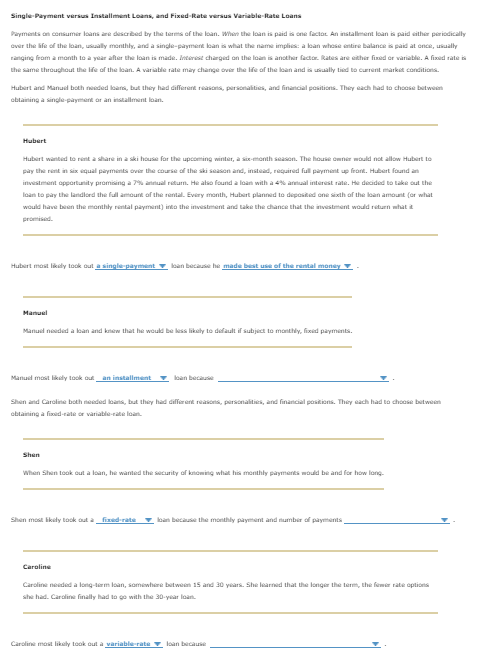

Question: drop down options: 1. an installment or a single payment 2. made best use of the rental money or didn't want to write a lot

drop down options:

1. an installment or a single payment 2. made best use of the rental money or didn't want to write a lot of checks

3.Manuel a single payment or installment 4. he only has to pay part of the loan each month or saving is easier for him than paying is

5. fixed rate or variable rate 6. were subject to change or were not subject to change

7. variable rate or fixed rate 8. the long term probably assured a variable rate or interest rates were holding steady

Single Payment versus Installment Loans, and Fixed-Rate versus Variable Rate Loans Payments on consumer loans are described by the arms of the loan. Where the loan is paid is one facto An installment loan is paid the periodically over the be of the loan, wally monthly, and a single-payment loan is what the name implies: a loan whose entire balance is paid at once, usually ranging from a month to a year after the loan is made. Interest changed on the loan is another factor Rates are either fixed or variable. A fixed rate is the same throughout the life of the loan. A variable rate may change over the life of the loan and is ally tied to current market conditions Hubert and Manuel both red loans, but they had different reasons, personalities, and financial positions. They each had to choose between obtaining a single-payment or an installment loan. Hubert Hubert wanted to rent a share in a ski house for the upcoming winter, a six-month season. The house Owne would not allow Hubert to pay the rest in six equal payments over the course of the ski season and instead, required full payment up front. Hubert found as investment opportunity promising a trulritum. He also found a loan with a 4% anual interest rate. He decided to take out the loan to pay the landlord the full amount of the rental. Every month, Hubert planned to deposited one sixth of the loan amount (or what would have been the monthly rental payment into the investment and take the chance that the intent would return what it promised Hubert most likely took out a single payment on because he made best use of the rental money Manuel Manuel needed a loan and that he would be less likely to default if subject to monthly, fixed payments. Manual most likely took out_an installment loan because Shen and Caroline both needed loans, but they had different reasons, personalities, and financial positions. They each had to choose between obtaining a fixed-tate or variable-cate la Shen When She look out a loan, he wanted the security of knowing what his monthly payment would be and for how long- Shen most likely took out a fixed-rate and because the monthly payment and number of payments Caroline Caroline needed a long-term loan, Somewhere between 15 and 30 years. She learned that the longer the term, the fame rate options She had. Caroline finally had to go with the 30-year loan Caroline most likely took out a variable-rate lande

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts