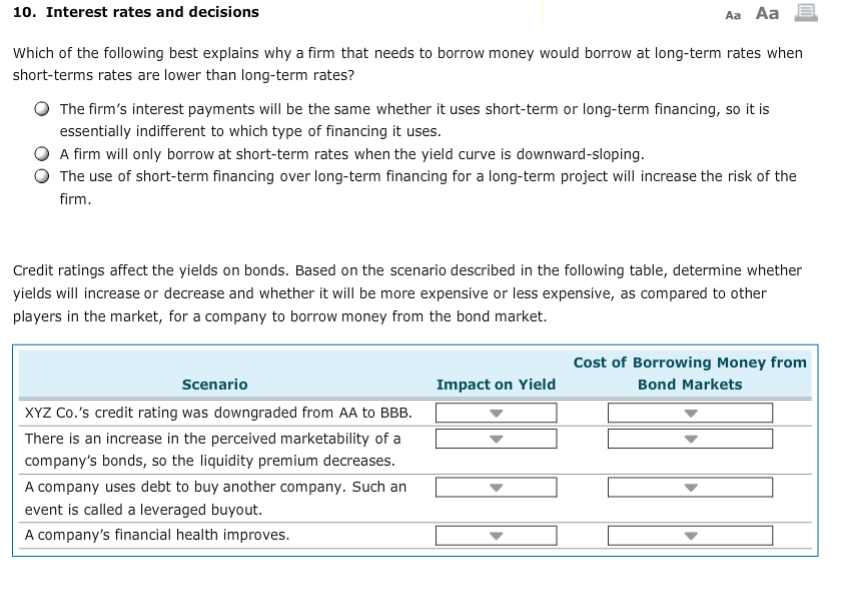

Question: Drop Down Impact on Yield: Increase or Decrease Cost of Borrowing Money from Bond Market: More or Less Expensive 10. Interest rates and decisions Aa

Drop Down

Drop Down

Impact on Yield: Increase or Decrease

Cost of Borrowing Money from Bond Market: More or Less Expensive

10. Interest rates and decisions Aa Aa Which of the following best explains why a firm that needs to borrow money would borrow at long-term rates when short-terms rates are lower than long-term rates? O The firm's interest payments will be the same whether it uses short-term or long-term financing, so it is essentially indifferent to which type of financing it uses. A firm will only borrow at short-term rates when the yield curve is downward-sloping. O The use of short-term financing over long-term financing for a long-term project will increase the risk of the firm. Credit ratings affect the yields on bonds. Based on the scenario described in the following table, determine whether yields will increase or decrease and whetherit l be more expensive or less expensive, as compared to other players in the market, for a company to borrow money from the bond market. Cost of Borrowing Money from Bond Markets Scenario Impact on Yield XYZ Co.'s credit rating was downgraded from AA to BBB. There is an increase in the perceived marketability of a company's bonds, so the liquidity premium decreases A company uses debt to buy another company. Such an event is called a leveraged buyout. A company's financial health improves

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts