Question: Drop down options: 1. 2. Please answer all 3. Warrants Aa Aa Warrants are long-term options to buy a stated number of common shares at

Drop down options:

Drop down options:

1.

2.

Please answer all

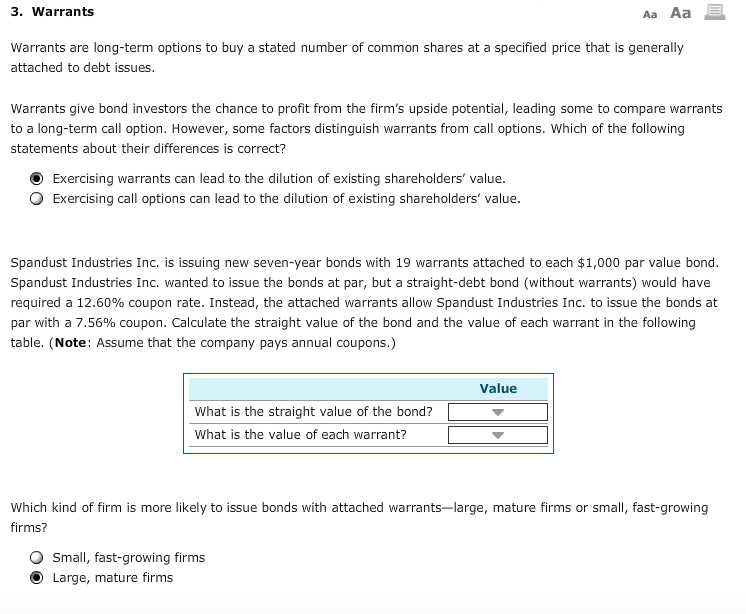

3. Warrants Aa Aa Warrants are long-term options to buy a stated number of common shares at a specified price that is generally attached to debt issues. Warrants give bond investors the chance to profit from the firm's upside potential, leading some to compare warrants to a long-term call option. However, some factors distinguish warrants from call options. Which of the following statements about their differences is correct? Exercising warrants can lead to the dilution of existing shareholders' value. Exercising call options can lead to the dilution of existing shareholders' value. Spandust Industries Inc. is issuing new seven-year bonds with 19 warrants attached to each $1,000 par value bond. Spandust Industries Inc. wanted to issue the bonds at par, but a straight-debt bond (without warrants) would have required a 12.60% coupon rate. Instead, the attached warrants allow Spandust Industries Inc. to issue the bonds at par with a 7.56% coupon. Calculate the straight value of the bond and the value of each warrant in the following table. (Note: Assume that the company pays annual coupons.) Value What is the straight value of the bond? What is the value of each warrant? Which kind of firm is more likely to issue bonds with attached warrants-large, mature firms or small, fast-growing firms? Small, fast-growing firms Large, mature firms $774.30 $635.74 $338.55 $371.50 $33.08 $14.26 $34.81 11.88

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts