Question: Drop down menu: 1: an actively managed concentrated stock-picking fund, a closet (or enhanced) index fund, a passive index fund. 2. differs, does not differ.

Drop down menu:

1: an actively managed concentrated stock-picking fund, a closet (or enhanced) index fund, a passive index fund.

2. differs, does not differ.

3. an actively managed concentrated stock-picking fund, a closet (or enhanced) index fund, a passive index fund.

4. less , more

5. fewer, more

6. bigger smaller

7.an actively managed concentrated stock-picking fund, a closet (or enhanced) index fund, a passive index fund.

8. in number of these holdings, in the investment weights of those holdings, both in number of holdings and the investment weights of those holdings.

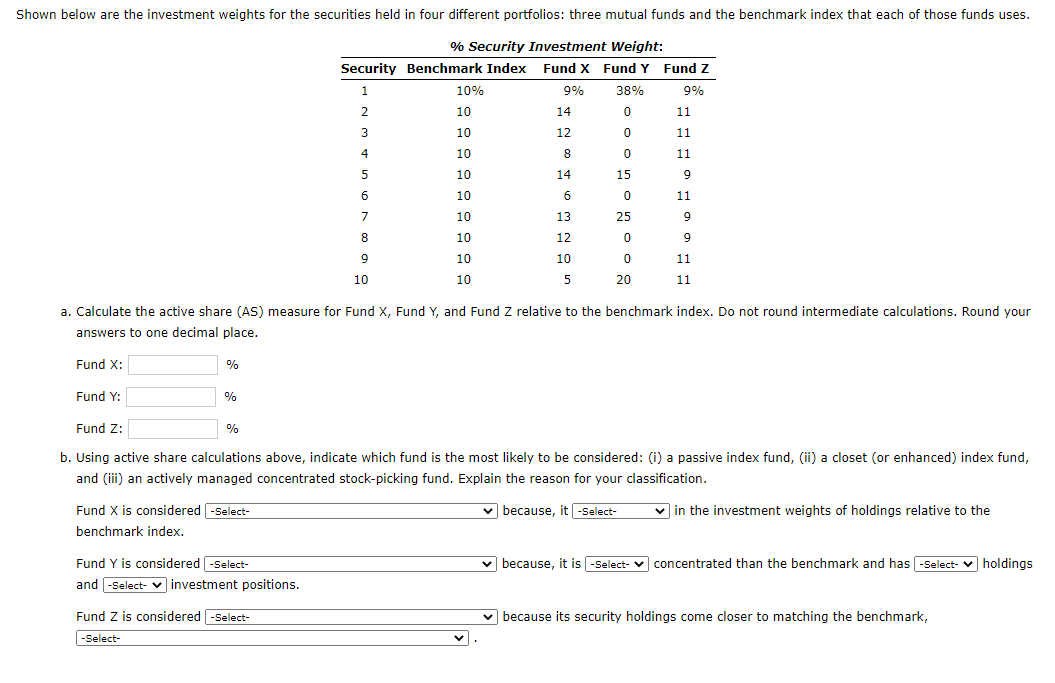

a. Calculate the active share (AS) measure for Fund X, Fund Y, and Fund Z relative to the benchmark index. Do not round intermediate calculations. Round your answers to one decimal place. Fund X : % Fund Y:% Fund Z: % b. Using active share calculations above, indicate which fund is the most likely to be considered: (i) a passive index fund, (ii) a closet (or enhanced) index fund, and (iii) an actively managed concentrated stock-picking fund. Explain the reason for your classification. Fund X is considered because, it in the investment weights of holdings relative to the benchmark index. Fund Y is considered because, it is concentrated than the benchmark and has holdings and investment positions. Fund Z is considered because its security holdings come closer to matching the benchmark, a. Calculate the active share (AS) measure for Fund X, Fund Y, and Fund Z relative to the benchmark index. Do not round intermediate calculations. Round your answers to one decimal place. Fund X : % Fund Y:% Fund Z: % b. Using active share calculations above, indicate which fund is the most likely to be considered: (i) a passive index fund, (ii) a closet (or enhanced) index fund, and (iii) an actively managed concentrated stock-picking fund. Explain the reason for your classification. Fund X is considered because, it in the investment weights of holdings relative to the benchmark index. Fund Y is considered because, it is concentrated than the benchmark and has holdings and investment positions. Fund Z is considered because its security holdings come closer to matching the benchmark

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts