Question: Pleas answer the multiple choice and fill in. Impact on yield: Increase or Decrease Cost of borrowing Money from bond markets: More expensive or Less

Pleas answer the multiple choice and fill in.

Impact on yield: Increase or Decrease

Cost of borrowing Money from bond markets: More expensive or Less Expensive

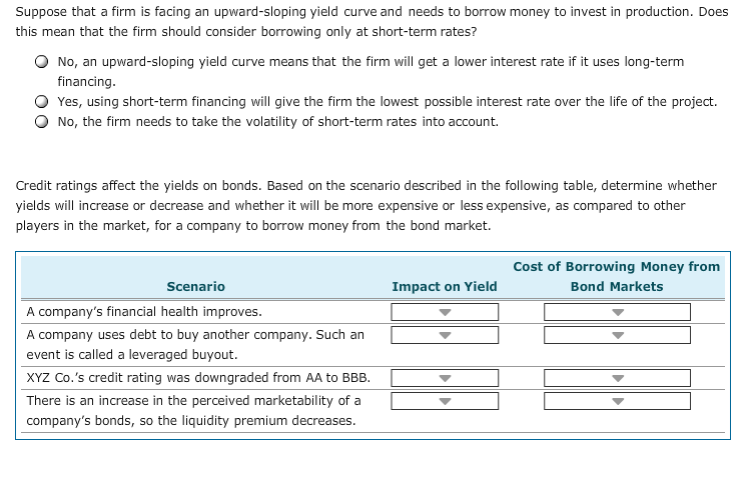

Suppose that a firm is facing an upward-sloping yield curve and needs to borrow money to invest in production. Does this mean that the firm should consider borrowing only at short-term rates? O No, an upward-sloping yield curve means that the firm will get a lower interest rate if it uses long-term financing. O Yes, using short-term financing will give the firm the lowest possible interest rate over the life of the project. O No, the firm needs to take the volatility of short-term rates into account. Credit ratings affect the yields on bonds. Based on the scenario described in the following table, determine whether yields will increase or decrease and whether it will be more expensive or less expensive, as compared to other players in the market, for a company to borrow money from the bond market. Cost of Borrowing Money from Bond Markets Scenario Impact on Yield A company's financial health improves. A company uses debt to buy another company. Such an event is called a leveraged buyout. XYZ Co. 's credit rating was downgraded from AA to BBB. There is an increase in the perceived marketability of a company's bonds, so the liquidity premium decreases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts