before tax 15200,000) 1$35,000) 155,000) $25,000 $5,000 $15,000 8) Sales for first year (1) 9) Sales increase per year 10) Operating cost (60% of Sales) (as a percent of sales in Year 1) 11) Depreciation 12) Marginal Corporate Tax Rate (1) 131 Cost of Capital (Discount Rate) $ 120,000) -60% Use 3-yr MACRIS 10% FWing data in the cells colored only. Do not write in any other cell Do not delete any row or column 25 ESTIMATING Initial Outlay (Cash Flow, CFO, T-0) -70 CFO CF1 CF2 CF3 CF4 23 Year 29 Investments: 301) Equipment cost 31 2) Shipping and Install cost 32 3) Start up expenses 3 Total Basis Cost (1+2+3) 34 4) Net Working Capital 36 Total Initial Outlay 37 Operations: 33 Sales 39 Operating cost negative 40 Depreciation 41 EBIT 42 Taxes 43 Net Income 44 45 Add back Depreciation 47 Total Operating Cash Flow $ . 49 Terminal values: 50 1) Change in net WC 512) Salvage value (after tax) 52 Total 54 Project Net Cash Flows $ . $ . 58 NPV- $0.00 IRRO #NUM! Payback 0.00 58 Profitability Index = NDIVIO! Discounted Payback = 0.00 PLEASE RESPOND TO THESE QUESTIONS ON ANOTHER TAB 65 Q#1 Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off Is 3 years? 18 QN2 Impact of 2017 Tax Cut Act on Net Income, Cash Flows and Capital Budgeting (Investment ) Decisions To (a) Estimate NPV, IRR and Payback Period of the project if tax rate equals to 21%. Would you TZ accept or reject the project? T3 (b) As a CFO of the firm, which of the above two scenarios (1) or (2) T4 would you choose? Why? TS Q#3 How would you explain to your CEO what NPV means? TI 77 Q#4 What are advantages and disadvantages of using only Payback method? na QN6 What are advantages and disadvantages of using NPV versus IRR? 31 QN6 Explain the difference between independent projects and mutually exclusive projects. When you are confronted with Mutually Exclusive Projects and have coflicts with NPV and IRR results, which criterion would you use (NPV or IRR) and why? 3651 Lor U2 Finst cumplute this apreadshut Then right-click on the tab Select More Copy Check the Create a Copy' hex in the lower left corner of the pull out menu Click "OK" Copy of the completed prendetul be created You can proceed to change the tax rate to 21% and adustdhepsyback period: Adjust salvage valuw aftur tax You should use the registo an the questions MACRS TABLE Year 20-year 3-year 33.33% 44.45 14.81 7.41 Depreciation rate for recovery period 5-year 7-year 10-year 15-year 20.00% 14.29% 10.00% 5.00% 32.00 24.49 18.00 9.50 19.20 17:49 14.40 8.55 11.52 12.49 11.52 7.70 11.52 8.93 9.22 6.93 3.750% 7.219 6.677 6. 177 5.713 5.76 8.92 8.93 4.46 7.37 6.55 6.55 6.56 6.55 6.23 5.90 5.90 5.91 5.90 5.285 4.888 4.522 4.462 4.461 3.28 $ 200,000 5% $ (120,000) -60% Use 3-yr MACRIS 35% 10% 5.91 5.90 5.91 5.00 5.91 4.462 4.461 4.462 4.461 4.462 2.95 4.461 4.462 4.461 4.462 4,461 2.231 CF4 Depreciation Calculation Depreciation Basis: # of years: Macrs A 3 years A A A*B Depreciation Year Basis Macrs % A $0 A $ - $ 0% $ - Salvage value*(1 - marginal tax rate) - $ . ek 0.00 Payback Period 0.00 Year Projected CF Cummulative CF Count 0 $ $ 3 AA 4 $ Payback period years Discounted Payback Period Year Projected CF Count Present Value Discount factor Discounted CF Cummulative CF $0 $0 $ $0 $0 $0 AA Payback period years 1/(1+r)^n Capital Budgeting Decisions CASE STUDY FINC 3310 - SPRING 2020 Learning Objectives 1. Understand how to use EXCEL Spreadsheet a) Develop proforma Income Statement Using Excel Spreadsheet 1 (b) Compute Net Project Cashflows, NPV, and IRR (c) Develop problem solving and critical thinking skills and make long-term investment decisions $ 100.000 15200.000 (595,000 15 1 Lite Period of the equipment - 4 years New equipoent cost Equipment Ship & install cost 4) Related start up cost hvery inerea F1 ACCOU Payable increase Equip. Savage value before Sales for first year (1) 9) Sales increase per year 10) Operating cost of Sales) (as a percent of sales in Year 11 11) Depreciation 12 Marginal Corporate Tax Rate 20 000 User MACRIS $5,000 Costa ng in the cells color Do not b e any rower com ESTIMATING in Cash Flow, CFO, CFO CF2CF3CF4 Investments DEUTECO 11215 poing into De penges 50 Change in W 2) Samage value after taxi Project Net Cash Flows NPV = Payback 000 Payback Period Profitability Index Discounted Payback PLEASE RESPOND TO THESE QUESTIONS ON ANOTHER TAB a Would you accept the project based on NPV, RR? Would you accept the project based on Payback ruf project cut-on is 3 years? OF2 impact of 2017 Tax Cut Act on Not income, Cash Flows and Capital Budgeting investment Decisions s m NPV RR and Period of the project quals to 217 Would you accept of the b) AS CFO of themWhich of o ver 2) Wand you choose? W 003 How would you explain to your CEO what NPV means? ON What are advantages and disadvantages of using only Payback method What are advantages and disadvantages of using NPV versus IRRY 06 Explain the difference between independent projects and mutually exclusive projects When you come with Minily Eco sande con CF1 - 6- Investments 28 Eure cos 312) Shipping and instali cost 323) Startup expenses Net Working Capital Depreciacon Calculation 27 Operations nepative 19 Operating cos Lepieciaron 11 EBIT Depreciation Basis of years Macre Net income Adi Dack Depreciation Total Onling Cash Flow Terminal values change in helve 2) Sage valur ax) Salvage value' - marinat tax rate Project Net Cash Flows NPV = IRR - ANUM Payback 0.00 Payback period Profitability Index - Discounted Payback PLEASE RESPOND TO THESE QUESTIONS ON ANOTHER TAB Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off mpact of 2017 Tax Cut Act on Net Income Cash Flows and Capital Budgeting investment Decisions Cate and Template Sheet 50 Change in W 2) Samage value after taxi Project Net Cash Flows NPV = Payback 000 Payback Period Profitability Index Discounted Payback PLEASE RESPOND TO THESE QUESTIONS ON ANOTHER TAB a Would you accept the project based on NPV, RR? Would you accept the project based on Payback ruf project cut-on is 3 years? OF2 impact of 2017 Tax Cut Act on Not income, Cash Flows and Capital Budgeting investment Decisions s m NPV RR and Period of the project quals to 217 Would you accept of the b) AS CFO of themWhich of o ver 2) Wand you choose? W 003 How would you explain to your CEO what NPV means? ON What are advantages and disadvantages of using only Payback method What are advantages and disadvantages of using NPV versus IRRY 06 Explain the difference between independent projects and mutually exclusive projects When you come with Minily Eco sande con AutoSave Off Capita Budgeting Case PROBLEM SPRING 2020 - Protected View File Home insert Page Layout Formulas Data Review View Help Power Pivot D PROTECTED VIEW Be careful files from the Internet can contain viruses. Unless you need to edit its safer to stay in Protected View Enable Editing PLEASE RESPOND TO THESE QUESTIONS ON ANOTHER TAB Q#1 Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off is 3 years? Q#2 Impact of 2017 Tax Cut Act on Net Income, Cash Flows and Capital Budgeting (Investment) Decisions Estimate NPV, IRR and Payback period of the project if tax rate equals to 21%. Would you accept or reject the project? As a CFO of the firm, which of the above two scenario (1) or (2) would you choose? Why? Q#3 How would you explain to your CEO what NPV means? 15 (6) Q#4 What are advantages and disadvantages of using only Payback method? 21 Q#5 What are advantages and disadvantages of using NPV versus IRR? Q#6 Explain the difference between independent projects and mutually exclusive projects. When you are confronted with Mutually Exclusive Projects and have coflicts with NPV and IRR results, which criterion would you use (NPV or IRR) and why? Case and Template Response Sheets te s Capital Budgeting Decisions CASE STUDY FINC 3310 - SPRING 2020 7 Learning Objectives 9 1. Understand how to use EXCEL Spreadsheet (a) Develop proforma Income Statement Using Excel Spreadsheet 1 (b) Compute Net Project Cashflows, NPV, and IRR (c) Develop problem-solving and critical thinking skills and make long-term investment decisions $ 200,000 6 1) Life Period of the Equipment - 4 years 52) New equipment cost 13) Equipment ship & install cost 4) Related start up cost 195) Inventory increase 20 6) Accounts Payable increase 217) Equip. salvage value before tax 15200,000) 1$35,000) 155,000) $25,000 $5,000 $15,000 8) Sales for first year (1) 9) Sales increase per year 10) Operating cost (60% of Sales) (as a percent of sales in Year 1) 11) Depreciation 12) Marginal Corporate Tax Rate (1) 131 Cost of Capital (Discount Rate) $ 120,000) -60% Use 3-yr MACRIS 10% FWing data in the cells colored only. Do not write in any other cell Do not delete any row or column 25 ESTIMATING Initial Outlay (Cash Flow, CFO, T-0) -70 CFO CF1 CF2 CF3 CF4 23 Year 29 Investments: 301) Equipment cost 31 2) Shipping and Install cost 32 3) Start up expenses 3 Total Basis Cost (1+2+3) 34 4) Net Working Capital 36 Total Initial Outlay 37 Operations: 33 Sales 39 Operating cost negative 40 Depreciation 41 EBIT 42 Taxes 43 Net Income 44 45 Add back Depreciation 47 Total Operating Cash Flow $ . 49 Terminal values: 50 1) Change in net WC 512) Salvage value (after tax) 52 Total 54 Project Net Cash Flows $ . $ . 58 NPV- $0.00 IRRO #NUM! Payback 0.00 58 Profitability Index = NDIVIO! Discounted Payback = 0.00 PLEASE RESPOND TO THESE QUESTIONS ON ANOTHER TAB 65 Q#1 Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off Is 3 years? 18 QN2 Impact of 2017 Tax Cut Act on Net Income, Cash Flows and Capital Budgeting (Investment ) Decisions To (a) Estimate NPV, IRR and Payback Period of the project if tax rate equals to 21%. Would you TZ accept or reject the project? T3 (b) As a CFO of the firm, which of the above two scenarios (1) or (2) T4 would you choose? Why? TS Q#3 How would you explain to your CEO what NPV means? TI 77 Q#4 What are advantages and disadvantages of using only Payback method? na QN6 What are advantages and disadvantages of using NPV versus IRR? 31 QN6 Explain the difference between independent projects and mutually exclusive projects. When you are confronted with Mutually Exclusive Projects and have coflicts with NPV and IRR results, which criterion would you use (NPV or IRR) and why? 3651 Lor U2 Finst cumplute this apreadshut Then right-click on the tab Select More Copy Check the Create a Copy' hex in the lower left corner of the pull out menu Click "OK" Copy of the completed prendetul be created You can proceed to change the tax rate to 21% and adustdhepsyback period: Adjust salvage valuw aftur tax You should use the registo an the questions MACRS TABLE Year 20-year 3-year 33.33% 44.45 14.81 7.41 Depreciation rate for recovery period 5-year 7-year 10-year 15-year 20.00% 14.29% 10.00% 5.00% 32.00 24.49 18.00 9.50 19.20 17:49 14.40 8.55 11.52 12.49 11.52 7.70 11.52 8.93 9.22 6.93 3.750% 7.219 6.677 6. 177 5.713 5.76 8.92 8.93 4.46 7.37 6.55 6.55 6.56 6.55 6.23 5.90 5.90 5.91 5.90 5.285 4.888 4.522 4.462 4.461 3.28 $ 200,000 5% $ (120,000) -60% Use 3-yr MACRIS 35% 10% 5.91 5.90 5.91 5.00 5.91 4.462 4.461 4.462 4.461 4.462 2.95 4.461 4.462 4.461 4.462 4,461 2.231 CF4 Depreciation Calculation Depreciation Basis: # of years: Macrs A 3 years A A A*B Depreciation Year Basis Macrs % A $0 A $ - $ 0% $ - Salvage value*(1 - marginal tax rate) - $ . ek 0.00 Payback Period 0.00 Year Projected CF Cummulative CF Count 0 $ $ 3 AA 4 $ Payback period years Discounted Payback Period Year Projected CF Count Present Value Discount factor Discounted CF Cummulative CF $0 $0 $ $0 $0 $0 AA Payback period years 1/(1+r)^n Capital Budgeting Decisions CASE STUDY FINC 3310 - SPRING 2020 Learning Objectives 1. Understand how to use EXCEL Spreadsheet a) Develop proforma Income Statement Using Excel Spreadsheet 1 (b) Compute Net Project Cashflows, NPV, and IRR (c) Develop problem solving and critical thinking skills and make long-term investment decisions $ 100.000 15200.000 (595,000 15 1 Lite Period of the equipment - 4 years New equipoent cost Equipment Ship & install cost 4) Related start up cost hvery inerea F1 ACCOU Payable increase Equip. Savage value before Sales for first year (1) 9) Sales increase per year 10) Operating cost of Sales) (as a percent of sales in Year 11 11) Depreciation 12 Marginal Corporate Tax Rate 20 000 User MACRIS $5,000 Costa ng in the cells color Do not b e any rower com ESTIMATING in Cash Flow, CFO, CFO CF2CF3CF4 Investments DEUTECO 11215 poing into De penges 50 Change in W 2) Samage value after taxi Project Net Cash Flows NPV = Payback 000 Payback Period Profitability Index Discounted Payback PLEASE RESPOND TO THESE QUESTIONS ON ANOTHER TAB a Would you accept the project based on NPV, RR? Would you accept the project based on Payback ruf project cut-on is 3 years? OF2 impact of 2017 Tax Cut Act on Not income, Cash Flows and Capital Budgeting investment Decisions s m NPV RR and Period of the project quals to 217 Would you accept of the b) AS CFO of themWhich of o ver 2) Wand you choose? W 003 How would you explain to your CEO what NPV means? ON What are advantages and disadvantages of using only Payback method What are advantages and disadvantages of using NPV versus IRRY 06 Explain the difference between independent projects and mutually exclusive projects When you come with Minily Eco sande con CF1 - 6- Investments 28 Eure cos 312) Shipping and instali cost 323) Startup expenses Net Working Capital Depreciacon Calculation 27 Operations nepative 19 Operating cos Lepieciaron 11 EBIT Depreciation Basis of years Macre Net income Adi Dack Depreciation Total Onling Cash Flow Terminal values change in helve 2) Sage valur ax) Salvage value' - marinat tax rate Project Net Cash Flows NPV = IRR - ANUM Payback 0.00 Payback period Profitability Index - Discounted Payback PLEASE RESPOND TO THESE QUESTIONS ON ANOTHER TAB Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off mpact of 2017 Tax Cut Act on Net Income Cash Flows and Capital Budgeting investment Decisions Cate and Template Sheet 50 Change in W 2) Samage value after taxi Project Net Cash Flows NPV = Payback 000 Payback Period Profitability Index Discounted Payback PLEASE RESPOND TO THESE QUESTIONS ON ANOTHER TAB a Would you accept the project based on NPV, RR? Would you accept the project based on Payback ruf project cut-on is 3 years? OF2 impact of 2017 Tax Cut Act on Not income, Cash Flows and Capital Budgeting investment Decisions s m NPV RR and Period of the project quals to 217 Would you accept of the b) AS CFO of themWhich of o ver 2) Wand you choose? W 003 How would you explain to your CEO what NPV means? ON What are advantages and disadvantages of using only Payback method What are advantages and disadvantages of using NPV versus IRRY 06 Explain the difference between independent projects and mutually exclusive projects When you come with Minily Eco sande con AutoSave Off Capita Budgeting Case PROBLEM SPRING 2020 - Protected View File Home insert Page Layout Formulas Data Review View Help Power Pivot D PROTECTED VIEW Be careful files from the Internet can contain viruses. Unless you need to edit its safer to stay in Protected View Enable Editing PLEASE RESPOND TO THESE QUESTIONS ON ANOTHER TAB Q#1 Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off is 3 years? Q#2 Impact of 2017 Tax Cut Act on Net Income, Cash Flows and Capital Budgeting (Investment) Decisions Estimate NPV, IRR and Payback period of the project if tax rate equals to 21%. Would you accept or reject the project? As a CFO of the firm, which of the above two scenario (1) or (2) would you choose? Why? Q#3 How would you explain to your CEO what NPV means? 15 (6) Q#4 What are advantages and disadvantages of using only Payback method? 21 Q#5 What are advantages and disadvantages of using NPV versus IRR? Q#6 Explain the difference between independent projects and mutually exclusive projects. When you are confronted with Mutually Exclusive Projects and have coflicts with NPV and IRR results, which criterion would you use (NPV or IRR) and why? Case and Template Response Sheets te

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts