Question: DROP DOWN OPTIONS 1. (LESS THAN, ABOVE, WITHIN) 2. (TOTAL ASSETS, HOME, NET WORTH) 3. (DOES, DOES NOT) 2. Balance sheet - Net worth and

DROP DOWN OPTIONS

1. (LESS THAN, ABOVE, WITHIN)

2. (TOTAL ASSETS, HOME, NET WORTH)

3. (DOES, DOES NOT)

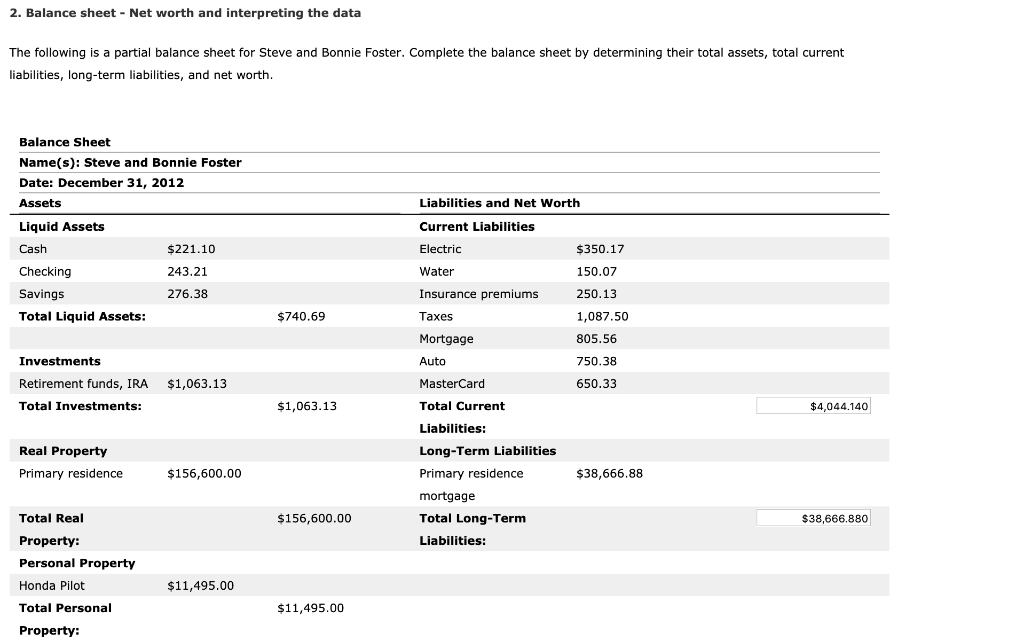

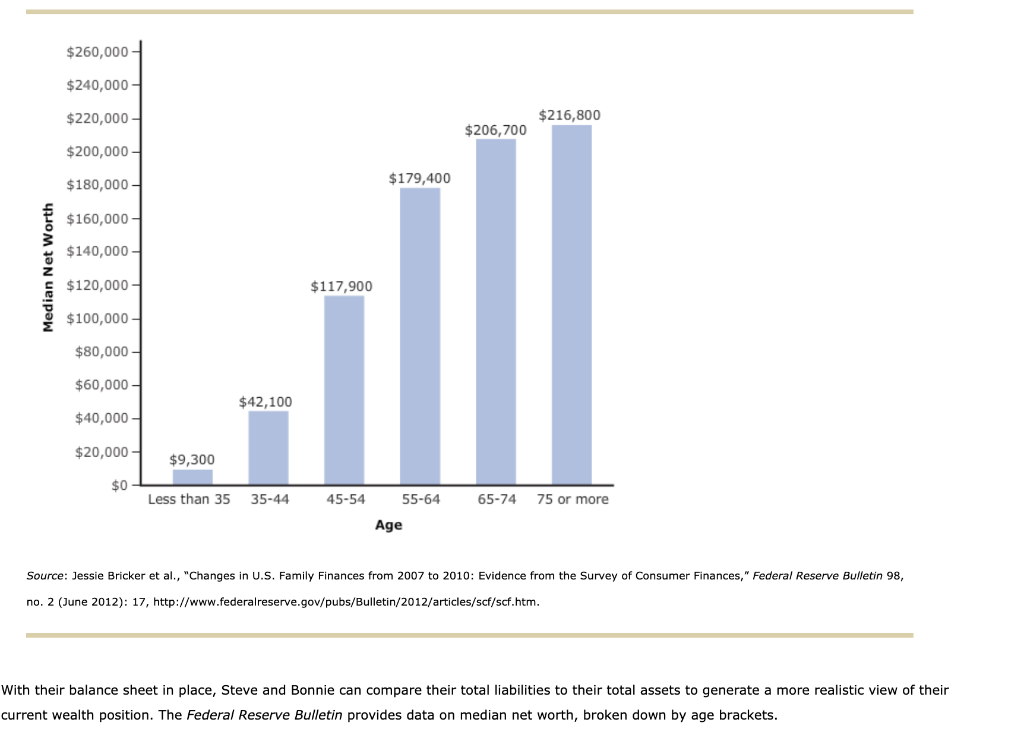

2. Balance sheet - Net worth and interpreting the data The following is a partial balance sheet for Steve and Bonnie Foster. Complete the balance sheet by determining their tota assets, total current liabilities, long-term liabilities, and net worth Balance Sheet Name(s): Steve and Bonnie Foster Date: December 31, 2012 Assets Liabilities and Net Worth Liquid Assets Current Liabilities Cash $221.10 $350.17 Electric 243.21 Checking Water 150.07 276.38 250.13 Savings Insurance premiums Total Liquid Assets $740.69 Taxes 1,087.50 Mortgage 805.56 750.38 Investments Auto 650.33 MasterCard Retirement funds, IRA $1,063.13 Total Investments: $1,063.13 Total Current $4,044.140 Liabilities: Real Property Long-Term Liabilities Primary residence $156,600.00 Primary residence $38,666.88 mortgage Total Real $156,600.00 Total Long-Term $38,666.880 Property: Liabilities: Personal Property Honda Pilot $11,495.00 Total Personal $11,495.00 Property: (2) Total Liabilities: $42,711.020 (1) Total Net Worth (1) - (2): $127,187800 $169,898.820 Assets: Total Liabilities and Nets Worth: Based on the completed balance sheet, the Fosters' net worth is $127,187.800. It isn't just the preparation of a balance sheet but the interpretation of the data that can reveal a family's financial condition. Steve and Bonnie Foster are both age 44. Using data from the 2012 Federal Reserve Bulletin (shown) and the Fosters' balance sheet, what conclusions can you draw? With their balance sheet in place, Steve and Bonnie can compare their total liabilities to their total assets to generate a more realistic view of their current wealth position. The Federal Reserve Bulletin provides data on median net worth, broken down by age brackets. the median net worth for their age group Based on the Federal Reserve Bulletin data, the Fosters are Their would be considered their dominant asset Based on their liabilities, it appear that they have adequate liquid assets to meet their bill payments and to cover any small, unexpected expenses. . Their balance sheet lists their house at 8% higher than the purchase price. The equity in their home is s

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts