Question: Using the previous two assignments (create a balance sheet and create an income statement), analyze the financial situation with ratios. After analyzing your financial statements,

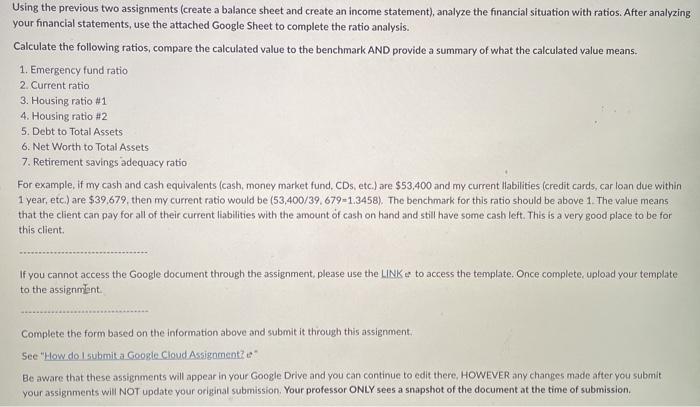

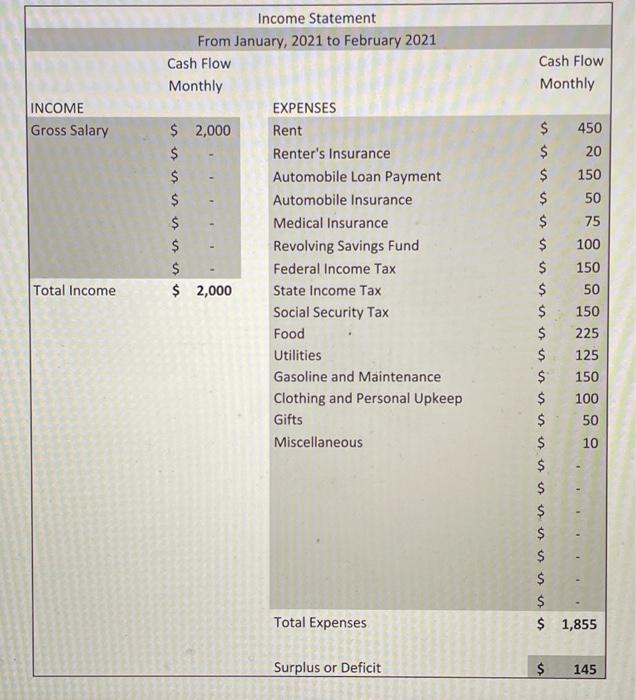

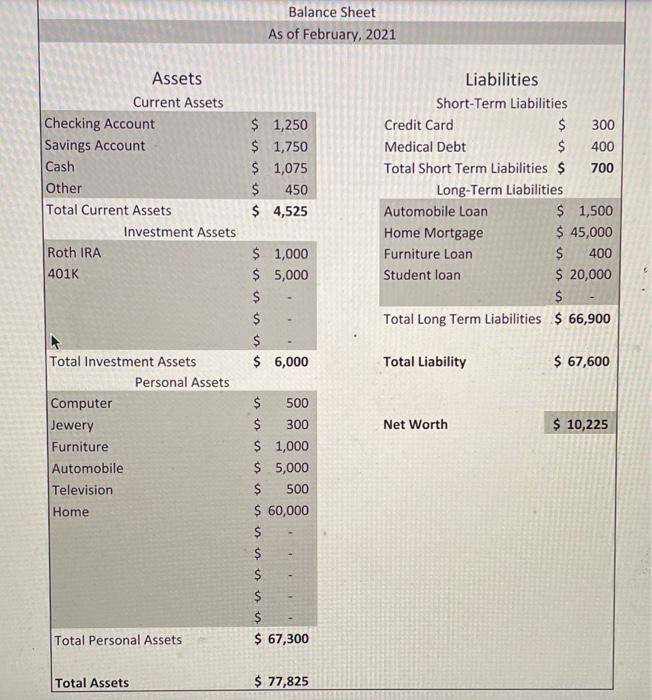

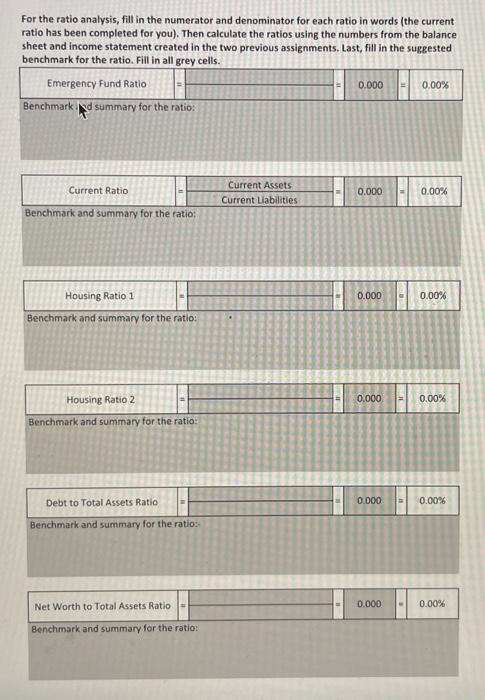

Using the previous two assignments (create a balance sheet and create an income statement), analyze the financial situation with ratios. After analyzing your financial statements, use the attached Google Sheet to complete the ratio analysis. Calculate the following ratios, compare the calculated value to the benchmark AND provide a summary of what the calculated value means. 1. Emergency fund ratio 2. Current ratio 3. Housing ratio #1 4. Housing ratio #2 5. Debt to Total Assets 6. Net Worth to Total Assets 7. Retirement savings adequacy ratio For example, if my cash and cash equivalents (cash, money market fund, CDs, etc.) are $53,400 and my current liabilities (credit cards, car loan due within 1 year, etc.) are $39,679, then my current ratio would be (53,400/39.6791,3458). The benchmark for this ratio should be above 1. The value means that the client can pay for all of their current liabilities with the amount of cash on hand and still have some cash left. This is a very good place to be for this client If you cannot access the Google document through the assignment, please use the LINK e to access the template. Once complete upload your template to the assignment Complete the form based on the information above and submit it through this assignment See "How do I submit a Google Cloud Assigamente Be aware that these assignments will appear in your Google Drive and you can continue to edit there, HOWEVER any changes made after you submit your assignments will NOT update your original submission. Your professor ONLY sees a snapshot of the document at the time of submission Cash Flow Monthly INCOME Gross Salary $ $ Income Statement From January, 2021 to February 2021 Cash Flow Monthly EXPENSES $ 2,000 Rent $ Renter's Insurance Automobile Loan Payment Automobile Insurance Medical Insurance Revolving Savings Fund $ Federal Income Tax $ 2,000 State Income Tax Social Security Tax Food Utilities Gasoline and Maintenance Clothing and Personal Upkeep Gifts Miscellaneous $ $ Total Income $ 450 $ 20 $ 150 $ 50 $ 75 $ 100 $ 150 $ 50 $ 150 $ 225 $ 125 $ 150 $ 100 $ 50 $ 10 $ $ $ $ $ $ $ $ 1,855 - - $ - Total Expenses Surplus or Deficit $ 145 Balance Sheet As of February, 2021 Assets Current Assets Checking Account Savings Account Cash Other Total Current Assets Investment Assets Roth IRA 401K $ 1,250 $ 1,750 $ 1,075 $ 450 $ 4,525 Liabilities Short-Term Liabilities Credit Card $ 300 Medical Debt $ 400 Total Short Term Liabilities $ 700 Long-Term Liabilities Automobile Loan $ 1,500 Home Mortgage $ 45,000 Furniture Loan $ 400 Student loan $ 20,000 $ Total Long Term Liabilities $ 66,900 $ 1,000 $ 5,000 $ $ $ $ 6,000 $ Total Liability $ 67,600 Net Worth $ 10,225 Total Investment Assets Personal Assets Computer Jewery Furniture Automobile Television Home $ 500 $ 300 $ 1,000 $ 5,000 $ 500 $ 60,000 $ $ $ $ $ $ $ 67,300 Total Personal Assets Total Assets $ 77,825 For the ratio analysis, fill in the numerator and denominator for each ratio in words (the current ratio has been completed for you). Then calculate the ratios using the numbers from the balance sheet and income statement created in the two previous assignments. Last, fill in the suggested benchmark for the ratio. Fill in all grey cells. Emergency Fund Ratio 0.000 0.00% Benchmark Id summary for the ratio: Current Ratio Current Assets Current Liabilities 0.000 0.00% Benchmark and summary for the ratio: 0.000 0.00% Housing Ratio 1 Benchmark and summary for the ratio: Housing Ratio 2 = 0.000 = 0.00% Benchmark and summary for the ratio: Debt to Total Assets Ratio 0.000 0.00% Benchmark and summary for the ratio: Net Worth to Total Assets Ratio - 0.000 0.00% Benchmark and summary for the ratio: Savings Rate 0.000 0.00% Benchmark and summary for the ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts