Question: DROP DOWN OPTIONS: 1. 2. 3. PLEASE ANSWER ALL 3. Merger valuation and discounted cash flows Aa Aa When a merger takes place between two

DROP DOWN OPTIONS:

1.

2.

3.

PLEASE ANSWER ALL

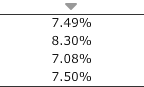

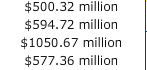

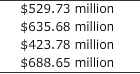

3. Merger valuation and discounted cash flows Aa Aa When a merger takes place between two companies to form a single firm, the target company to operate as a separate identity. does not continue continues Consider the following scenario: Three Waters Co. is considering an acquisition of Mall Toys Co. (MTC), and estimates that acquiring MTC will result in incremental after-tax net cash flows in years 1-3 of $17.0 million, $25.5 million, and $30.6 million, respectively. After the first three years, the incremental cash flows contributed by the MTC acquisition are expected to grow at a constant rate of 3% per year. Three Waters's current beta is 0.80, but its post-merger beta is expected to be 1.04. The risk-free rate is 3%, and the market risk premium is 5.10%. Based on this information, complete the following table by selecting the appropriate values: Value Post-merger cost of equity Projected value of the cash flows at the end of three years The value of Mall Toys Co. (MTC)'s contribution to Three Waters Co. Mall Toys Co. (MTC) has 6 million shares of common stock outstanding. What is the largest tender offer Three Waters Co. should make on each of Mall Toys Co. (MTC)'s shares? $70.63 $88.29 $105.95 7.49% 8.30% 7.08% 7.50% $500.32 million $594.72 million $1050.67 million $577.36 million $529.73 million $635.68 million $423.78 million $688.65 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts